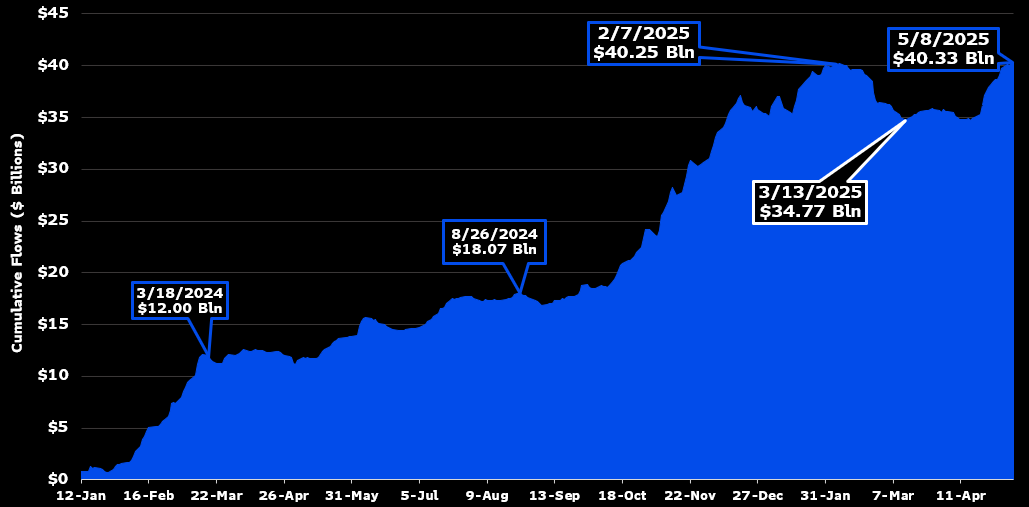

Newest information claims that Bitcoin Spot ETFs surpassed their earlier inflows document. Inflows presently sit at $40.33 billion, regardless of over $5 billion in outflows over the last two months.

Regardless of the local weather of Excessive Concern within the crypto markets, Bitcoin ETFs noticed comparatively restricted losses throughout this era. By reclaiming this document so shortly, the market demonstrated a formidable resilience.

Bitcoin ETFs Break Influx Data Once more

For the reason that Bitcoin ETFs first launched in 2024, they’ve completely reworked the crypto business. Analysts known as BlackRock’s IBIT “the best launch in ETF historical past,” reflecting their outsized market attraction.

In the present day, the info displays one other encouraging victory for Bitcoin ETFs, as their inflows surpassed an all-time document set in February:

Shortly after Bitcoin Spot ETFs surpassed $40 billion in inflows, the market noticed a large reversal. Over $5 billion in outflows devoured all of the positive aspects in 2025, inflicting issuers to partially offload their BTC reserves.

These companies collectively had a ravenous demand for Bitcoin, so their collective market dumping raised issues of broader bother.

These losses had been clearly brought on by fears of a recession and the specter of Trump’s tariffs. Nevertheless, a restoration started in late April.

Whilst Bitcoin ETFs began their rebound, inflows fell to a 2025 low. This dynamic is a part of why ETF analyst Eric Balchunas finds this metric so helpful in market evaluation: it’s very troublesome to faux.

“Lifetime internet flows is a very powerful metric to look at in my view: very exhausting to develop, pure reality, no BS. [It’s] spectacular [that] they had been in a position to make it to new excessive water mark so quickly after the world was supposed to finish. Byproduct of barely anybody leaving, left solely a tiny gap to dig out of,” Balchunas claimed over social media.

In different phrases, the crypto group’s “diamond palms” mentality could have outlined this sharp turnaround. On the top of the tariff panic, markets had been in Excessive Concern, the bottom stage of investor confidence for the reason that FTX collapse.

On this gentle, these merchandise carried out extraordinarily effectively. Two months later, the Bitcoin ETFs are having fun with constant inflows but once more.

In fact, this influx document doesn’t assure that every part will stay sunny for BTC ETFs. Bitcoin not too long ago reclaimed $100,000, sparking a surge in inflows for this market, however just a few bearish indicators linger in choices buying and selling.

For now, nevertheless, this accomplishment may be very noteworthy. The ETFs’ successes have been explosive, and Bitcoin has seen growing TradFi liquidity in latest weeks.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.