Bitcoin is buying and selling above the $104,000 stage after posting its second-highest weekly shut in historical past, reinforcing the power of the present uptrend. The bullish momentum has been constructing steadily over the previous few weeks, with value surging aggressively after reclaiming each the $90K and $100K psychological ranges. This marks a big shift in sentiment after months of consolidation and market hesitation.

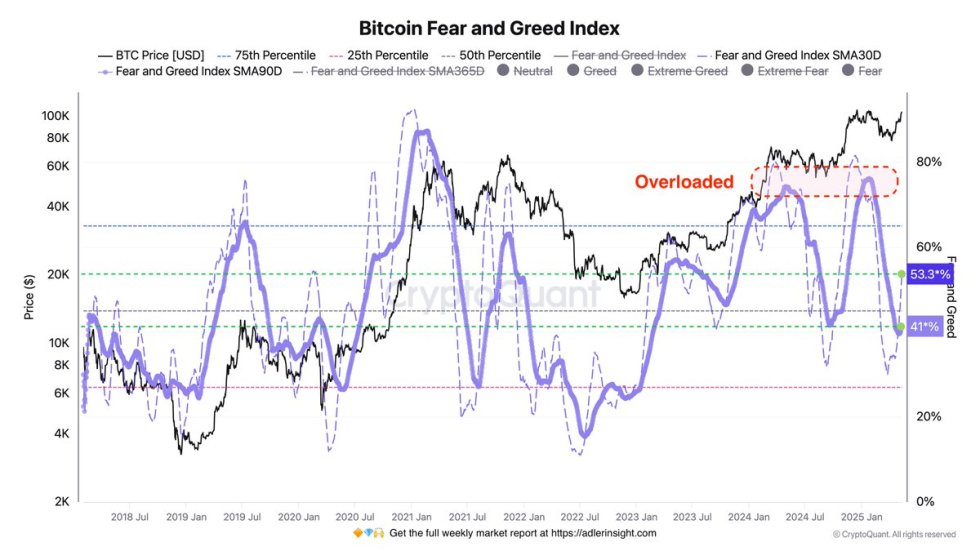

In keeping with knowledge from CryptoQuant, the Worry and Greed Index has began to rise considerably, reflecting rising optimism amongst Bitcoin traders. Whereas sentiment is clearly leaning bullish, the index nonetheless stays effectively beneath the euphoric “overload” zone, suggesting there’s extra room for upside earlier than reaching overheated situations.

This mix of sturdy value motion and managed sentiment might point out a sustainable rally quite than a speculative blow-off. As Bitcoin holds above key resistance zones, analysts and traders are starting to give attention to the all-time excessive close to $109K as the subsequent main goal. The current transfer has additionally energized the broader crypto market, with altcoins gaining power alongside Bitcoin. As momentum builds, the market seems poised to enter a brand new section of growth, fueled by renewed confidence and capital inflows.

Momentum Builds As Bitcoin Eyes $109K All-Time Excessive

Bitcoin is getting into a essential week as bulls set their sights on the $109,000 all-time excessive. After months of heavy promoting stress and widespread market doubt, the main cryptocurrency has surged again into the highlight, buying and selling slightly below the $105,000 mark. This stage now acts as instant resistance and will develop into a significant pivot within the coming classes. If bulls handle to push by way of this barrier, a breakout into uncharted territory could be imminent. Nevertheless, if promoting stress intensifies round this zone, Bitcoin might face a interval of consolidation or retracement earlier than making one other try.

Market sentiment has notably improved, as highlighted by high analyst Axel Adler. In keeping with Adler’s insights, the present common values of the Worry and Greed Index are climbing steadily, signaling an increase in investor confidence. Importantly, the index stays removed from excessive greed territory, which means that optimism is constructing however not but overheated — a constructive signal for a sustainable rally.

Additional fueling the constructive outlook are macro developments. Sunday’s negotiations between Washington and Beijing introduced a way of aid to international markets, contributing to the broader upswing. With geopolitical tensions easing and Bitcoin holding its floor close to multi-month highs, the setup for one more leg larger is taking form.

BTC Faces A Essential Check Close to All-Time Highs

Bitcoin is buying and selling above $104,000, following the second-highest weekly shut in its historical past. After reclaiming the $90K stage in late April, the worth surged aggressively and now hovers slightly below the all-time excessive (ATH) zone. This weekly chart reveals clear momentum, with BTC pushing by way of key resistance zones with excessive quantity and conviction. Nevertheless, value is now instantly testing the identical vary that marked the highest earlier this yr—between $104K and $105.7K.

This zone is essential. If bulls can push above this stage and shut the weekly candle close to or above the present all-time excessive, it could seemingly affirm the long-term uptrend. Such a breakout would put BTC in value discovery, doubtlessly triggering momentum-driven shopping for and institutional inflows. Then again, if Bitcoin stalls or retraces from right here, it might sign a short-term exhaustion and presumably a correction towards the $100K–$103K help zone.

Quantity traits and market sentiment stay favorable, particularly with declining alternate balances and rising investor optimism. Nevertheless, a confirmed weekly breakout above the ATH stays the last word affirmation for the subsequent macro leg up. All eyes at the moment are on whether or not BTC could make historical past with a brand new all-time excessive this week.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.