Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

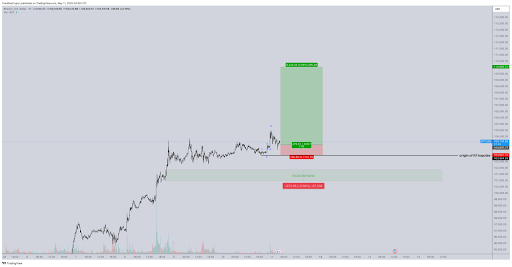

Over the previous three days, Bitcoin has hovered between $103,000 and $104,500, making a slender channel after a notable rally that noticed it break above $100,000 final week. Technical evaluation of the day by day candlestick chart exhibits the formation of a minor impulsive wave from $103,000, which can mark the ultimate finish of the latest consolidation and the start of a recent rally in direction of new highs.

Notably, latest value motion up to now 12 hours or so has seen the gradual finish of the consolidation, and a focus is now turning to the following psychological stage at $110,000.

Analyst Sees Breakout As Sign For Upside Continuation

In a put up shared on the social media platform X, crypto analyst CrediBULL defined the logic behind his present lengthy commerce setup, stating that Bitcoin has damaged away from its three-day consolidation zone with an early impulse that began on the $103,000 stage. His evaluation predicted that this motion could possibly be the beginning of a a lot bigger leg upward, particularly if the present value construction holds with out falling again into a neighborhood demand zone between $101,000 and $102,000.

Associated Studying

In keeping with CrediBULL, the present commerce has a clear invalidation stage just under the impulse origin, permitting for a good cease loss. This setup yields a excessive reward-to-risk ratio exceeding 5:1, with an upside goal of $110,660, as illustrated within the chart. If this breakout is real, it could possibly be a sign that Bitcoin is making ready for an aggressive push towards new all-time highs.

Alternatively, CrediBULL cautioned that if the present transfer proves to be a deviation and value falls beneath the impulse origin, focus ought to shift to the native demand zone round $101,800. The chart helps this with a clearly marked inexperienced space labeled “native demand.” That is the following main help if Bitcoin bulls fail to carry the present value ranges.

$110,000 Bitcoin Goal In Sight With Rising Market Momentum

In keeping with the crypto analyst, his prediction of the following transfer to $110,000 has at the very least a 20% likelihood of taking part in out. These odds are fairly good, contemplating the unpredictable nature of the crypto market.

Associated Studying

Notably, value motion up to now 24 hours has seen the main cryptocurrency break above $105,000 once more, peaking at an intraday excessive of $105,503 earlier than easing barely. This transfer strengthens the case that the latest consolidation part might have concluded, and a profitable transfer above $110,000 earlier than the top of the week is underway.

On the time of writing, Bitcoin is buying and selling at $104,428. A profitable rally to the $110,660 goal would characterize a 6% achieve from the present value, whereas draw back threat is capped beneath the $103,000 stage.

Featured picture from Getty Photographs, chart from Tradingview.com