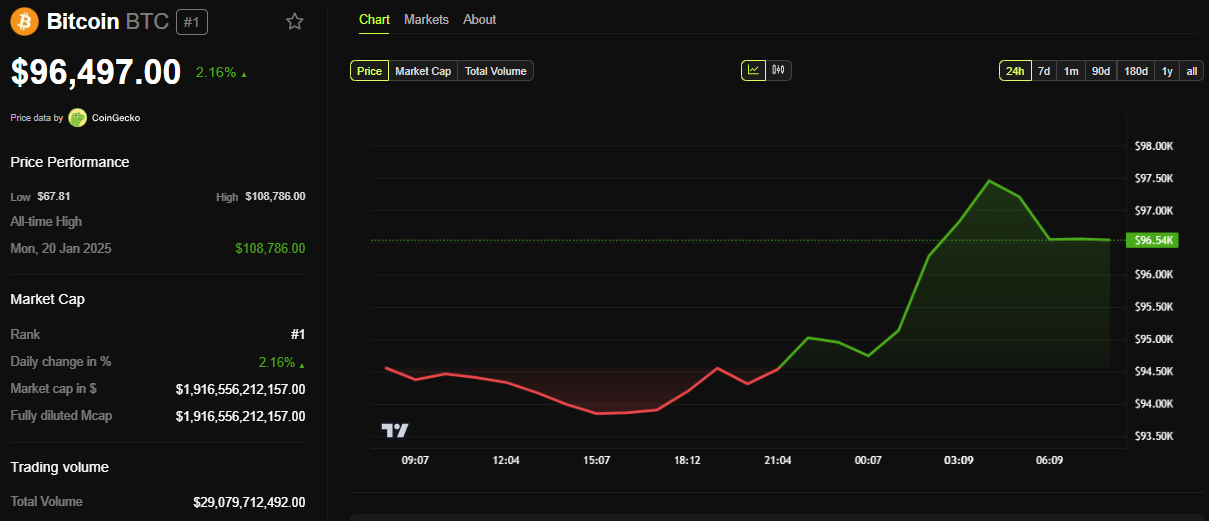

Bitcoin (BTC) jumped above $97,000 on Wednesday earlier than retreating to the $96,000 vary. The temporary take a look at got here as markets absorbed a wave of liquidity-boosting bulletins from China and rising hypothesis that the US Federal Reserve (Fed) could also be edging towards a return to quantitative easing (QE).

The strikes’ timing, simply hours earlier than a vital FOMC (Federal Open Market Committee) assembly, has despatched merchants scrambling to reassess the worldwide macro image.

China Unleashes $138 Billion in Liquidity As Commerce Talks Reignite Danger-On Sentiment

The State Council Info Workplace hosted a press convention. In attendance, Governor Pan Gongsheng of the Individuals’s Financial institution of China (PBOC) introduced rate of interest cuts.

The PBOC stated it might minimize the reserve requirement ratio by 0.5 share factors, releasing roughly 1 trillion yuan ( ~ $138 billion) in long-term liquidity, and decrease the coverage rate of interest by 10 foundation factors.

“Pan Gongsheng, governor of the Individuals’s Financial institution of China, introduced at a press convention that the reserve requirement ratio can be minimize by 0.5 share factors, offering the market with about 1 trillion yuan of long-term liquidity, and reducing the coverage rate of interest by 0.1 share factors,” native media reported.

The PBOC minimize the seven-day reverse repo charge from 1.5% to 1.4%. This can decrease the mortgage prime charge by one other 10 foundation factors.

It additionally unveiled further help measures, together with a 500-billion-yuan re-lending instrument for aged care and consumption. Additional, it lowered mortgage charges and reserve necessities for auto financing companies.

The timing of China’s stimulus was not coincidental. Hours earlier, US Treasury Secretary Scott Bessent confirmed he would meet with Chinese language Vice Premier He Lifeng in Switzerland on Might 10 and 11. This could mark the primary official commerce talks since President Trump escalated tariffs to 145% on Chinese language imports.

“Because of POTUS, the world has been coming to the US, and China has been the lacking piece—we are going to meet on Saturday and Sunday to debate our shared pursuits. The present tariffs and commerce boundaries are unsustainable, however we don’t wish to decouple. What we wish is honest commerce,” Bessent said.

Markets reacted swiftly. Based on The Kobeissi Letter, S&P 500 futures surged over +1% on this information. Bitcoin adopted swimsuit, spiking above $97,000 earlier than sliding again.

As of this writing, BTC was buying and selling for $96,497, up by a modest 2.16% within the final 24 hours. This retraction to the $96,000 vary comes amid market uncertainty, as merchants brace for the FOMC later as we speak.

Fed Bond Shopping for Raises Quantitative Easing Flags

In the meantime, the Fed’s steadiness sheet exercise this week is elevating eyebrows. On Might 6, the Fed bought $14.8 billion price of 10-year Treasury notes, following a $20 billion buy of 3-year notes on Might 5, totaling $34.8 billion in two days.

“The Fed purchased $14.8 billion price of 10-year bonds as we speak. That is on high of the $20 Billion it purchased yesterday. That’s $34.8 Billion in 2 days,” The Coastal Journal reported.

With no formal announcement, these purchases recommend that the Fed quietly injects liquidity in a delicate quantitative easing transfer.

Arthur Hayes, former BitMEX CEO, sees a dovish shift as wildly bullish for crypto. In a latest column, Hayes argued that Bitcoin can be price $250,000 by the tip of 2025 if the Fed restarts QE. He sees the Fed’s liquidity strikes as the start of that course of.

BeInCrypto additionally explored the percentages of QE returning and its implications. Any recent wave of QE may scale back actual yields, devalue fiat, and probably drive important inflows into crypto property.

Nonetheless, not everyone seems to be satisfied QE is critical. In a counterpoint report, macro specialists argue that quantitative easing is pointless amid the present market turmoil. They contend that the monetary system has not but proven indicators of systemic misery.

In the meantime, gold surged to near-record highs of $3,437.60 per ounce, up 28.84% year-to-date, reflecting investor unease.

The surge in gold suggests a worry of commerce as buyers maneuver the continuing financial instability.

Buyers are bracing for readability or additional ambiguity as Fed Chair Jerome Powell prepares to handle markets later as we speak. Bitcoin’s temporary rally above $97,000 indicators optimism, however the broader crypto market might stay range-bound till the Fed reveals its playing cards.

Bitcoin may quickly set up help above the $97,000 threshold if Powell indicators a delicate pivot. If not, merchants might face extra volatility.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.