Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

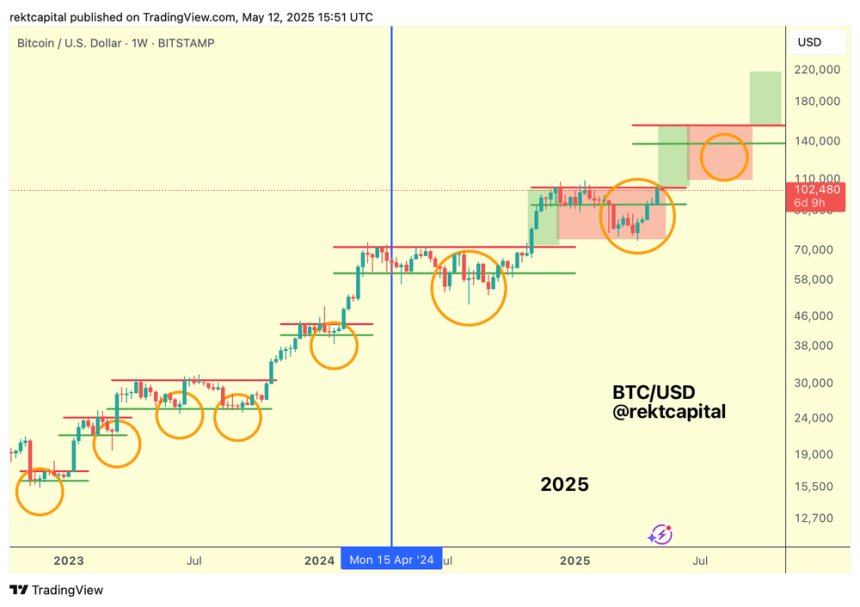

After leaping by 10% over the previous week, Bitcoin (BTC) has hit an important resistance degree, which may push or momentarily halt the flagship crypto’s rally towards a brand new all-time excessive (ATH).

Associated Studying

Bitcoin Hits Key Degree

Bitcoin just lately jumped above the $100,000 barrier for the primary time since February. Throughout its important weekly efficiency, BTC has surged over 10% to hit a three-month excessive of $105,500 on Monday, fueling traders’ sentiment relating to a brand new ATH rally.

On Monday, Analyst Rekt Capital highlighted that the flagship crypto rallied throughout the complete re-accumulation vary, concluding its draw back deviation and the primary worth discovery correction. After surging to its vary excessive of $104,500, Bitcoin has confronted rejection from this key degree, momentarily pausing its rally.

He identified that Bitcoin already had its first Value Discovery Uptrend and Value Discovery Correction. The cryptocurrency is now trying to substantiate its second Value Discovery Uptrend, however must reclaim the $104,500 degree as help to substantiate this section.

Because the analyst defined, this degree is at the moment appearing as resistance after it closed the week at $104,118, slightly below the vary excessive. He added that “technically BTC can attempt to verify an uptrend past this level by Each day Closing above $104.5k after which holding it as help, so it will likely be value waiting for this decrease timeframe affirmation.”

Nonetheless, “till that affirmation is in, this resistance will proceed to behave as one. And as resistances do, they have a tendency to reject worth.”

In line with Rekt Capital, Bitcoin has repeated some key parts from its Publish-halving vary in its present vary, suggesting that if BTC continues to reject from this degree, it may face a post-breakout retest of its decrease excessive resistance.

One Dip Left Earlier than ATHs?

Beforehand, the analyst detailed that BTC could possibly be repeating its This autumn 2024 efficiency, the place the cryptocurrency recovered from its draw back deviation to hit a brand new ATH.

BTC initially bought rejected at its decrease excessive resistance and fell to the vary’s lows earlier than breaking above the decrease excessive, retesting it as help, and hovering to a brand new ATH.

For historical past to repeat, BTC should get rejected at $99,000, maintain $93,500 as help, and break the $97,000-$99,000 vary earlier than being rejected on the $104,500 resistance, which is the extent “to show into help for Bitcoin to breakout into its second Value Discovery Uptrend.”

Notably, BTC adopted this path carefully over the previous week, getting rejected close to $99,000 and retesting the $93,500 help earlier than leaping above the $100,000 mark. To proceed this efficiency, the cryptocurrency should fall to the $97,000-$99,000 vary and maintain it as help for the same breakout to new ATHs.

Associated Studying

In his Monday evaluation, Rekt Capital shared that BTC’s decrease excessive resistance is on the $98,500 degree, signaling {that a} 5% drop could possibly be forward. Nonetheless, he famous that the retest “doesn’t must occur in any respect,” as Bitcoin may Each day Shut above the important thing resistance, maintain this degree, and rally to new ATHs.

“However within the occasion of a dip, turning the Decrease Excessive resistance into a brand new help may absolutely verify the break of this Decrease Excessive, flip it into new help, and in doing so, solidify BTC’s positioning within the $98.5k-$104.5k portion of the ReAccumulation Vary,” he concluded.

Featured Picture from Unsplash.com, Chart from TradingView.com