The crypto market turned inexperienced within the first week of Might, however skepticism stays robust. Some imagine present indicators present indicators of a bigger upcoming bullish cycle, particularly as Bitcoin breaks a key psychological threshold.

Nonetheless, others warn that short-term elements could also be distorting the indications. This text makes use of on-chain knowledge and historic patterns to discover each side of the argument.

Is the Crypto Market About to See a Bull Run?

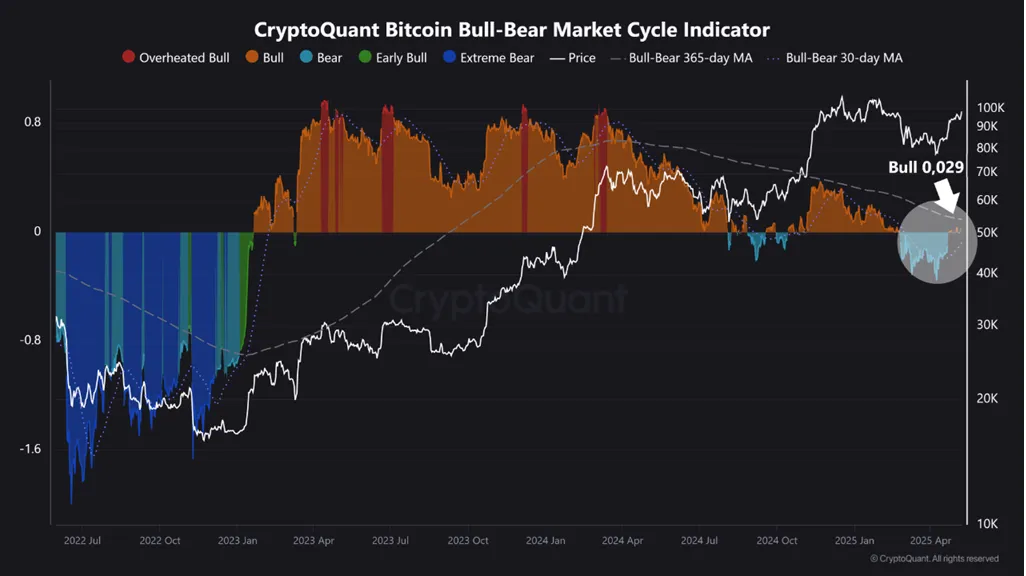

CryptoQuant’s Bull-Bear Market Cycle Indicator, designed to determine bullish and bearish phases within the crypto market, has not too long ago proven optimistic indicators.

Since February 24, 2024, the indicator has persistently signaled a bearish market. Nonetheless, in latest days, it has begun to indicate indicators of a possible reversal.

Nonetheless, the sign stays weak and unclear. Throughout mid-2024, this identical indicator triggered deceptive predictions. The market moved sideways for a very long time with out forming a transparent development.

Analyst Burakkesmeci added observations utilizing the 30-day and 365-day transferring averages (30DMA and 365DMA) to make clear the bullish potential.

“Extra importantly, the Bull-Bear 30DMA — a short-term transferring common — has turned upward. If this metric crosses above the Bull-Bear 365DMA, historical past suggests we may see parabolic rallies in Bitcoin as soon as once more,” Burakkesmeci predicted.

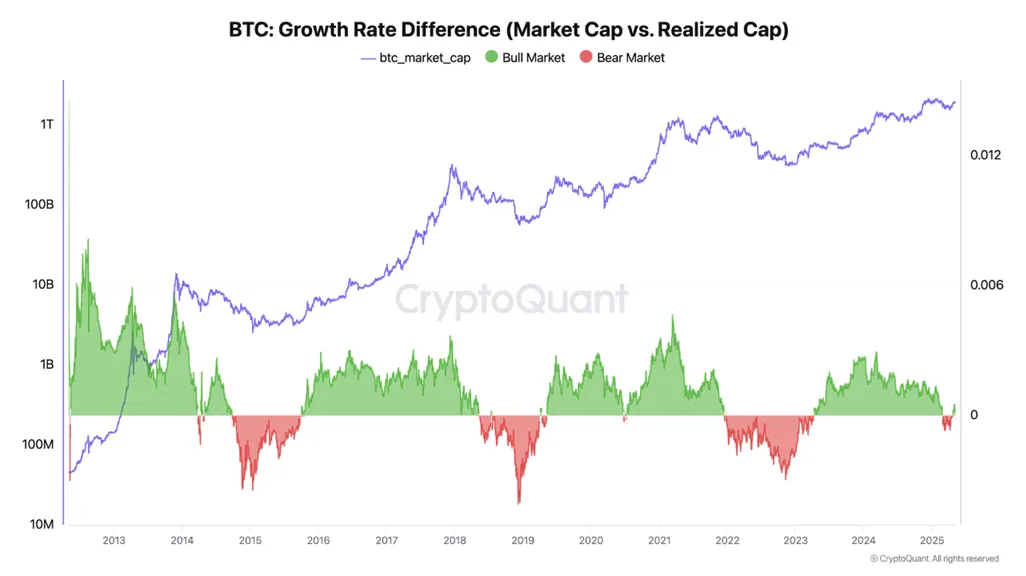

Nonetheless, analyst Darkfost provided a extra cautious perspective when reviewing the Progress Charge Indicator. This indicator assesses the state of the Bitcoin market—bull or Bear—by evaluating the Market Cap and Realized Cap of Bitcoin.

He famous that the indicator is returning to bullish territory, coinciding with Bitcoin ($BTC) reclaiming the essential $100,000 mark.

As an alternative of predicting the top of the bear market and the beginning of a bull run, Darkfost warned this may very well be a false restoration triggered by particular situations.

These particular situations embrace Donald Trump signing a commerce settlement with the UK, which helped ease issues over tariff shocks. In the meantime, the Federal Reserve maintained a cautious stance and stored rates of interest unchanged.

“It’s doable that conventional market dynamics will proceed to be disrupted for a while, making the present surroundings significantly tough to learn,” Darkfost stated.

One other noteworthy knowledge level is the Crypto Concern & Greed Index. It rose to 73, getting into the “Greed” zone — its highest stage in two months. This means that investor sentiment is shifting from warning to pleasure.

Nonetheless, excessive ranges of “Greed” and even “Excessive Greed” typically function warning indicators. Traditionally, these ranges have preceded main value corrections.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.