Bitcoin and the broader cryptocurrency market are grappling with a major downturn, with the chance of a deeper correction looming. After reaching an all-time excessive of $108,300, Bitcoin’s momentum seems exhausted, and bearish sentiment has dominated the market. The pullback has left buyers cautious, elevating issues about whether or not BTC can reclaim its bullish trajectory.

Amid this difficult atmosphere, a captivating development has emerged. Key metrics reveal that the variety of BTC change deposits has plummeted to a report low of 30,000—a stage not seen since 2016. This sharp decline suggests a notable shift in investor habits.

Fairly than partaking in short-term buying and selling, many BTC holders are adopting a long-term “HODL” (maintain on for expensive life) technique. This strategy displays their perception in Bitcoin’s enduring worth and potential as a hedge towards financial uncertainties. By holding their cash off exchanges, these buyers are additionally contributing to a discount in promoting strain, which might assist stabilize the market throughout this correction section.

Whereas BTC’s speedy value motion appears bearish, the decreased change exercise presents a silver lining, indicating confidence amongst long-term holders. Because the market navigates these risky occasions, this shift might play a pivotal position in shaping Bitcoin’s subsequent transfer.

Altering Bitcoin Dynamics

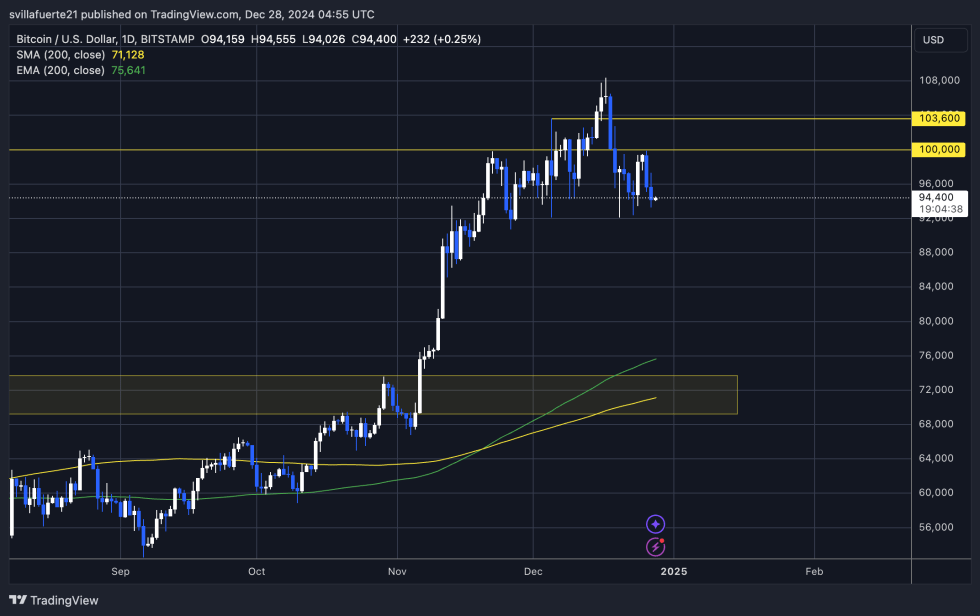

Bitcoin has confronted persistent challenges staying above the $100,000 stage since shedding this essential psychological mark. The decline has prompted many analysts and buyers to foretell a deeper correction, doubtlessly driving costs even decrease. Regardless of these issues, knowledge signifies a robust long-term dedication from BTC buyers, suggesting a extra optimistic outlook for the asset’s future.

Key metrics shared by famend analyst Axel Adler on X spotlight a major shift in Bitcoin holder habits. The variety of BTC deposits on exchanges has dropped to a report low of 30,000 per day, a determine not seen since 2016.

It is a stark distinction to the 10-year common of 90,000 day by day deposits. Furthermore, the cycle’s peak of 125,000 deposits occurred when Bitcoin was buying and selling close to $66,000, signaling intense promoting strain at the moment.

The present decline in change deposits means that BTC holders are opting to “HODL” their cash relatively than promote them throughout market fluctuations. This habits reduces promoting strain, even within the face of potential value drops. It seems that extra buyers are adopting a long-term perspective, believing in Bitcoin’s worth as a retailer of wealth and hedge towards macroeconomic uncertainties.

Value Motion: Breakdown Or Breakout?

Bitcoin is buying and selling at $94,400 after repeated makes an attempt to reclaim the $100,000 stage fell quick, whereas assist at $92,000 continues to carry agency. This value vary locations BTC at a essential juncture, with its subsequent transfer more likely to decide the route of the market within the close to time period.

If Bitcoin loses the $92,000 mark, it dangers coming into a deeper correction section, doubtlessly triggering a wave of promoting strain that might drive the worth considerably decrease. This state of affairs has many buyers and analysts watching intently, as a breakdown under this stage might problem bullish sentiment within the present cycle.

Then again, Bitcoin nonetheless has the potential to reclaim its upward momentum. A decisive push above the $100,000 mark within the coming days would sign a robust resurgence of bullish management, seemingly propelling the worth to new all-time highs. Such a transfer would reaffirm Bitcoin’s standing because the main asset within the crypto market and will encourage contemporary inflows from buyers searching for to capitalize on its upward trajectory.

Featured picture from Dall-E, chart from TradingView