Bitcoin’s latest rally has captured investor consideration as its value inches nearer to $105,000. The main cryptocurrency has gained momentum all through the previous month, fueled by sturdy institutional curiosity and renewed market optimism.

Nonetheless, conflicting market situations might maintain Bitcoin again from reaching a brand new all-time excessive.

Bitcoin Holders Closely Accumulate

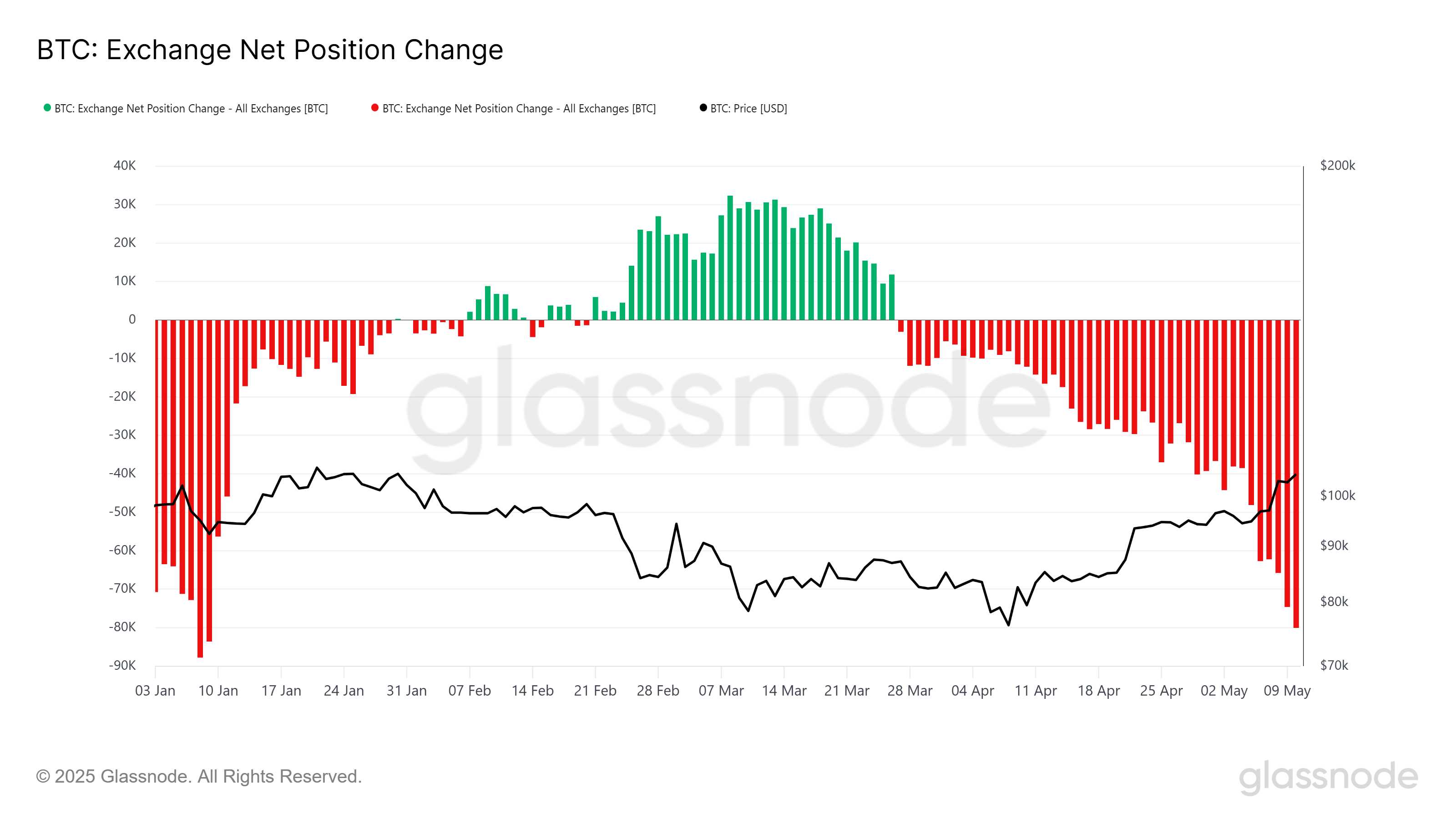

Investor exercise has been overwhelmingly bullish. Over the previous week alone, greater than 30,072 BTC, valued at over $3.13 billion, have been bought. This surge in shopping for exercise has pushed the alternate web place to its lowest stage in 4 months.

The metric signifies that extra cash are being withdrawn from exchanges than deposited, a basic signal of accumulation.

Worry of lacking out on earnings is pushing Bitcoin holders to build up at a fast tempo. As Bitcoin hovers close to its report highs, long-term traders seem like including to their positions, betting on a recent breakout.

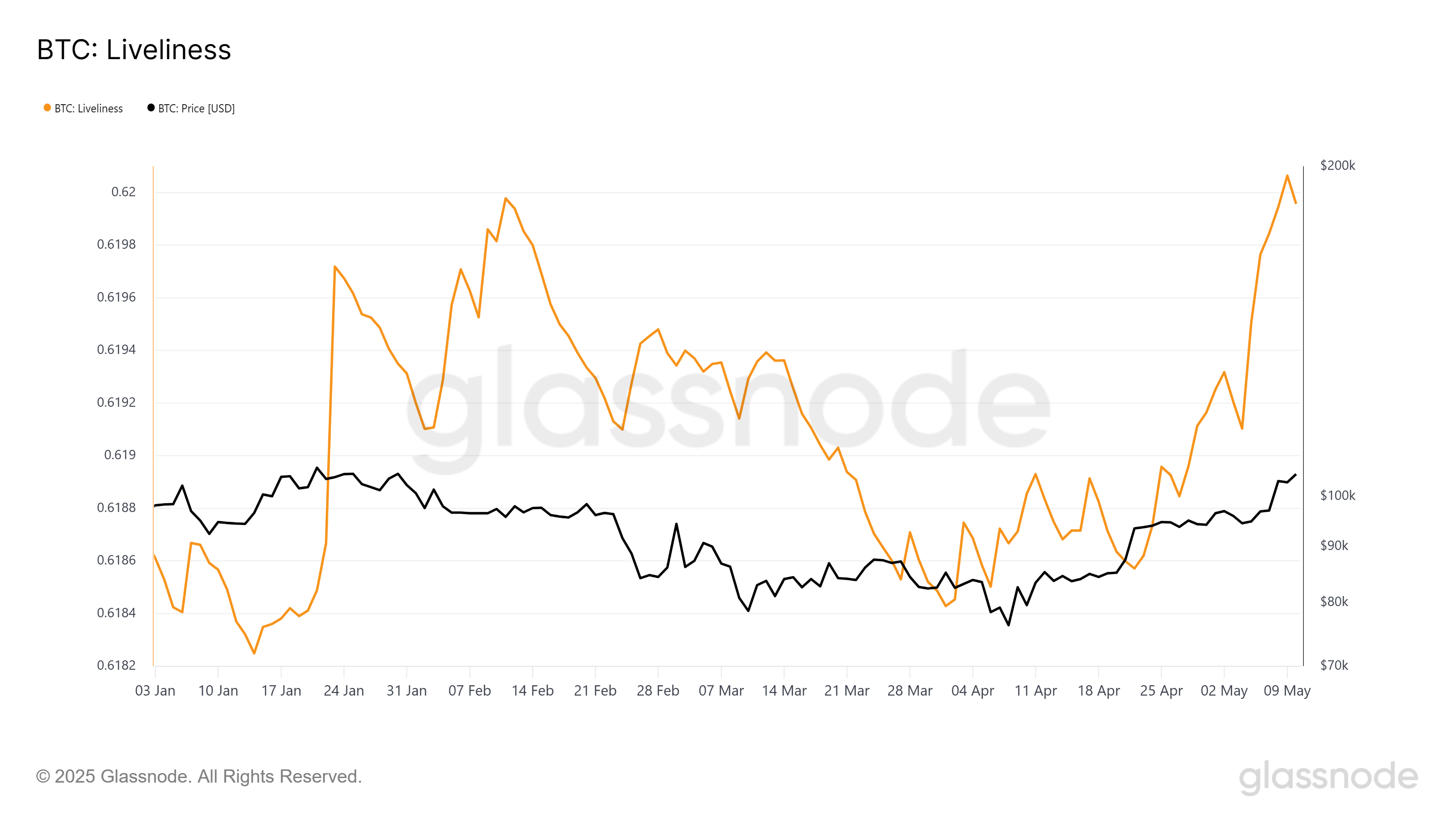

Whereas accumulation stays sturdy, the macro pattern presents a blended image. The Liveliness indicator, a key on-chain metric, has seen a notable spike because the begin of Could. At present sitting at a multi-week excessive, it means that long-term holders (LTHs) are starting to liquidate.

A rise in Liveliness usually signifies that dormant cash have gotten lively once more, usually signaling that early adopters are taking earnings. This conduct might introduce new promoting strain into the market.

If Bitcoin LTHs proceed to dump their holdings, it may undermine the bullish sentiment pushed by recent accumulation.

BTC Worth Goals For New ATH

Bitcoin is at the moment buying and selling at $104,231, slightly below the important thing psychological resistance of $105,000. Nonetheless, technical knowledge reveals that the precise resistance sits at $106,265. This value stage has acted as a ceiling since December 2024, stopping Bitcoin from gaining additional traction.

Regardless of the all-time excessive standing at $109,588, the $106,265 mark is Bitcoin’s speedy hurdle. Market dynamics—together with the promoting from LTHs and conflicting investor sentiment—make this stage notably troublesome to breach.

Ought to Bitcoin fail to beat this resistance, a value correction again to $100,000 stays a powerful risk.

Conversely, if BTC manages to interrupt and flip $106,265 right into a help ground, it may reignite bullish momentum. Such a transfer would pave the best way for Bitcoin to reclaim $109,588 and doubtlessly kind a brand new all-time excessive.

Surpassing this stage would invalidate the bearish outlook and will set the stage for a run to $110,000.

Disclaimer

In keeping with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.