Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

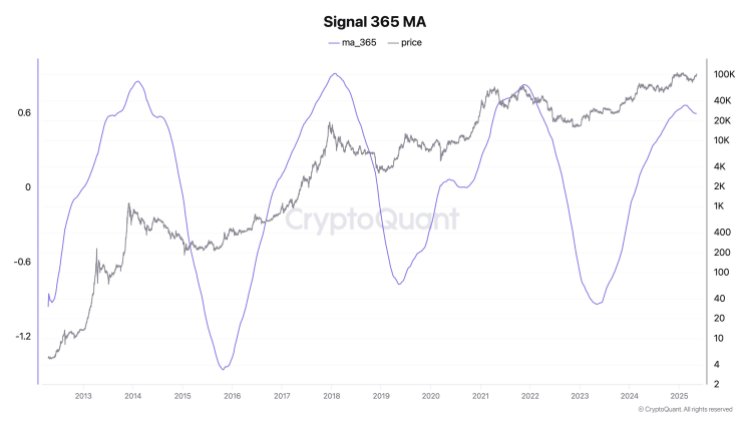

CryptoQuant Founder and CEO Ki Younger Ju has walked again his bearish prediction after the Bitcoin worth broke out above $100,000. This transfer has taken your complete market abruptly after requires decrease costs dominated the crypto area for the previous couple of months. As sentiment has moved again into the optimistic, Younger has turned bullish, explaining the change in his stance and what’s going on with the market proper now.

Bitcoin Bull Cycle Is Not Over

In an X put up, CEO Ki Younger Ju defined how the present market has deviated from the earlier cycles. For one, he explains that the market is not reliant on previous Bitcoin whales, retail buyers, and miners to maneuver the market. This was once the best way to know the cycle prime, which was when previous whales and miners had been offloading their baggage. Nevertheless, the market has managed to maneuver on, and the Bitcoin worth is now higher positioned to soak up giant sell-offs with out subject.

Associated Studying

Younger explains that this may be attributed to how various the market has grow to be thus far. The arrival of Spot Bitcoin ETFs, which had been permitted by the Securities and Trade Fee (SEC) again in 2024, have opened up new avenues for liquidity. Now, it’s not solely new retail buyers taking part in the sphere, but additionally institutional buyers who’ve been given an avenue to enter the market, and with a lot bigger pockets.

This new and substantial move of liquidity has made it in order that even sell-offs from giant whales are not impacting the Bitcoin worth the best way they used to. Thus, the CEO believes that it’s time to truly shift focus from the previous to the brand new.

Given this alteration within the tide, the CryptoQuant CEO acknowledged that it is likely to be time to throw out the cycle principle. That is due to the adjustments in liquidity move, as sources have grow to be extra unsure. “Now, as an alternative of worrying about previous whales promoting, it’s extra vital to concentrate on how a lot new liquidity is coming from establishments and ETFs since this new inflow can outweigh even sturdy whale sell-offs,” Younger defined.

Associated Studying

However, he nonetheless posits that the present market isn’t flashing a transparent bearish or bullish sample with regards to the profit-taking cycle. As he explains, the market continues to be sluggish round absorbing the entire new liquidity coming from the completely different sources and indicators are nonetheless “hanging across the borderline.”

As for the Bitcoin worth, it continues to indicate energy after crossing $100,000, as bulls eye new all-time highs above $109,000. Investor profitability has additionally skyrocket and a whopping 99% of all Bitcoin holders are actually sitting in revenue, in keeping with knowledge from IntoTheBlock.

Featured picture from Dall.E, chart from TradingView.com