Ethereum (ETH) is coming into a vital week, with technical indicators, on-chain information, and a serious improve all converging. The Pectra Improve, set for Could 7, goals to enhance staking and pockets performance, however short-term volatility is probably going in the course of the rollout.

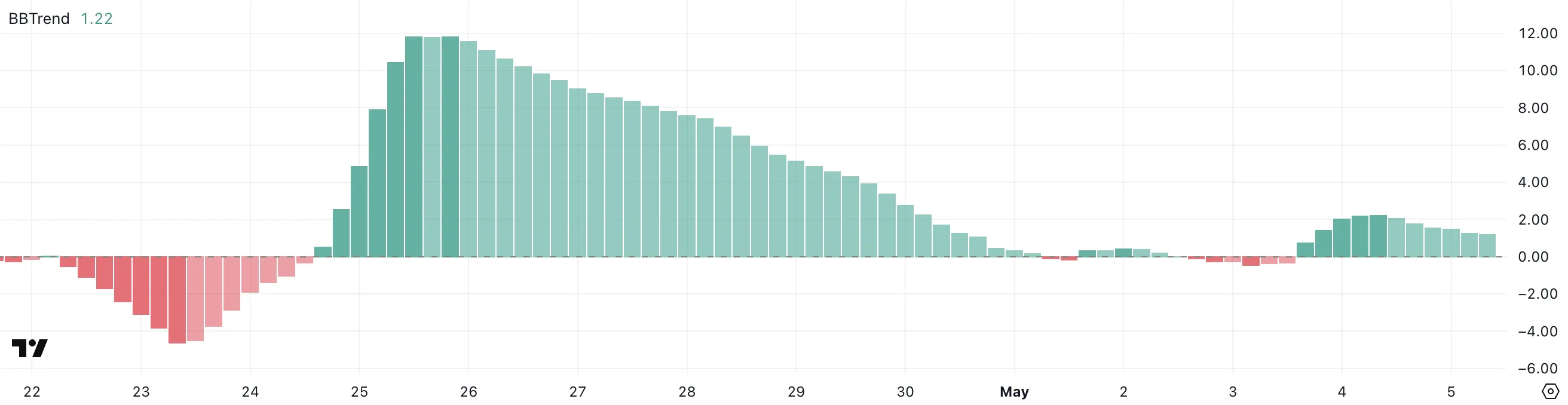

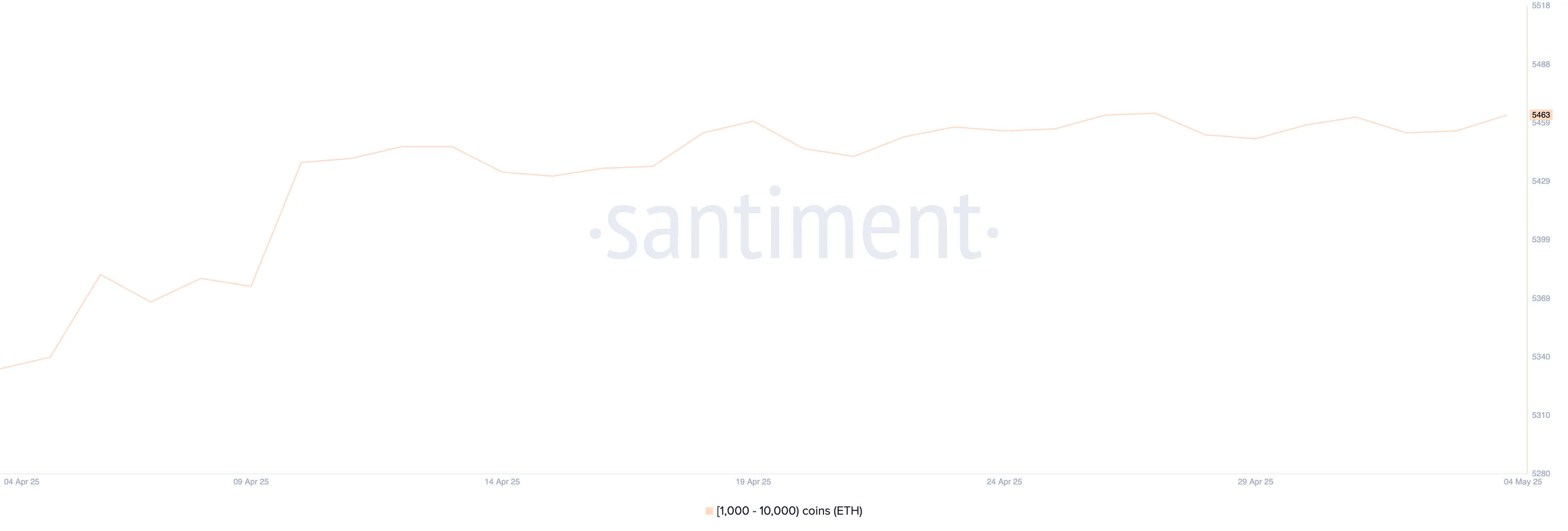

In the meantime, ETH’s BBTrend sits at 1.22, exhibiting early bullish momentum, although not but sturdy sufficient to substantiate a breakout. On the identical time, whale exercise stays close to 5,463 addresses, and worth continues to commerce in a good vary between $1,828 and $1,749—setting the stage for a possible breakout or breakdown.

Ethereum Pectra Improve Set for Could 7: What to Count on

Ethereum’s extremely anticipated Pectra Improve is ready to go dwell on Could 7, introducing 11 new Ethereum Enchancment Proposals (EIPs). EIP-7251 stands out for elevating the staking cap from 32 ETH to 2048 ETH, aiming to streamline validator operations and enhance staking effectivity.

The improve additionally consists of pockets enhancements centered on person expertise, similar to simpler restoration and gasless transactions, which may drive broader dApp adoption. Whereas this may increasingly improve ETH demand long run, exchanges may briefly halt ETH transfers throughout deployment, inflicting short-term volatility.

Although the improve guarantees important enhancements, it has already confronted a number of delays because of prolonged testing on networks like Hoodi and Sepolia. A clean rollout might enhance confidence and worth, however any technical points may set off adverse market reactions.

ETH Development Sign at 1.22: Early Uptrend or Simply Noise?

Ethereum’s BBTrend indicator is at 1.22, signaling a gentle bullish bias. Over the previous day, the BBTrend reached a excessive of two.23, exhibiting stronger momentum earlier than pulling again barely.

Though the present studying has cooled, it stays optimistic, suggesting the uptrend isn’t but invalidated. Merchants are watching whether or not BBTrend can rise once more to substantiate renewed power or if momentum continues to fade.

The BBTrend (Band-Break Development) is a volatility-based indicator designed to detect the power and path of worth developments. Readings above 1.00 sometimes recommend a bullish development, whereas readings beneath -1.00 point out a bearish development.

Values between -1.00 and 1.00 are thought-about impartial or trendless, signaling both sideways motion or weak conviction in both path. The farther the BBTrend strikes from zero, the stronger the development, making values like 2.23 notable for development affirmation.

With ETH’s BBTrend at 1.22, the indicator hints at a weak however optimistic development—suggesting Ethereum could also be coming into the early phases of an uptrend.

Nevertheless, it’s not a robust breakout degree, which means the worth may nonetheless reverse if promoting strain will increase or momentum fades.

A push again above 2.00 would seemingly verify sustained bullish momentum, whereas a drop beneath 1.00 may point out a return to consolidation or perhaps a shift to bearish situations.

Including to the broader image, the variety of Ethereum whales—addresses holding between 1,000 and 10,000 ETH—at the moment stands at 5,463.

This quantity has fluctuated in latest weeks, struggling to interrupt decisively increased. Whale exercise is a vital on-chain sign, as these giant holders typically affect worth actions via accumulation or distribution. A gradual or rising whale rely sometimes indicators confidence and long-term accumulation, which may help ETH’s worth within the coming weeks.

Conversely, a continued stall or drop in whale numbers might mirror hesitation amongst bigger buyers, probably limiting upside momentum.

ETH Caught in a Vary as Merchants Await Breakout or Breakdown

Ethereum worth has traded between $1,828 resistance and $1,749 help since April 21. The vary has held for over two weeks, exhibiting market indecision.

The EMA strains stay bullish, with short-term averages nonetheless above long-term ones. Nevertheless, they’re beginning to converge, and a dying cross may type quickly.

If the $1,749 help breaks, ETH may fall to $1,689. If the downtrend intensifies, targets like $1,538 and $1,385 grow to be related.

On the upside, if ETH breaks $1,873, it may rally to $1,954, and probably hit $2,104, reclaiming the $2,000 degree for the primary time since March 27.

Disclaimer

In keeping with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.