Solana (SOL) is up 17% within the final seven days and reveals sturdy technical momentum throughout a number of indicators. Its Ichimoku Cloud chart stays firmly bullish, with value motion properly above the cloud and key help traces holding.

The BBTrend indicator additionally confirms development energy, leaping from adverse territory to 16.7 and holding regular. With SOL approaching a serious resistance zone, a breakout might open the door for a transfer above $200 for the primary time since February.

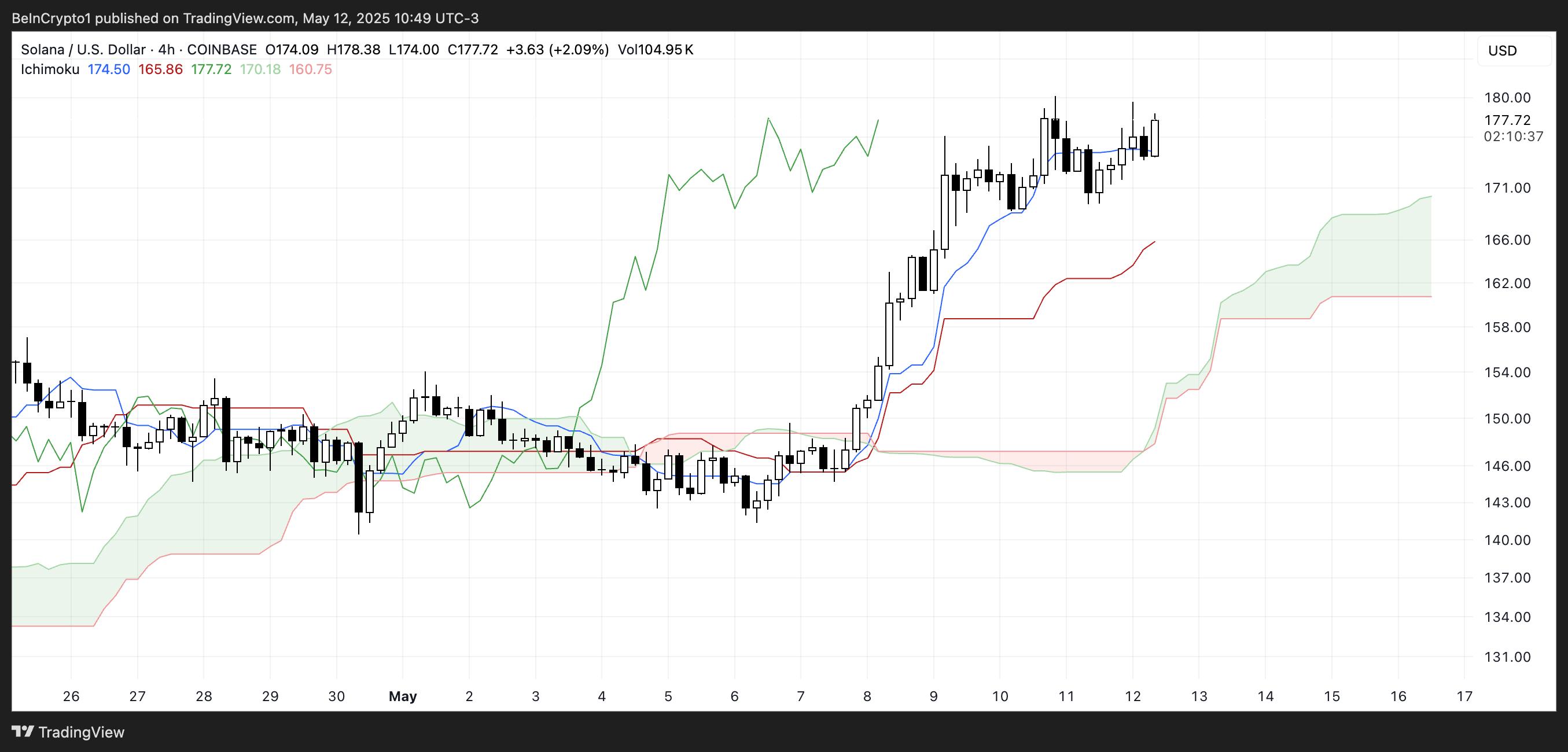

Solana Maintains Bullish Momentum on Ichimoku Cloud Breakout

Solana Ichimoku Cloud chart is presently displaying a bullish construction. The worth is buying and selling properly above the Kumo (cloud), which has turned inexperienced—signaling that momentum is favoring the bulls.

The Main Span A (inexperienced cloud boundary) is above Main Span B (pink cloud boundary), confirming a constructive development.

Moreover, the value persistently holds above the Tenkan-sen (blue line) and Kijun-sen (pink line), which signifies that short-term and medium-term help ranges stay intact.

The Lagging Span (inexperienced line) is positioned above each the value and the cloud, which confirms the bullish bias additional.

The extensive hole between the present value and the cloud suggests sturdy bullish momentum with minimal resistance within the close to time period.

So long as the value stays above the cloud and key help traces, the development stays clearly upward. Regardless of the great momentum, giant transfers and unstaking from main wallets, together with FTX/Alameda and Pump.enjoyable, have sparked fears of a attainable sell-off following SOL’s fast value surge.

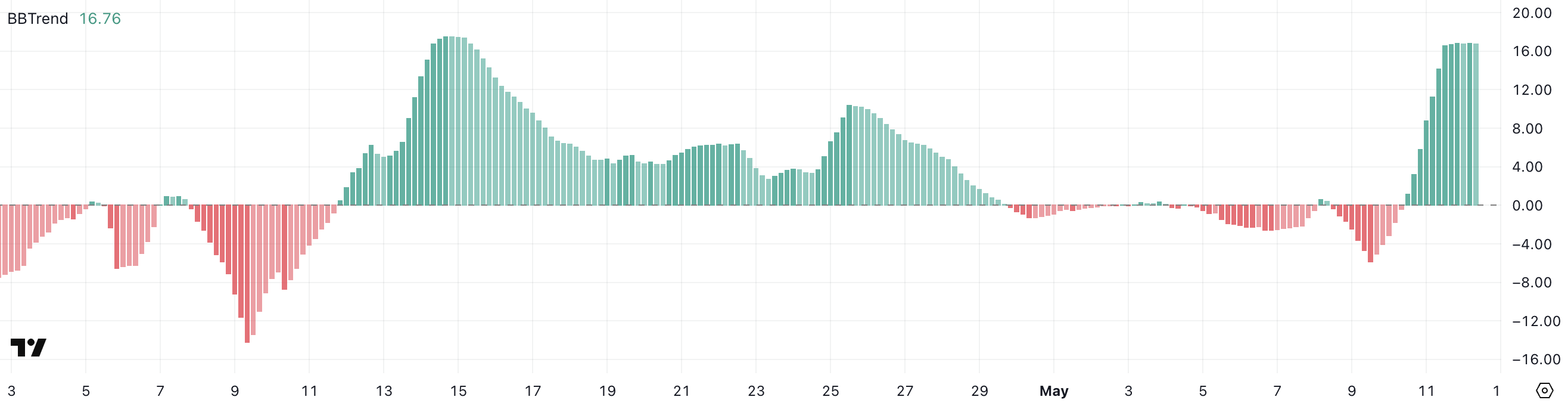

SOL BBTrend Holds Round 16.7, Confirming Sturdy Bullish Momentum

Solana’s BBTrend (Bollinger Band Pattern) indicator has surged sharply from -0.41 to 16.76 in simply two days, indicating a powerful shift from a consolidating or bearish part into clear bullish territory.

BBTrend measures the space between the value and the Bollinger Band centerline, serving to establish the energy of a development. Values above 0 recommend bullish situations, whereas adverse values level to potential downtrends or sideways motion.

A transfer as sharp as this indicators that SOL has entered a part of increasing volatility with upward momentum.

The BBTrend has stabilized across the 16.7 stage during the last a number of hours, suggesting that the sturdy bullish impulse might now be consolidating.

This might indicate two potential eventualities: continued upward motion if momentum builds once more, or a cooling-off interval as merchants assess current positive aspects.

The sustained excessive BBTrend worth displays sturdy development energy, and except there’s a pointy reversal, SOL’s value motion will doubtless stay favorable within the quick time period.

SOL Eyes Break Above $200 as EMA Strains Sign Power

Solana value is buying and selling slightly below a key resistance stage at $180.54, a zone that has capped its upward motion in current classes.

The EMA traces present a transparent bullish construction, with short-term averages positioned properly above the long-term ones and sustaining wholesome separation, indicating a powerful and sustained uptrend.

If SOL breaks by way of this resistance and maintains momentum, it might climb towards $205, marking its first transfer above $200 since February 10.

A continued breakout past that would take the value to $220, representing a attainable 24% upside from present ranges.

On the draw back, merchants ought to watch the $160.78 help intently. A breakdown under that stage would sign weakening momentum and push SOL to $147.6.

If bearish strain intensifies and help fails, the following key stage sits at $140.4.

Disclaimer

In step with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.