- Coinbase Premium Index flips unfavorable, marking a vital second for U.S.-based Bitcoin demand traits

- Macro components and institutional shifts weigh on Bitcoin’s rally because it hovers close to $95K

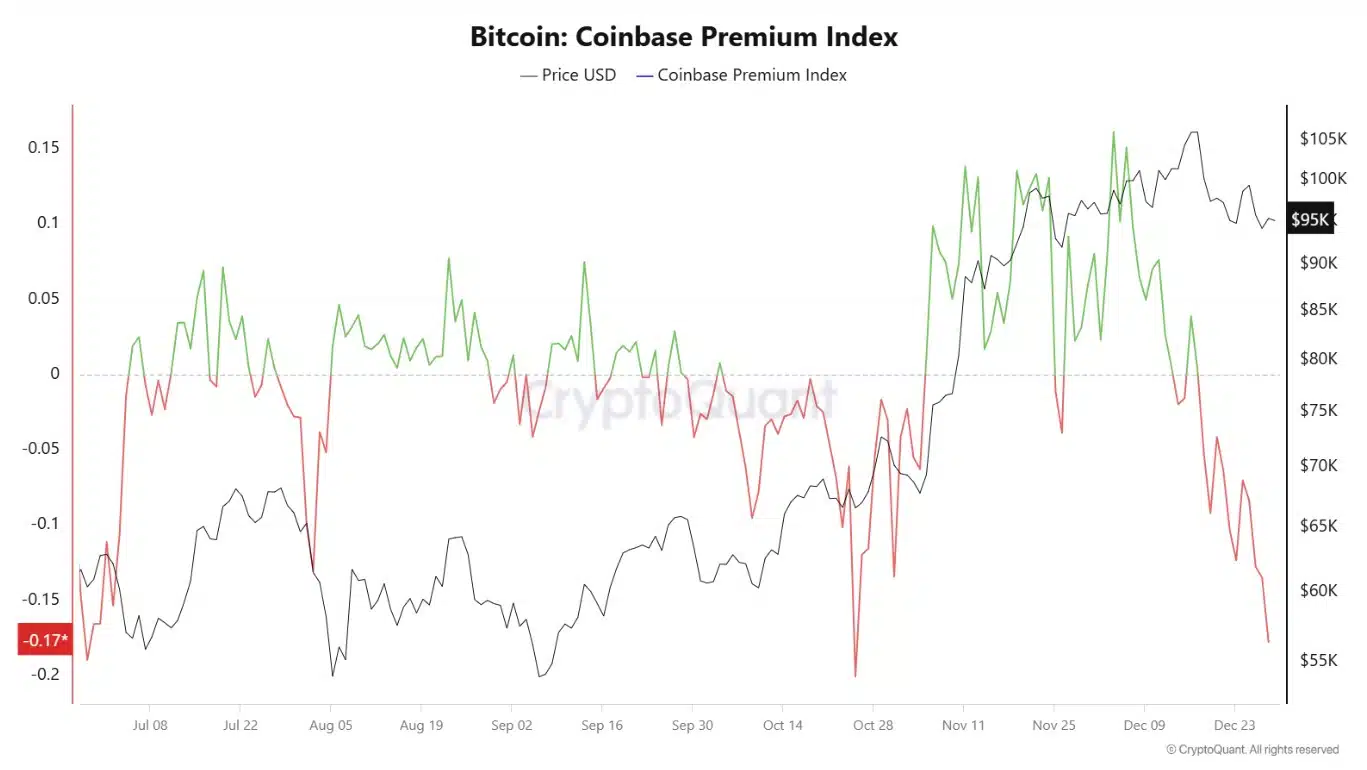

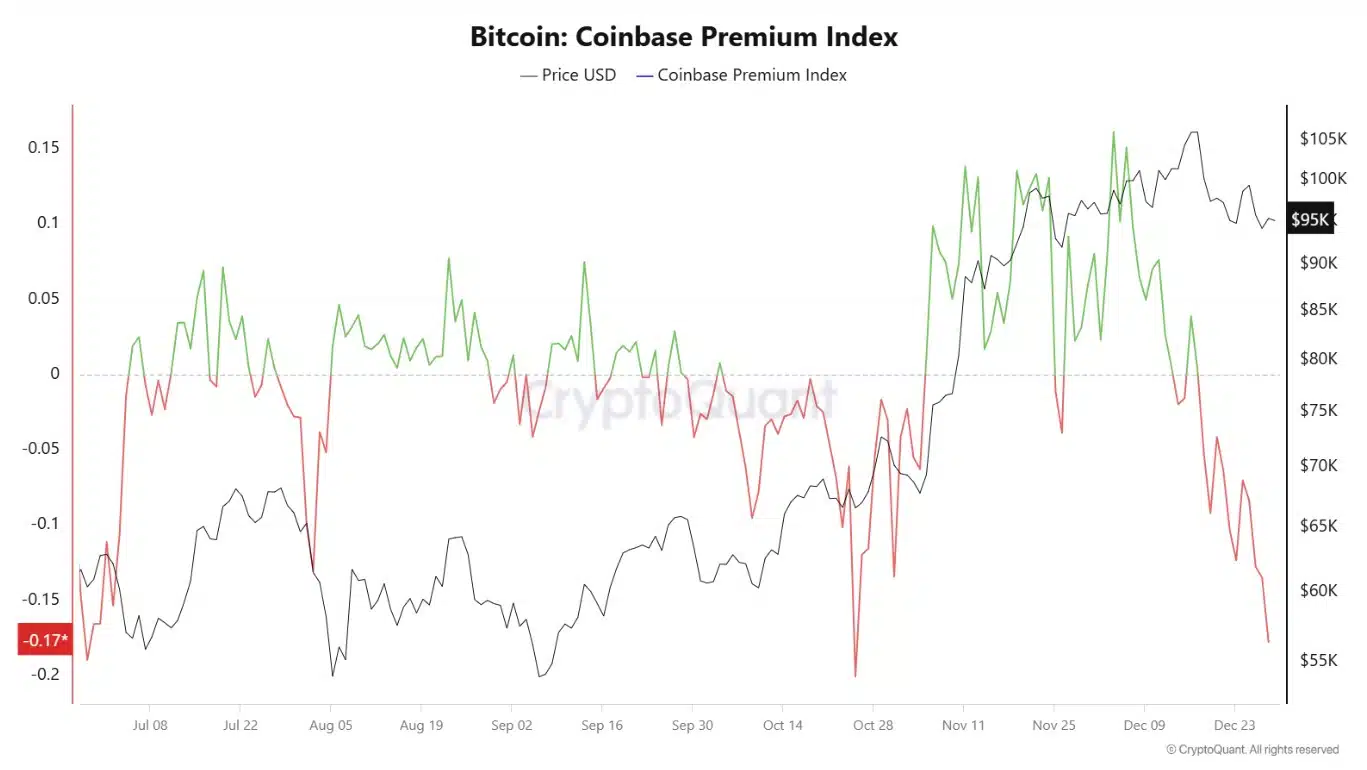

The Coinbase Premium Index has flipped unfavorable, casting a shadow over Bitcoin’s [BTC] latest rally.

This metric, which measures the worth distinction between Bitcoin on Coinbase and different international exchanges, serves as a barometer for U.S.-based demand.

A unfavorable studying suggests diminishing shopping for strain from American retail and institutional buyers — a worrying signal for the crypto market’s short-term outlook.

With institutional enthusiasm cooling and U.S. demand waning, Bitcoin’s potential to keep up its upward momentum faces a important check.

The query now could be whether or not this shift alerts a brief lull or a broader retracement for Bitcoin.

US institutional demand wavers

Supply: Cryptoquant

The Coinbase Premium Index has plummeted to -0.17 as of late December 2024, marking its steepest drop this yr, per CryptoQuant information.

This sharp decline mirrored weakening demand for Bitcoin amongst U.S. retail and institutional buyers — a stark distinction to the optimism seen throughout Bitcoin’s earlier rally previous $100,000 in November.

The unfavorable premium alerts a shift in market sentiment, as U.S. consumers at the moment are offloading moderately than accumulating Bitcoin, probably because of rising treasury yields, macroeconomic uncertainty, and year-end portfolio rebalancing.

With Bitcoin presently hovering close to $95,000, the dearth of US-based shopping for strain may act as a headwind for additional progress.

This bearish divergence highlights US buyers’ cooling enthusiasm because the market heads into 2025.

Bitcoin value consolidation: $95K in focus

Bitcoin was buying and selling just under $95,000 at press time, with $95,170 appearing as a formidable resistance. A number of rejections at this stage recommended an exhaustion of bullish momentum.

Help stays important at $93,000, with a breach doubtless paving the best way for a retest of the $90,000 psychological barrier.

Supply: TradingView

The RSI at 45.60 confirms a bearish divergence, whereas the OBV at 1.65M reveals a modest decline in shopping for quantity over latest periods.

This stagnation aligns with broader market hesitation as merchants assess year-end macro traits and diminished institutional inflows.

For Bitcoin to regain its bullish footing, it should decisively shut above $95,000 on excessive quantity, concentrating on $100,000. Failing this, the chance of a breakdown under key helps will increase as we method 2025.

Catalysts for reversing the unfavorable Coinbase premium

The unfavorable Coinbase Premium Index may reverse with a number of key developments. Firstly, elevated institutional adoption is pivotal.

BlackRock’s latest advice for institutional buyers to allocate as much as 2% of their portfolios to Bitcoin alerts rising acceptance, probably attracting extra U.S. buyers and positively impacting the premium.

Secondly, favorable regulatory developments may increase confidence amongst U.S. buyers. The approval of Bitcoin ETFs earlier this yr has already contributed to mainstream adoption.

Additional regulatory readability and supportive insurance policies may improve market sentiment, encouraging elevated participation from each retail and institutional buyers.

A possible shift in Federal Reserve insurance policies, comparable to a pause or discount in rates of interest, may make threat property like Bitcoin extra enticing, prompting elevated demand from U.S. buyers.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Lastly, technological developments and elevated utility of Bitcoin may drive adoption.

Developments in cost techniques and broader acceptance of Bitcoin as a medium of change might improve its enchantment, probably influencing the Coinbase Premium Index positively.