Uncertainty is driving gold’s worth momentum, in accordance with analysts on the capital markets publication The Kobeissi Letter.

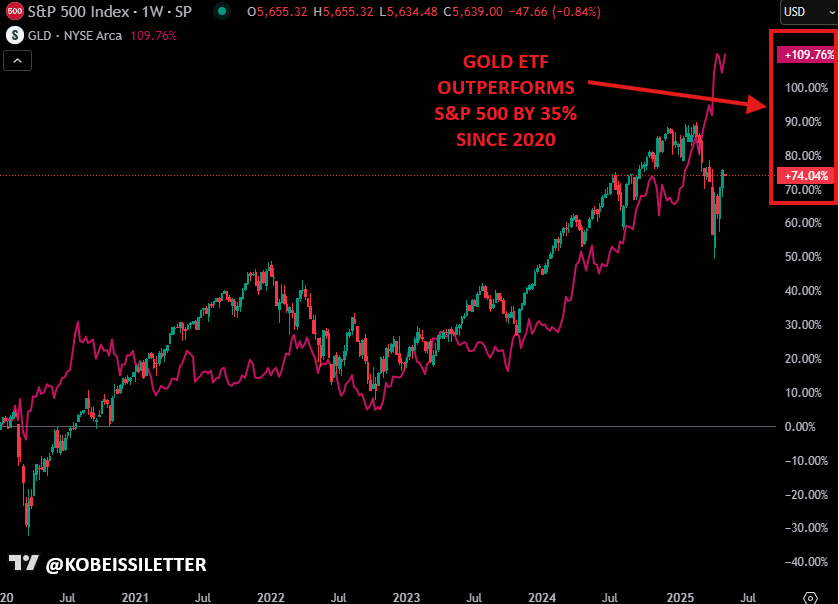

The Kobeissi Letter’s official account on the social media platform X notes that heading into this yr, gold had been underperforming the S&P 500 by roughly 10% since 2020.

“Nonetheless, as uncertainty has risen, GLD is now up +109% since 2020 in comparison with +74% within the S&P 500. However, why are gold costs surging even because the market recovers? Uncertainty stays the reply.”

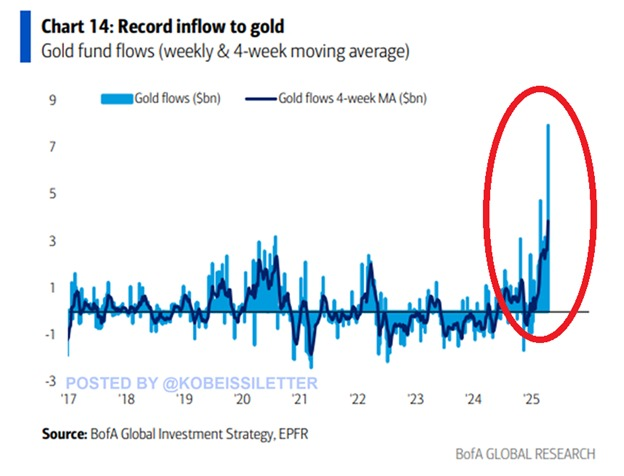

The analysts additionally be aware that gold funds witnessed roughly $8 billion in internet inflows three weeks in the past, a record-setting complete they are saying suggests “a continued flight to security.”

“Consequently, the four-week shifting common of inflows jumped to ~$4 billion, additionally an all-time excessive. That is seemingly the strongest gold market of all time.”

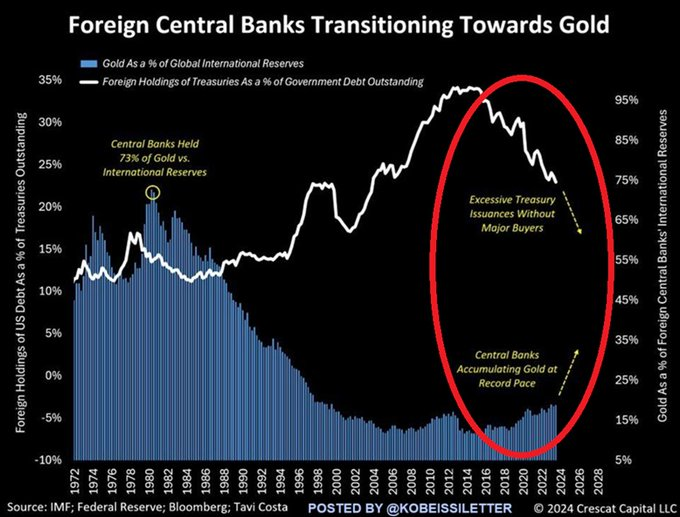

Additionally they say central financial institution shopping for stays “traditionally robust.” The publication notes that foreign holdings of Treasuries as a proportion of US authorities debt have fallen to roughly 23%, the bottom in additional than 20 years.

The analysts, citing knowledge from macro strategist Otavio Costa, additionally be aware that gold holdings as a proportion of worldwide reserves have surged to roughly 18%, the best in 26 years.

The Kobeissi Letter additionally factors out that the US Greenback Index (DXY) lately plunged to a 52-week low. The DXY measures the energy of the USD in opposition to a basket of different main foreign currency echange.

“The US Greenback, DXY, has weakened by almost 10% for the reason that commerce struggle started. A weaker greenback makes USD-denominated gold cheaper for overseas traders. Gold is nearly serving as a number one indictor for tariffs.”

Comply with us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Value Motion

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any losses it’s possible you’ll incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney