Bitcoin is ready to shut out a risky week, marked by an try to interrupt its all-time excessive (ATH) that in the end resulted in a retracement to decrease demand ranges. Regardless of this pullback, market sentiment stays largely optimistic.

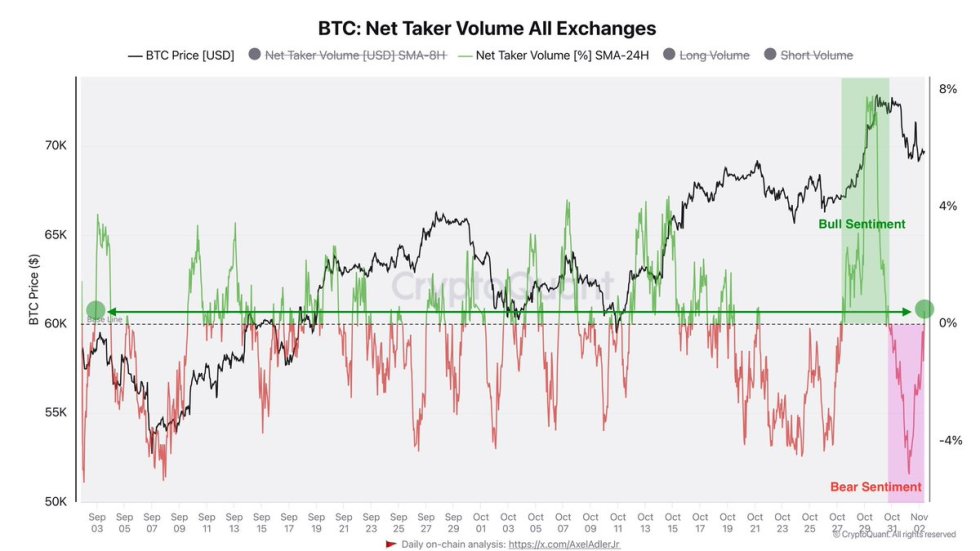

Key knowledge from CryptoQuant reveals that the Web Taker Quantity (SMA-24H) throughout all exchanges presently signifies a bullish outlook, as shopping for stress outweighs promoting stress on this metric. This development highlights rising confidence amongst buyers, aligning with the broader sentiment seen after the current U.S. election outcomes, which have injected contemporary optimism into the crypto market.

Analysts anticipate an uptrend for Bitcoin, supported by sturdy shopping for curiosity from retail and institutional gamers. The info underscores that whereas Bitcoin faces short-term hurdles round its ATH, the underlying demand suggests one other rally could also be on the horizon.

With the election influence nonetheless unfolding and Bitcoin’s value consolidating above key demand zones, the approaching days can be essential in setting the stage for its subsequent main transfer. Whether or not Bitcoin can reclaim its upward momentum and break into value discovery will rely on sustained demand and the continuation of this bullish development throughout exchanges.

Bitcoin Prepares For A Risky Week

Bitcoin is gearing up for one of the pivotal weeks in its historical past, with main occasions on the horizon that might form market sentiment for the remainder of the 12 months. The US election on Tuesday and the Federal Reserve’s upcoming rate of interest determination on Thursday will create a high-stakes atmosphere for BTC and the broader crypto market.

These two occasions are anticipated to drive volatility and inject uncertainty into value motion, making this an exceptionally crucial second for Bitcoin.

Outstanding analyst and investor Axel Adler just lately shared knowledge on X that underscores a optimistic outlook for Bitcoin. His evaluation highlights the Web Taker Quantity (SMA-24H) throughout all exchanges, which signifies the steadiness between aggressive purchase and promote orders. This indicator reveals a bullish sentiment, with shopping for curiosity exceeding promoting stress. This knowledge means that consumers are making ready for a possible value surge, additional strengthening the bullish outlook for BTC because it heads into this decisive week.

Nonetheless, Adler warns that the trail to new ATH is unsure. Whereas the Web Taker Quantity hints at a potential upward trajectory, the sheer scale of this week’s occasions might result in elevated volatility. Traditionally, such occasions have triggered sharp market reactions, making BTC vulnerable to speedy value swings in both path.

If the Fed indicators an rate of interest lower, or if election outcomes favor crypto-friendly insurance policies, BTC might see a strong rally. Conversely, any indications of tighter monetary circumstances or regulatory dangers might dampen sentiment and result in a pullback.

General, Bitcoin faces each a major alternative and substantial danger this week. The actions of the U.S. authorities and central financial institution can be pivotal in figuring out whether or not BTC can capitalize on present bullish momentum and probably obtain new all-time highs.

BTC Holding Essential Degree

Bitcoin is presently buying and selling at $68,500, following a 7% pullback from its current excessive of $73,600. Regardless of the retrace, BTC stays resilient above the $67,000 mark, an important assist degree that has held agency amid market volatility. This degree is essential for sustaining a bullish outlook, as any drop beneath it might sign additional correction and dampen momentum within the quick time period.

Nonetheless, if BTC can maintain regular above $67,000 and get better towards the $70,000 degree, it might arrange a robust basis for a renewed push towards its all-time highs. This situation would possible reinvigorate bullish sentiment, positioning BTC to problem the earlier peak of $73,794 and probably enter value discovery territory.

The market is carefully watching these crucial ranges, with $67,000 appearing as a line within the sand. So long as BTC stays above it, confidence within the bullish development stays intact. Breaking by means of the $70,000 barrier might act as a catalyst, drawing in new consumers and placing BTC on a direct path to retest and probably surpass its all-time highs, solidifying its place because the market chief.

Featured picture from Dall-E, chart from TradingView