Pudgy Penguins (PENGU) value has surged 12% within the final 24 hours, surpassing BONK to turn into the most important meme coin within the Solana ecosystem with a market cap of roughly $2.5 billion.

PENGU’s present uptrend positions it close to key resistance ranges, with the potential for vital positive factors if bullish momentum persists. Nevertheless, merchants are additionally cautious of a attainable reversal, because the uptrend reveals early indicators of shedding energy.

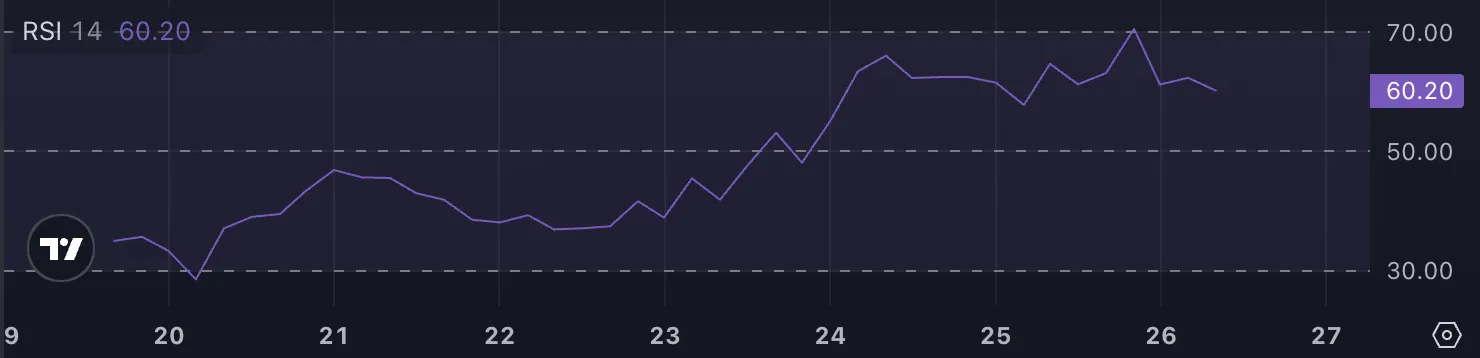

PENGU RSI Is Now Impartial, After Touching 70

PENGU Relative Energy Index (RSI) is at the moment at 60.2, down from 70 just some hours in the past after climbing from beneath 50 solely two days in the past. This latest motion displays a robust surge in shopping for momentum, adopted by a slight pullback because the token dipped out of overbought territory.

Whereas the RSI stays in a neutral-to-bullish vary, the decline suggests a cooling of shopping for exercise, doubtlessly indicating that the market is coming into a consolidation part.

RSI is a momentum oscillator that measures the velocity and magnitude of value actions on a scale of 0 to 100. An RSI above 70 signifies overbought circumstances, usually resulting in a value correction, whereas an RSI beneath 30 suggests oversold circumstances, signaling a possible rebound.

With PENGU’s RSI at 60.2, the coin is in a wholesome vary, suggesting there’s nonetheless room for upward motion if consumers reassert management. Nevertheless, the latest decline from overbought ranges implies that PENGU value could stabilize within the quick time period, permitting the market to soak up positive factors earlier than deciding its subsequent route.

PENGU CMF Is Nonetheless Very Optimistic

PENGU Chaikin Cash Move (CMF) is at the moment at 0.17, down barely from its peak of 0.21 on December 25. This follows a big shift from adverse CMF values between December 21 and December 23, indicating that purchasing strain has strengthened significantly over the previous few days.

Whereas the CMF stays firmly constructive, the slight decline means that the depth of capital inflows has eased however nonetheless displays a bullish market atmosphere.

CMF is a volume-weighted indicator that measures the buildup or distribution of an asset over time, with values starting from -1 to +1. Optimistic CMF values point out accumulation and robust shopping for strain, whereas adverse values sign distribution and promoting exercise.

With PENGU’s CMF at 0.17, the continued constructive influx means that consumers are sustaining management, supporting the chance of value stability or additional positive factors within the quick time period. Nevertheless, the slight drop from the latest peak might sign a attainable consolidation interval because the market balances the latest upward momentum.

PENGU Worth Prediction: A Additional 29.7% Upside?

If the present uptrend continues, PENGU value might quickly check $0.43, a key degree that will pave the way in which for additional positive factors.

Breaking this resistance might see PENGU rise to $0.45 and even $0.50, marking a possible 29.7% upside from present ranges. This might consolidate PENGU’s place as the most important meme coin on Solana much more.

Nevertheless, as highlighted by RSI and CMF, the uptrend may very well be shedding energy, suggesting the potential of a reversal. If this happens, PENGU might check the $0.37 assist degree, and if that fails to carry, the worth may drop additional to $0.30.

In a worst-case situation, a chronic downtrend might push PENGU value as little as $0.229.

Disclaimer

According to the Belief Challenge pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.