Este artículo también está disponible en español.

Chainlink (LINK) has proven outstanding resilience amid market volatility, holding above key help ranges whereas different belongings expertise sharp fluctuations. Regardless of uncertainty throughout the crypto house, LINK has surged over 12% since Wednesday, signaling robust bullish momentum and suggesting that the worth is able to proceed climbing.

Associated Studying

High analyst Carl Runefelt shared a technical evaluation on X, revealing that LINK is forming a bullish sample that would result in a major breakout. In line with Runefelt, Chainlink is on the verge of breaking out of a Descending Triangle, a construction that always precedes robust upward strikes. If this breakout materializes, LINK may enter a brand new bullish section, pushing towards increased resistance ranges.

As market sentiment shifts and altcoins begin to transfer, buyers are carefully watching Chainlink’s worth motion. A profitable breakout from its present consolidation section may set off a brand new rally, reinforcing LINK’s place as a top-performing asset within the crypto market. The approaching days might be essential in figuring out whether or not Chainlink can maintain its momentum and enter a brand new section of worth discovery.

Chainlink Eyes Main Breakout as Worth Holds Bullish Construction

Chainlink (LINK) has skilled its justifiable share of market volatility, however its long-term outlook stays robust. The mission has continued to safe strategic partnerships, together with a key collaboration with Ripple, additional solidifying its place as a frontrunner within the real-world asset (RWA) market. As Chainlink’s adoption grows, analysts count on it to be one of many top-performing belongings on this market cycle.

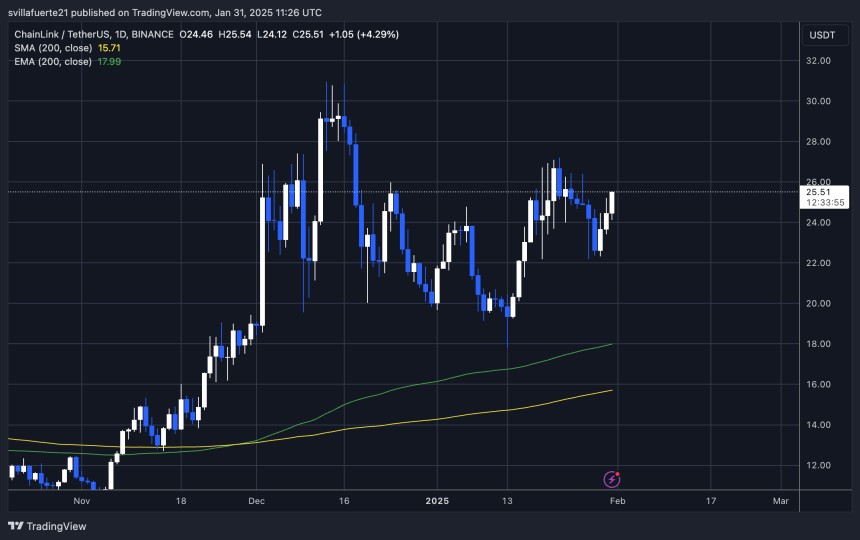

Regardless of short-term worth fluctuations, LINK is making an attempt to clear key provide ranges, which may set off a robust upward transfer. High analyst Carl Runefelt shared a technical evaluation on X, highlighting that LINK has been buying and selling in a bullish sample since late January. In line with Runefelt, Chainlink is at present inside a Descending Triangle, a formation that always results in breakouts with vital upside potential.

Runefelt believes a breakout is imminent, stating that LINK may escape of this sample at any hour. If the breakout occurs, he expects the worth to shortly attain the $30 mark, a stage not seen in over two years.

Associated Studying

With fundamentals strengthening and technical indicators pointing towards a rally, Chainlink is in a major place for a serious transfer within the coming days. Traders are watching carefully to see if LINK can capitalize on its momentum and make sure a bullish breakout.

LINK Holds Robust at $25, Eyes Multi-12 months Highs

Chainlink (LINK) is buying and selling at $25, exhibiting robust bullish momentum because it appears to be like able to reclaim increased ranges. After weeks of consolidation, LINK seems poised for a breakout, with buyers carefully watching the $27 resistance stage as the subsequent main hurdle. If bulls efficiently push above $27 and maintain it as help, a large rally into multi-year highs will seemingly observe, setting the stage for a brand new bullish section.

Nevertheless, to take care of this bullish construction, LINK should maintain robust above the $22 mark. Shedding this stage may lead to a deeper pullback, delaying the anticipated uptrend. Regardless of market fluctuations, Chainlink stays one of many strongest belongings on this cycle, with analysts predicting a major upside within the coming weeks.

Associated Studying

With technical indicators aligning for a breakout and robust basic backing, LINK is in a major place to surge increased. Traders at the moment are ready for affirmation of a development reversal, which might solidify LINK’s potential for brand new highs. If bulls efficiently clear key resistance ranges, Chainlink may quickly enter a parabolic rally, reinforcing its function as a top-performing altcoin within the present market cycle.

Featured picture from Dall-E, chart from TradingView