A vital vulnerability within the Mobius Token (MBU) good contract on BNB Sensible Chain has led to a $2.15 million loss, including to the rising record of crypto-related exploits in 2025. Mobius is a lesser-known mission inside the BNB ecosystem.

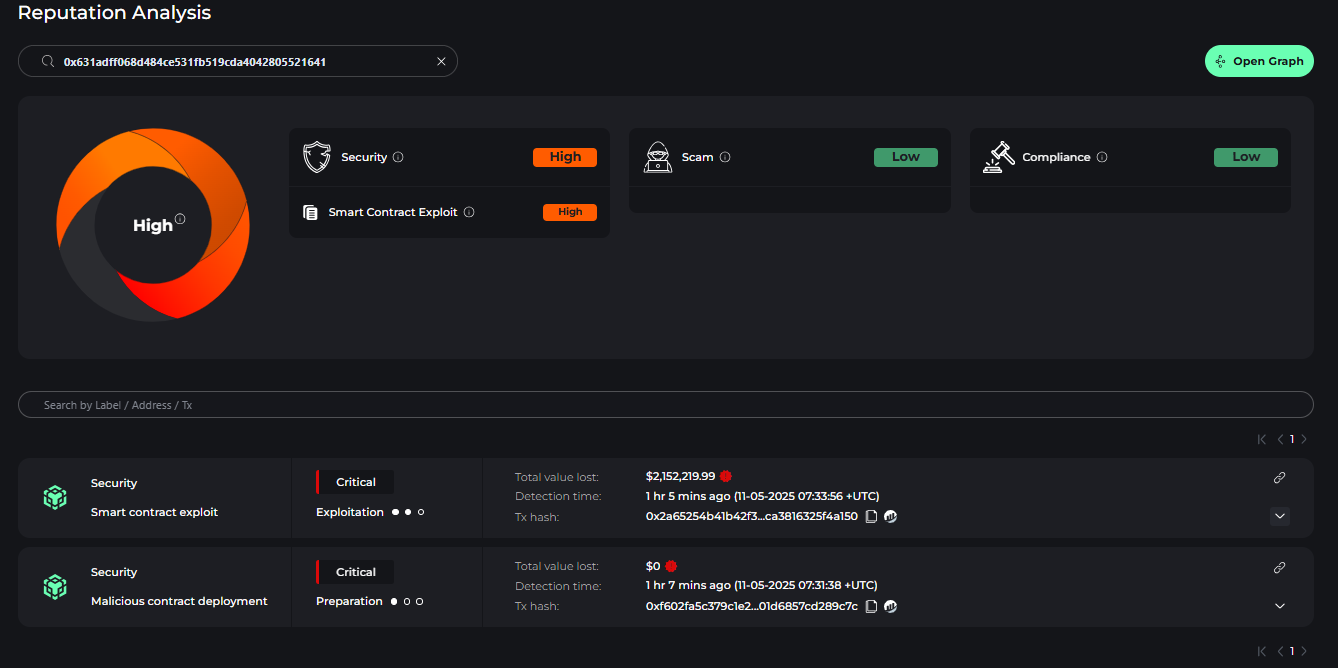

The assault, confirmed by Web3 safety agency Cyvers on Might 11, concerned a malicious hacker who took benefit of a flaw within the MBU minting mechanism.

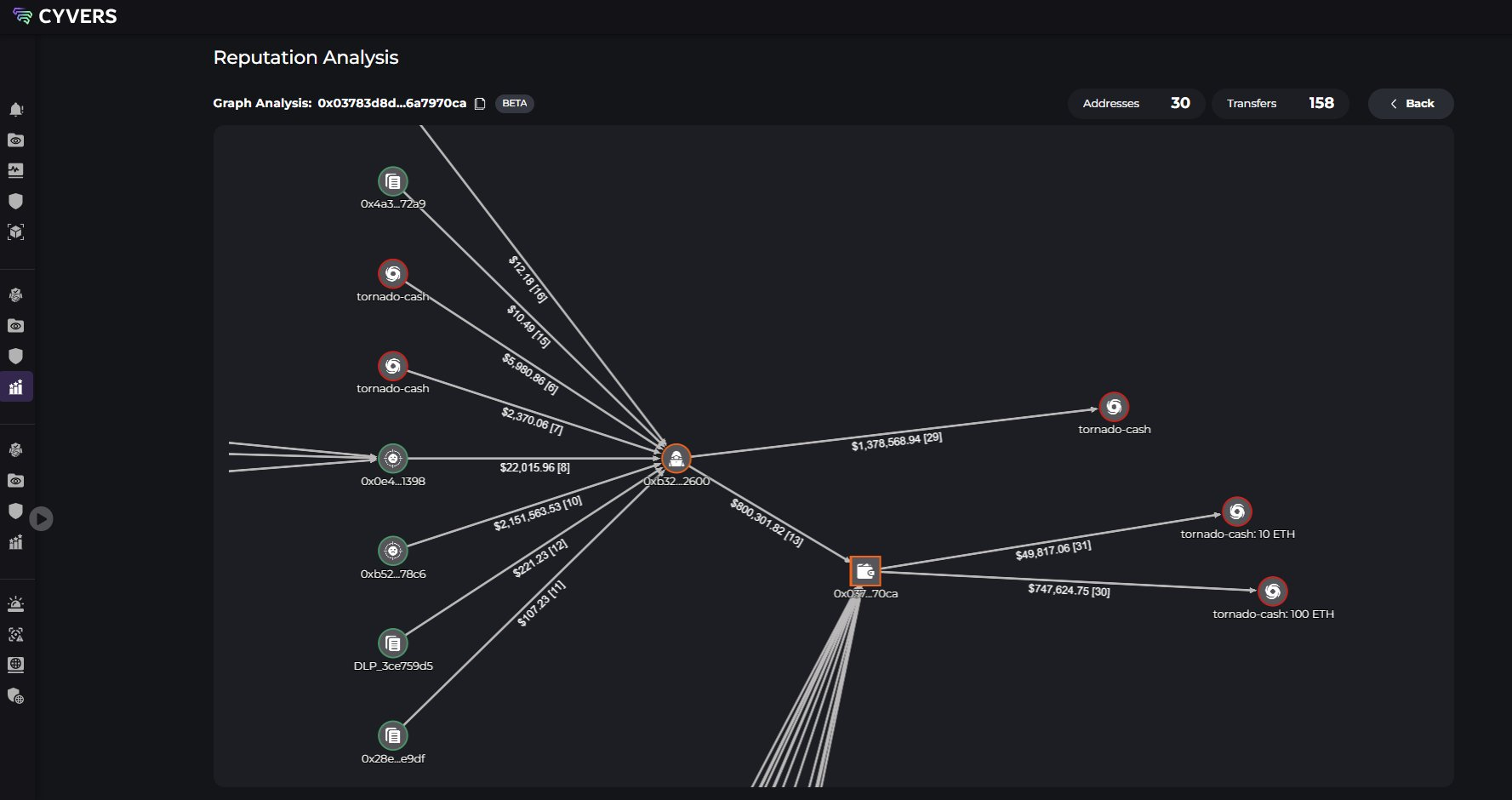

Mobius Attacker Strikes Fund By way of Twister Money

In line with Cyvers, the incident started at 07:31 UTC when a pockets (0xB32A5) deployed a rogue contract. Simply two minutes later, one other handle (0x631adf) initiated a sequence of suspicious transactions.

Utilizing solely 0.001 BNB, the attacker minted 9.73 quadrillion MBU tokens and rapidly exchanged them for stablecoins, netting $2.15 million. In the identical course of, the attacker additionally gained a further 28.5 million MBU tokens.

After the exploit, the stolen belongings had been moved to Twister Money, a well-liked protocol that anonymizes transactions.

The strategy and pace of the exploit level to a calculated transfer to evade monitoring and asset restoration. This incident additional highlights the persistent vulnerabilities dealing with good contract-based methods.

In the meantime, this Mobius hack makes it the most recent sufferer in a wave of blockchain exploits which have resulted within the lack of round $2 billion throughout numerous platforms, together with Bybit.

BNB Chain Exercise Surges

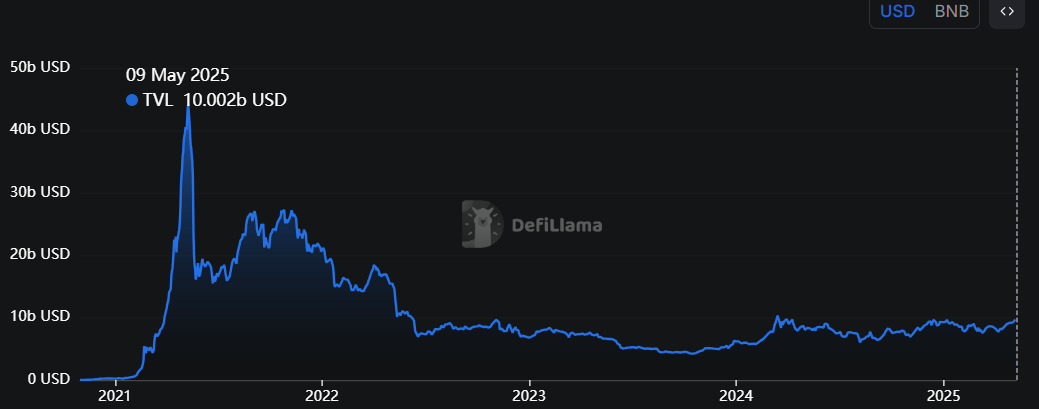

Regardless of remoted incidents just like the Mobius breach, BNB Chain is witnessing a big resurgence in person and developer exercise. Over the previous months, the community has reemerged as a high contender within the DeFi area.

Information from DefiLlama reveals that the whole worth locked (TVL) on BNB Chain has surpassed $10 billion, reaching a three-year excessive. Nevertheless, it’s nonetheless considerably under the 2021 all-time excessive of greater than $40 billion.

BNB Chain additionally just lately claimed the highest spot within the decentralized trade (DEX) sector, outpacing each Ethereum and Solana.

Market observers famous that the community’s progress is fueled by recent institutional curiosity, a rise in DeFi participation, and powerful demand for on-chain belongings.

Furthermore, the momentum can be partly attributed to Binance’s continued affect and Changpeng Zhao’s renewed deal with the blockchain community.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.