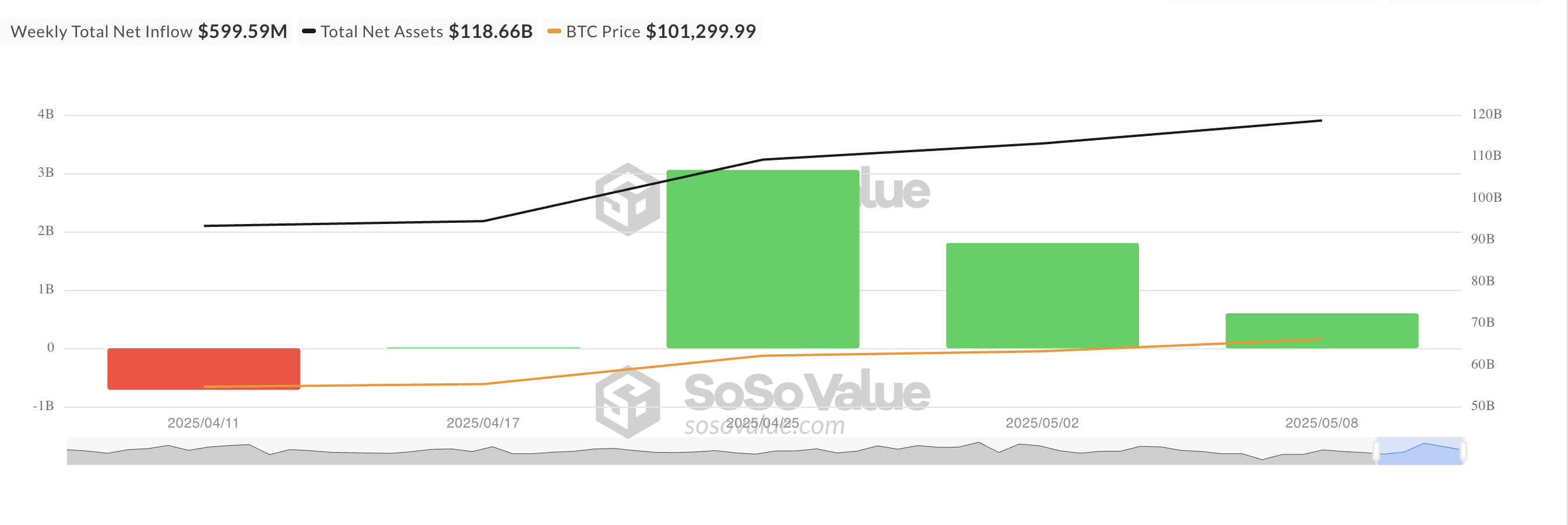

Final week, Bitcoin-backed funds noticed internet inflows of $600 million. Whereas this was a optimistic inflow of capital, it represented a pointy 67% decline from the $1.81 billion recorded the earlier week.

Apparently, this slowdown in institutional flows occurred regardless of BTC’s rally above the $100,000 value mark for the primary time since early February. So, what does this divergence inform us about investor sentiment?

Bitcoin ETF Capital Inflows Drop Amid Cautious Investor Sentiment

Final week, inflows into spot BTC ETFs totaled $600 million. Though it was a internet optimistic when it comes to capital influx, it marked a 67% dip from the $1.81 billion these funds noticed in inflows the earlier week.

Notably, this development occurred the identical week the main coin broke decisively above the $100,000 value mark for the primary time since February. This means that the breakout, fairly than sparking a shopping for frenzy, prompted some ETF holders to lock in beneficial properties or maintain off on contemporary entries.

Final week’s drop in inflows means that whereas institutional urge for food for BTC publicity stays, the tempo is slowing, presumably as a result of warning or worry. It displays a wait-and-see angle from traders who had waited three months for the coin to interrupt above $100,000 and are actually watching to see if it may maintain and stabilize above that key stage.

Bitcoin Sees Bullish Alerts from Derivatives Market

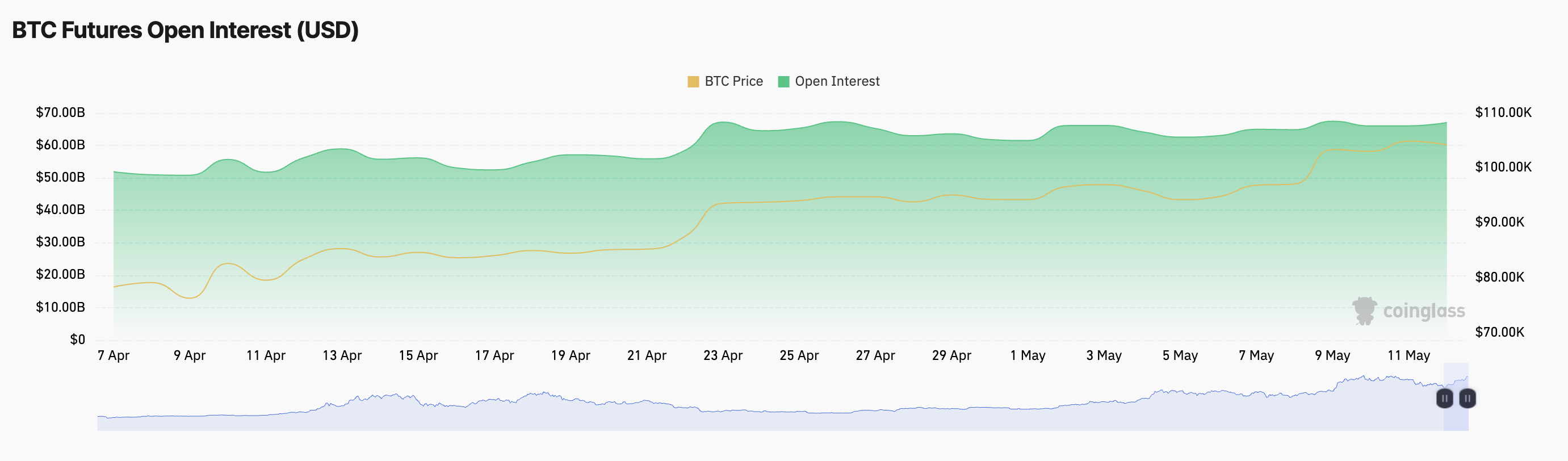

BTC trades at $103,979, with 0.24% beneficial properties over the previous 24 hours. Throughout that interval, open curiosity in BTC futures has climbed 2%, reflecting growing buying and selling participation. At press time, this stands at $67.04 billion.

An increase in BTC’s value and open curiosity alerts confidence, as extra merchants are taking positions. This mixture suggests a powerful development, with merchants anticipating the value motion to proceed within the course it’s heading.

Moreover, the coin’s funding charges stay optimistic at 0.0082%. This implies lengthy positions pay shorts, indicating market individuals are leaning bullish.

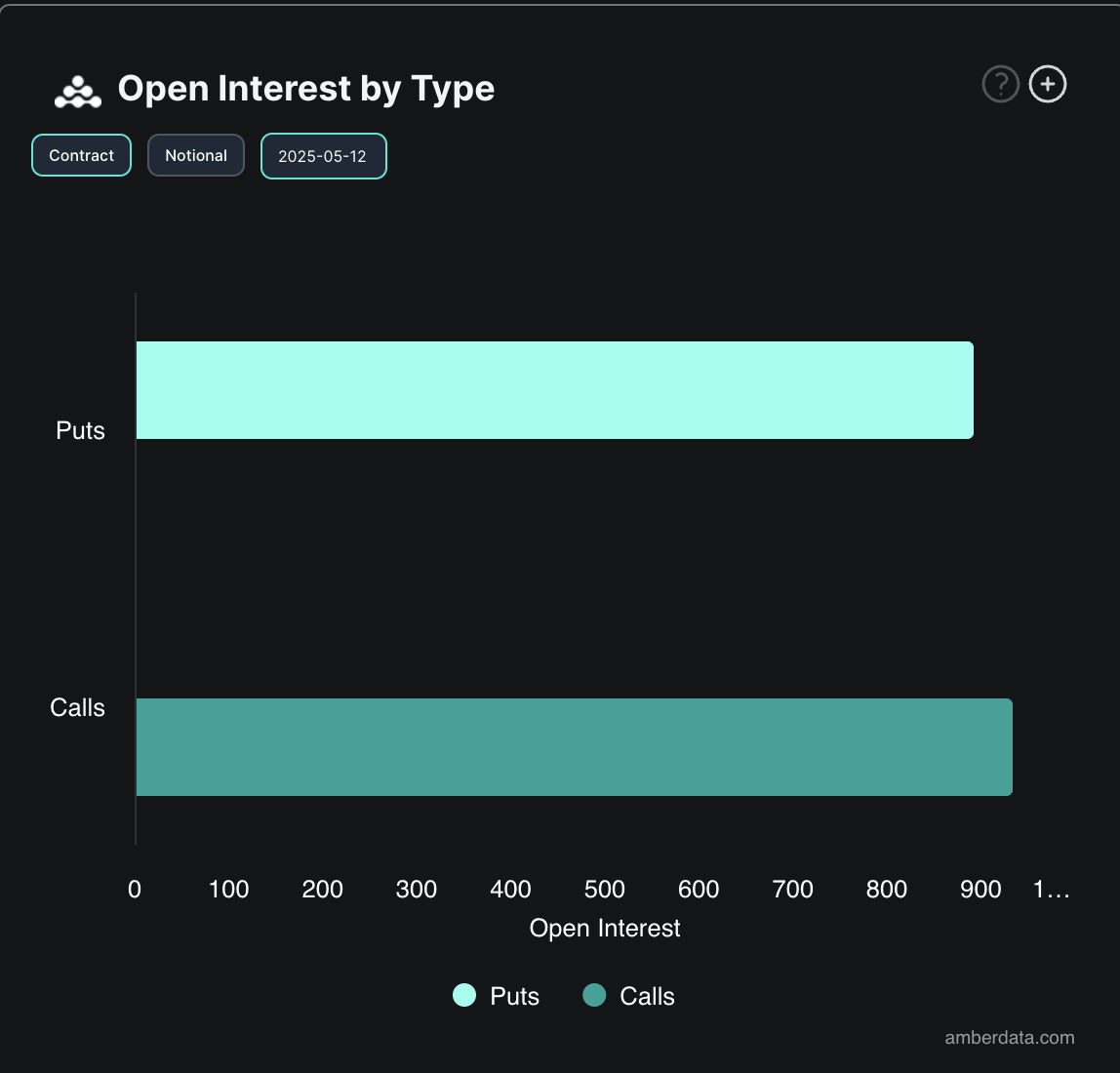

Choices market exercise additionally reinforces this bullish outlook. At the moment, name contracts exceed places, exhibiting that merchants are betting on extra upside.

A mixed studying of those metrics means that whereas ETF inflows might have dipped, broader market sentiment stays assured and risk-on.

Disclaimer

According to the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.