Bitcoin (BTC) enters the second week of Might buying and selling in a fragile however important zone, with conflicting technical alerts and rising macro uncertainty shaping short-term expectations. Whereas the ADX from the Directional Motion Index is rising, bearish stress nonetheless dominates, and momentum stays weak throughout a number of indicators.

Though the value continues to carry above the $92,900 assist stage, weakening EMAs and the looming FOMC assembly go away Bitcoin’s $100,000 restoration path unsure, however not out of attain.

BTC Development Energy Rises, however Bears Nonetheless in Management

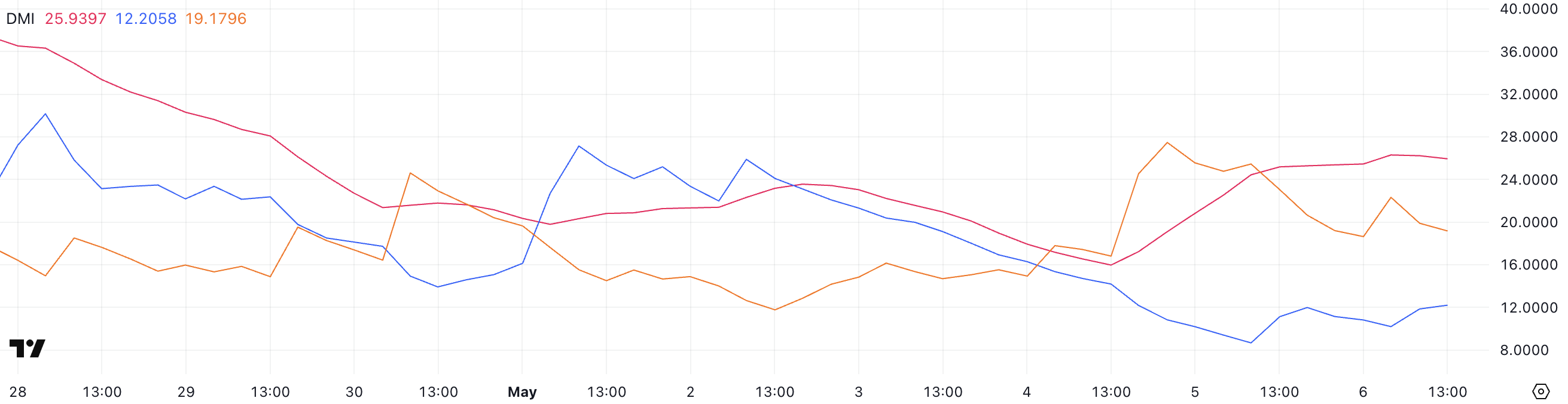

Bitcoin’s Directional Motion Index (DMI) is exhibiting a notable shift.

The ADX, which measures the energy of a development no matter course, has climbed sharply to 25.93, up from 15.97 simply two days in the past—crossing the important thing 25 threshold that alerts a development is beginning to acquire traction.

This rising ADX means that volatility is returning and a brand new directional transfer could also be forming, even when the course itself continues to be unclear.

Wanting on the parts of the DMI, +DI (bullish energy) has bounced to 12.2, up barely from yesterday’s low of 8.67 however nonetheless down considerably from 21.31 three days in the past.

In the meantime, -DI (bearish energy) is at 19.17, barely off its peak of 25.44 however nonetheless increased than three days in the past. This means that though the current bearish momentum has cooled considerably, sellers nonetheless have the higher hand.

With ADX rising and -DI main, Bitcoin may stay underneath stress except +DI recovers sharply within the coming days.

Bitcoin Trapped Under the Cloud as Momentum Stalls

The present Ichimoku Cloud chart for Bitcoin displays a market in consolidation, with a slight bearish undertone. Worth motion is sitting very near the blue Kijun-sen (baseline), which generally represents medium-term development momentum.

Buying and selling beneath this line means that BTC lacks the energy to reclaim bullish momentum within the brief time period. The white candlesticks hovering close to the cloud’s decrease boundary point out indecision amongst merchants, with no clear breakout in sight.

The inexperienced Kumo (cloud) itself is comparatively skinny at this stage, hinting at a fragile assist zone that would simply be damaged if bearish stress returns.

Wanting forward, the pink Senkou Span B—the highest of the projected cloud—is performing as dynamic resistance, capping any upward makes an attempt. For a stronger bullish sign, BTC would want to shut decisively above each the Kijun-sen and your entire cloud.

Complicating issues additional, the Tenkan-sen (conversion line) is flat and overlapping with the Kijun-sen, signaling weak momentum and a scarcity of course. Flat Tenkan and Kijun strains usually precede sideways motion or delayed development improvement.

Till Bitcoin breaks convincingly above the cloud with rising quantity, the present setup leans impartial to bearish, with worth trapped in a zone of low conviction and restricted momentum.

Bitcoin Holds Key Assist as $100,000 Reclaim Hangs within the Stability

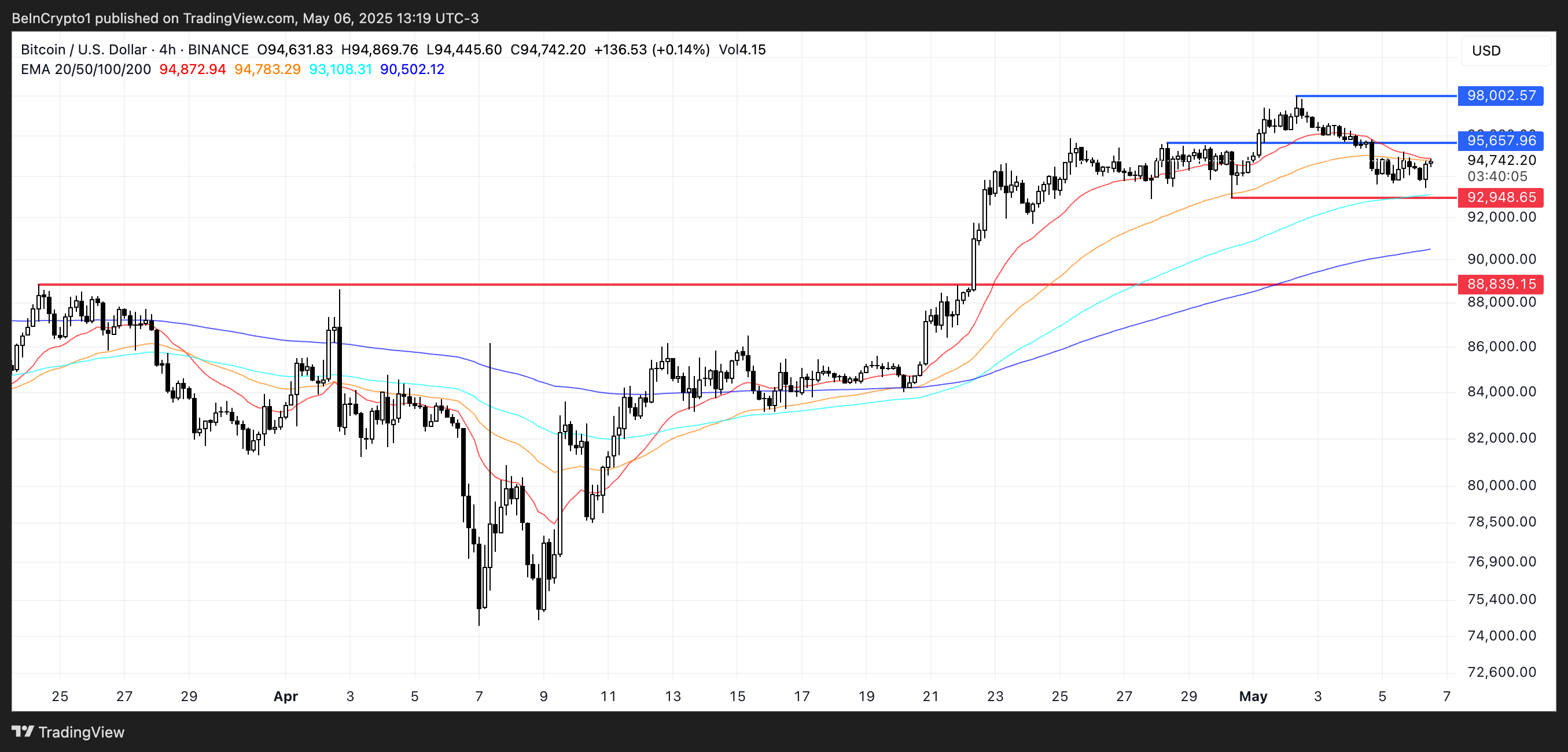

Bitcoin worth has remained resilient above the $90,000 stage since April 22, repeatedly holding assist close to $92,945 regardless of broader market uncertainty. The exponential shifting averages (EMAs) nonetheless replicate a bullish construction, with short-term averages positioned above long-term ones.

Nevertheless, there are early indicators of weakening momentum, because the short-term EMAs have begun to slope downward—a sign that consumers could also be shedding energy quickly.

If BTC fails to carry its key assist, a drop towards $88,839 may observe, breaking the construction that has held for over two weeks.

Nonetheless, some analysts stay assured. Nick Purin, founding father of The Coin Bureau, believes Bitcoin is well-positioned to reclaim the $100,000 mark, whilst markets brace for volatility surrounding the upcoming FOMC assembly:

“It will likely be a unstable week. Firstly, we’ve got the FOMC assembly tomorrow. Whereas it’s fairly clear there will probably be no price cuts, it’s what Chair Powell says that would transfer the markets. On high of that, buying and selling quantity is low and the lengthy/brief ratio is sitting at 50/50, which signifies that, but once more, BTC can swing in both course from right here. The excellent news is that there’s a substantial amount of shopping for curiosity across the $90,000-$93,000 vary, so a dip to these ranges is nothing to be involved about – it’s going to seemingly bounce again. And general, the BTC/USD chart is wanting sturdy because it continues to print increased lows.” – Purin informed BeInCrypto.

Nick states how Fed subsequent selections may affect the market within the subsequent months:

“If the Fed surprises with some dovish tones in addition to steerage for price cuts in June, there’s room for Bitcoin to rally all the best way again as much as that $100,000 stage, which stays a liquidity magnet. However even when Powell strikes a hawkish tone, the influence on BTC will seemingly be minimal. There’s merely an excessive amount of constructive momentum – spot BTC ETFs are hoovering up belongings, corporates are increase BTC treasuries and the correlation between Bitcoin and shares is breaking down. On high of this, historic knowledge reveals that BTC has posted features throughout 9 out of the final 12 Mays. So, regardless of the chance of heightened volatility, the close to future is wanting promising. As such, following the previous adage of ‘promote in Might’ could be insanity at this level.” – Purin informed BeInCrypto.

A restoration in momentum may first drive BTC to retest resistance at $95,657, with a breakout probably resulting in $98,002 and finally a problem of the psychological $100,000 stage.

With macro headwinds and technical crossroads converging this week, the following transfer will seemingly hinge on how BTC responds to its assist zone and the way broader market sentiment reacts to Fed commentary.

Disclaimer

According to the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.