On Friday, November 15, Bitcoin’s (BTC) dominance — a metric monitoring the cryptocurrency’s share of the general market — confirmed readiness to climb to 65%. Nevertheless, this state of affairs didn’t occur as Bitcoin’s worth fell in need of retesting $93,000, suggesting that the altcoin season cycle could possibly be right here.

This stagnation appears to have created a chance for altcoins, which have lagged considerably behind BTC. The urgent query now could be whether or not Bitcoin dominance will proceed to say no as altcoin costs surge.

Bitcoin Steps Again Amid Grasping Market

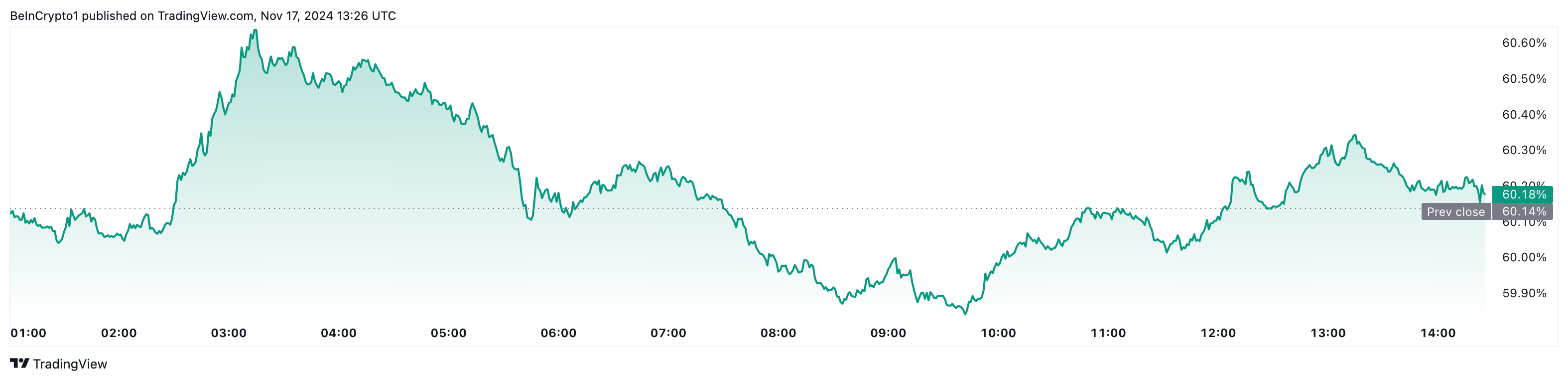

As of this writing, Bitcoin’s dominance has dropped to 60%. This decline contradicts some analysts’ expectations that Bitcoin’s worth may rise as excessive as $100,000 inside a couple of days.

In line with BeInCrypto’s findings, this fall is also linked to the rising efficiency of altcoins. Some days in the past, the altcoin season index was 33. As we speak, based on knowledge from Blockchaincenter, it has risen to 39.

This enhance means that extra altcoins throughout the prime 50 are outperforming Bitcoin (BTC). Tokens like Bonk (BONK) and Ripple (XRP) have maintained their upward momentum, contributing to each the rise in altcoin’s market cap and the next decline in Bitcoin dominance.

Additional, the market’s excessive greed may have implications for Bitcoin’s trajectory. At the moment, the Crypto Worry and Greed Index, which primarily gauges Bitcoin sentiment, has reached a putting “Excessive Greed” degree of 90.

“Excessive Worry” usually signifies heightened investor nervousness, which may current a possible shopping for alternative. Conversely, when buyers grow to be overly grasping, it usually signifies that the market could also be ripe for a correction.

Subsequently, contemplating the present outlook, it’s possible that Bitcoin’s worth could possibly be due for a correction. This assertion additionally aligns with the sentiment of analyst Rekt Capital. In line with him, altcoins may quickly start to interrupt out because of Bitcoin’s dominance fall.

“Bitcoin Dominance — We’re seeing the results of the best-case state of affairs in full drive. It’s Altcoin season.The pullback in BTC DOM to 57.68% is enabling this Altcoin Window. Continued dips to inexperienced will allow Altcoin breakouts,” Rekt Capital shared on X (previously Twitter).

Altcoins Look to Hit Increased Highs

In the meantime, the TOTAL2, which is the whole market cap of the highest 125 altcoins, together with Ethereum (ETH), has reached $1.19 trillion. The final time it reached such a worth was in June.

Primarily based on the each day chart, TOTAL2 reached this level as a consequence of huge curiosity in altcoins and a breakout of a descending triangle. A descending triangle is usually seen as a bearish sample. Nevertheless, it might additionally signify a bullish reversal if the value breaks out in the other way, which is the case with the altcoins’ market cap.

Ought to this place speed up, then the altcoin season may start. However for that to occur, Bitcoin dominance has to maintain falling, and the altcoin season index has to maneuver a lot nearer to 75 from 39.

If that occurs, then the TOTAL2 may rise to $1.27 trillion. Nevertheless, if Bitcoin’s worth bounces above its all-time excessive, the altcoin season cycle could also be delayed, and this prediction could also be invalidated.

Disclaimer

In keeping with the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.