This week, all eyes are on Bitcoin (BTC) as crypto market individuals anticipate key US financial indicators. President Trump’s financial insurance policies, specifically, have made Bitcoin and crypto markets vulnerable to macroeconomic knowledge and related woes.

Because the pioneer crypto holds above $100,000, its upward potential hinges on the next US financial knowledge.

US Financial Knowledge To Watch This Week

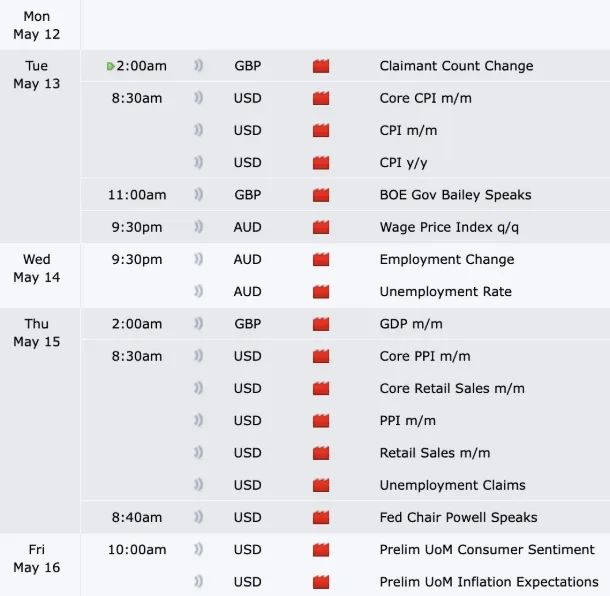

The next US financial indicators will curiosity crypto merchants and buyers this week.

CPI

“We’re beginning with a no-news Monday adopted by CPI on Tuesday, which is the principle focus for the week.” That is the overall sentiment amongst crypto market individuals watching this week’s US financial calendar.

Maybe probably the most crucial US financial indicator for Bitcoin and crypto merchants is April’s US CPI (Client Value Index), due on Tuesday.

After China’s CPI inflation got here in at 0.1% MoM (Month-over-Month) in April versus March’s 0.4% decline, coupled with the nation’s capital injection, all eyes are on the US CPI this week.

The April CPI comes after the FOMC assembly and Fed chair Jerome Powell’s remarks final week. As was extensively anticipated, the Fed’s transfer to steady rates of interest turned consideration to the financial institution’s accompanying assertion and Fed Chair Powell’s press convention.

In accordance with Powell, uncertainty in regards to the financial outlook has elevated additional, making Tuesday’s CPI inflation knowledge a key indicator.

Notably, the Fed is anxious over the US’s commerce insurance policies, with Powell implying that the Fed could also be ready to stay on maintain for a chronic interval.

“CPI is among the major indicators for the Fed, and this launch may present whether or not tariffs are pushing inflation larger,” a person famous on X (Twitter).

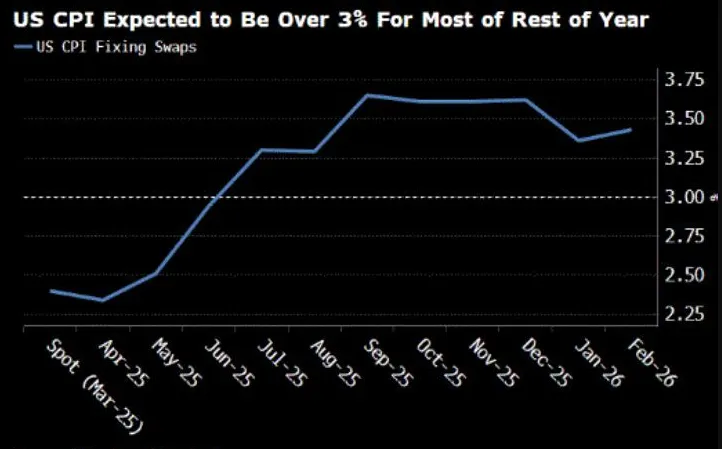

Nonetheless, amid the commerce chaos, some say US CPI may stay over 3% for a lot of the remainder of the 12 months.

In accordance with knowledge on MarketWatch, the US CPI forecast is 2.3%, in comparison with the 2.4% recorded in March. The March studying got here beneath the anticipated 2.5%, indicating cooling inflation within the US.

If the pattern extends in April, exhibiting easing inflationary pressures, it might improve requires the Fed to chop charges quickly. Such an motion may weigh the greenback however enhance curiosity in Bitcoin and crypto.

Conversely, if the CPI charges point out an acceleration of inflationary pressures, coming in above March’s CPI fee of two.4%, it may amplify requires the Fed to lengthen its present financial coverage stance. Such an final result may help the greenback and draw sentiment away from Bitcoin.

Preliminary Jobless Claims

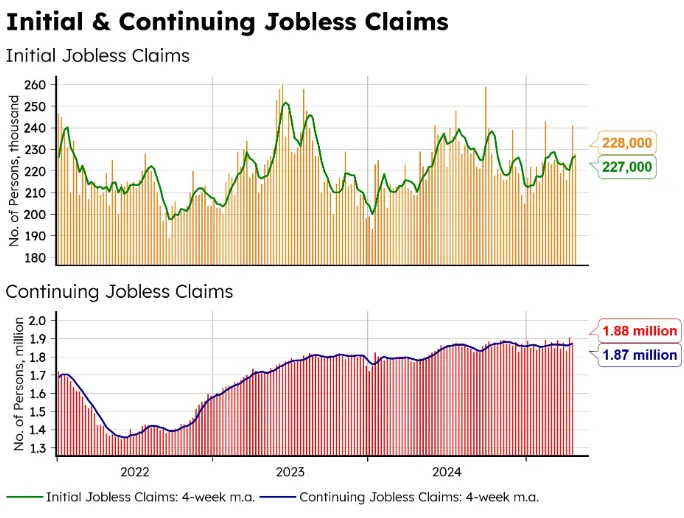

One other US financial indicator to look at this week is the preliminary jobless claims, detailing the variety of US residents who filed for unemployment insurance coverage for the primary time final week.

For the week ending Might 3, preliminary jobless claims recorded 228,000. This marked a drop that beat market expectations after 241,000 claims within the week ending April 26 and the projected 230,000.

“No indicators of labor market stress within the final week of April. Jobless claims—each preliminary and persevering with—are regular, proper consistent with the previous 3 years,” international macro researcher The Bitcoin Layer remarked in a put up.

Notably, a lower-than-expected studying is mostly thought of constructive or bullish for the USD and due to this fact bearish for Bitcoin.

In opposition to this backdrop, the drop advised a more healthy employment outlook within the US. It additionally pointed to an enchancment within the labor market, interpreted as a constructive signal for the economic system.

If the pattern sustains, preliminary jobless claims for the week ending Might 10 may are available in beneath analysts’ median forecast and projections of 227,000. This may weigh on risk-on property like Bitcoin.

PPI

Including to the record of US financial indicators this week is the US PPI (Producer Value Index), monitoring the value adjustments firms see.

March PPI dropped 0.4% MoM, beneath the anticipated 0.2% rise, signaling easing inflation pressures. 12 months-over-year (YoY), PPI was 2.7%, beneath the forecasted 3.3%.

Decrease-than-expected PPI may gasoline optimism for Fed fee cuts, doubtlessly boosting danger property like Bitcoin. Nonetheless, Trump’s tariff insurance policies encourage volatility on account of their capability to encourage disinflationary developments.

“Sizzling CPI and PPI knowledge this week may probably set off short-term draw back for the S&P 500 (2–5% pullback) and Bitcoin (5–10% decline) on account of fears of tighter Fed coverage and rising yields. Nonetheless, cooling geopolitical tensions (India/Pakistan and Russia/Ukraine) and potential US/China commerce deal progress may mitigate losses by fostering risk-on sentiment and capping commodity-driven inflation, and S&P 500 and BTC may shortly get better,” an analyst wrote on X.

Client Sentiment

The Client Sentiment report can also be a key watch, reflecting whether or not the market is rising pessimistic or optimistic. Due to this fact, the Might 16 preliminary knowledge can be a vital watch as merchants and buyers gauge sentiment shifts.

In April 2025, the College of Michigan’s Client Sentiment Index plummeted to 52.2, an 8% drop from March’s 57, hitting a close to five-year low.

This decline, pushed by fears of inflation (expectations surged to six.5%) and commerce coverage uncertainty from Trump’s tariffs, alerts lowered client spending. Decrease spending might restrict liquidity for danger property like crypto, doubtlessly triggering a correction in Bitcoin value.

BeInCrypto knowledge reveals BTC was buying and selling for $103,991 as of this writing, down by 0.09% within the final 24 hours.

Disclaimer

In adherence to the Belief Mission tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.