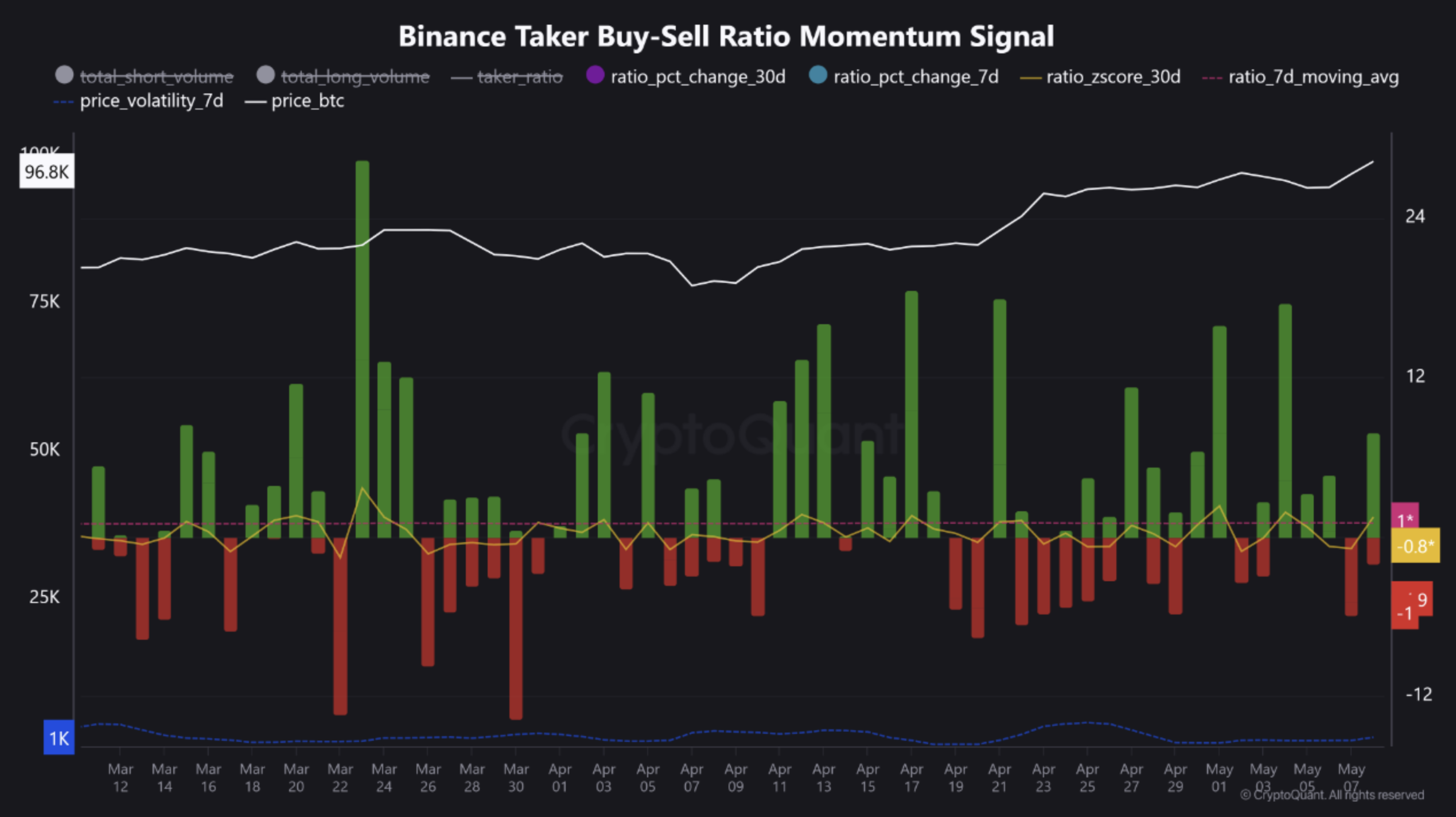

In a latest CryptoQuant Quicktake publish, on-chain analyst Crazzyblockk highlighted that Bitcoin’s (BTC) Binance Taker Purchase-Promote Ratio has climbed to 1.131 – indicating rising bullish momentum and a market dominated by aggressive patrons.

Bitcoin Using The Bullish Wave

As BTC trades barely above the $100,000 mark, the Binance Taker Purchase-Promote metric means that bulls are gaining management. In keeping with Crazzyblockk’s evaluation, the present ratio of 1.131 implies sturdy upward strain, reflecting the dominance of patrons over sellers on Binance.

For the uninitiated, the Binance Taker Purchase-Promote Ratio measures the stability between aggressive patrons and sellers for Bitcoin on Binance. A ratio above 1 signifies patrons are dominant (bullish sentiment), whereas beneath 1 indicators vendor dominance (bearish sentiment).

At the moment, the 7-day shifting common of the ratio sits at 1.045 and is trending upward. Moreover, the 30-day share change has surged by 12.1%, pointing to sustained shopping for curiosity and powerful optimistic momentum.

Nevertheless, not all indicators are flashing inexperienced. The ratio’s Z-score – a statistical measure of how far the present worth deviates from the imply – has reached 2.45, suggesting that the market could also be nearing overbought territory. In keeping with the analyst:

Traditionally, ratios above 1.1 with elevated z-scores have led to corrections earlier than resuming uptrends.

Crazzyblockk added that Binance knowledge presents a number of advantages. As an illustration, deep liquidity so as books provides an correct illustration of taker habits. Additional, excessive buying and selling quantity makes it a dependable indicator.

When it comes to technique, the analyst famous {that a} ratio remaining above 1.1 – coupled with BTC holding above $99,000 – can be a bullish signal. Conversely, a drop beneath 1.05 might point out elevated profit-taking and the potential for a short-term pullback.

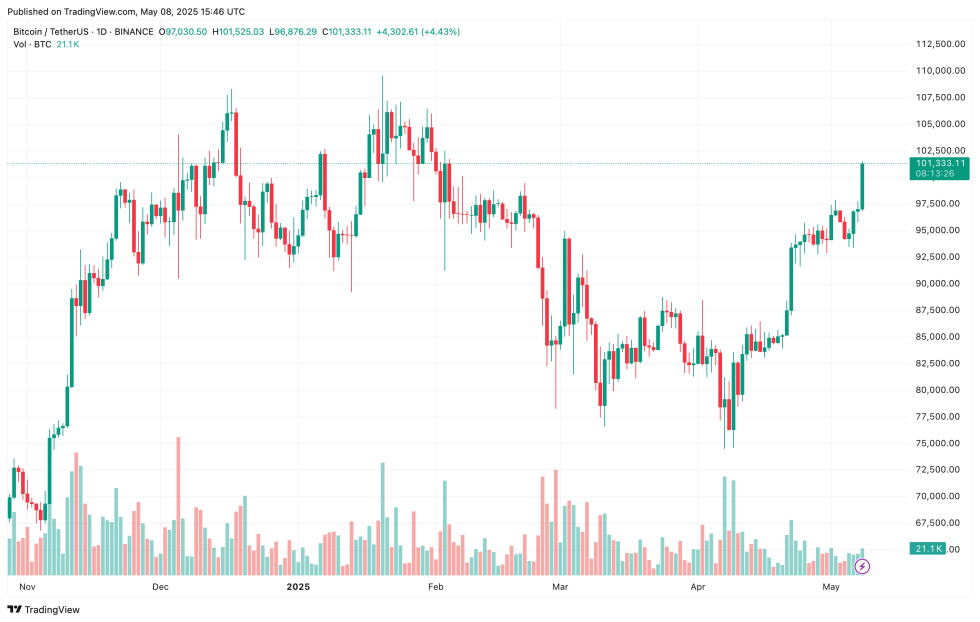

BTC Breaking Downtrend However Faces Resistance Forward

In the meantime, well-liked analyst Rekt Capital shared a weekly Bitcoin chart exhibiting that BTC is on the verge of breaking out of a long-standing downtrend that dates again to December 2024. In keeping with the analyst, BTC should keep above $98,700 to verify this breakout and put together for a rally towards the following resistance degree at $104,500.

Equally, analyst Ali Martinez pinpointed $101,673 as a vital resistance zone—the place practically 81,910 BTC have been beforehand gathered. Martinez warned that failure to interrupt above this degree might end in a consolidation part.

There are a number of essential help ranges that BTC should defend to keep away from one other sharp downturn. As pointed out by Martinez in one other X publish, BTC should not fall beneath the $93,198 help degree or else it might danger dumping all the best way right down to $83,444.

On a optimistic notice, trade depositing BTC pockets addresses lately fell to a 8-year low, a bullish signal that might additional propel BTC nearer to its all-time excessive. At press time, BTC trades at $101,333, up 3.7% up to now 24 hours.

Featured Picture from Unsplash.com, charts from CryptoQuant, X, and TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.