Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

In response to a latest CryptoQuant Quicktake submit by contributor burakkemeci, Bitcoin (BTC) is starting to indicate indicators of a pattern reversal after weeks of downward motion. Notably, BTC surged previous $100,000 yesterday for the primary time since February 3.

Bitcoin On The Verge Of Development Reversal?

On the time of writing, Bitcoin is buying and selling barely above $100,000, roughly 5.2% beneath its all-time excessive (ATH) of $108,786, set earlier this yr on January 20. The main cryptocurrency has staged a formidable rebound of over 20% from its latest low of $74,508 recorded on April 6.

Associated Studying

Of their evaluation, crypto analyst burakkemeci referred to the CryptoQuant Bull-Bear Market Cycle indicator, saying that it’s flashing the early indicators of a possible bullish pattern reversal. The analyst famous:

With Bitcoin surging again above $100K, the indicator has began flashing bullish alerts once more – for the primary time in weeks. Though the sign remains to be weak (coefficient: 0.029), the mere look of a optimistic shift is encouraging.

To elucidate, the CryptoQuant Bull-Bear Market Cycle indicator is an on-chain device that tracks long-term and short-term market sentiment by evaluating value momentum and investor conduct traits. It makes use of two key parts – the 30-day and 365-day shifting averages (MA) – to determine shifts between bull and bear cycles.

Importantly, the analyst identified that the Bull-Bear 30-day MA has began to show upward. If this metric crosses above the 365-day MA, historic traits recommend Bitcoin might enter a part of parabolic value development.

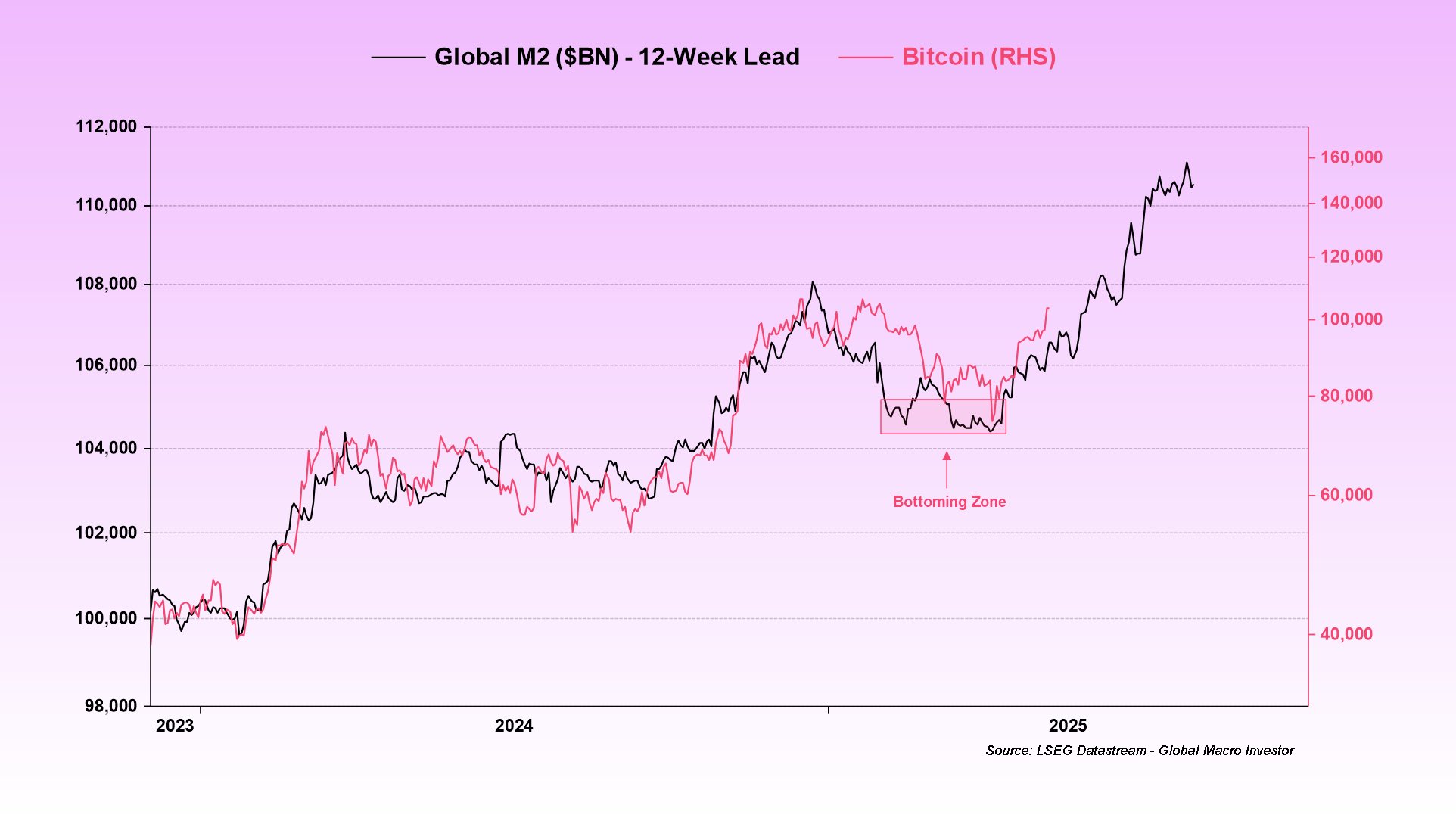

Latest macroeconomic developments might additional assist the bullish narrative for Bitcoin. Julien Bittel, Head of Macro Analysis at International Macro Investor, lately highlighted the connection between the worldwide M2 cash provide and the value of BTC.

Bittel shared a chart that overlays BTC’s value with the M2 cash provide, adjusted with a 12-week lag. The information reveals a steep improve in international liquidity since early 2025, implying that BTC might comply with this pattern and proceed rising within the months forward.

Warning Indicators Nonetheless Linger For BTC

Regardless of latest energy, not all alerts are bullish. Analysts warning that the present rally has been accompanied by aggressive profit-taking, rising the probabilities of an area high forming.

Associated Studying

Additional, latest evaluation reveals that BTC’s Demand Momentum is but to return out of detrimental territory. The analyst famous that such market conduct is generally prevalent throughout late-cycle distribution phases or macro-level consolidation durations.

That stated, Bitcoin’s Stochastic Relative Power Index (RSI) is starting to replicate renewed bullish momentum. At press time, BTC trades at $103,444, up 4% up to now 24 hours.

Featured picture created with Unsplash, charts from CryptoQuant, X, and TradingView.com