Solana’s worth has fallen under the essential $200 threshold. This decline mirrors the broader market downturn triggered by Bitcoin’s drop under $100,000.

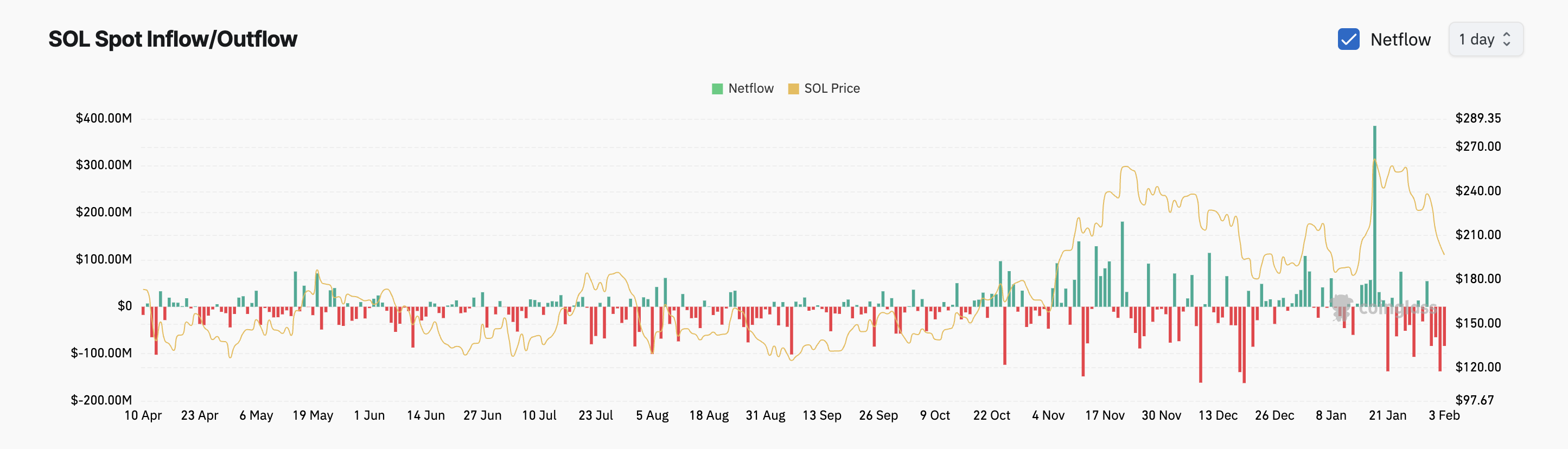

The falling demand is clear from the constant outflows from SOL’s spot markets, which have surpassed $365 million over the previous three days.

Solana Information Regular Spot Outflows

SOL shares a robust constructive correlation with Bitcoin and has confronted elevated promoting stress as merchants react to BTC’s weak point. Because the main coin fell under the $100,000 worth mark on February 1, SOL spot merchants have lowered their publicity to the altcoin.

That is mirrored by the constant outflows from SOL’s spot markets previously three days, which have totaled $367 million per Coinglass.

When an asset experiences regular outflows from its spot market, extra merchants are promoting or withdrawing the asset than shopping for it. This means a lower in demand and alerts a bearish sentiment in the direction of the asset.

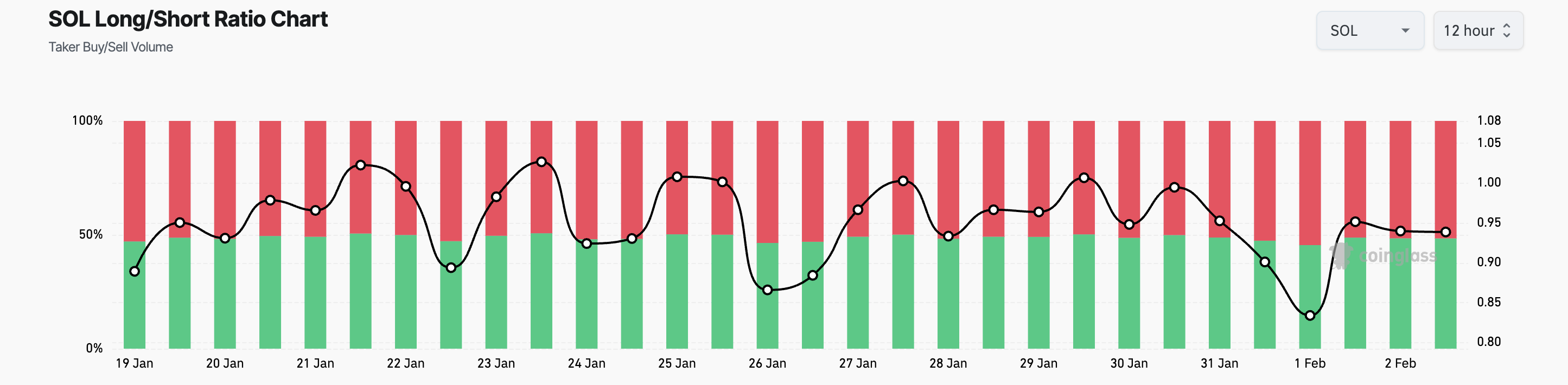

Notably, SOL’s lengthy/quick ratio on Monday morning confirms this bearish sentiment. At press time, it stands under one at 0.93.

This ratio compares the variety of lengthy positions, bets that the worth will rise, to quick positions, bets that the worth will fall, in a market. As with SOL, when the ratio is under 1, it signifies that there are extra quick than lengthy positions, suggesting a bearish sentiment amongst merchants.

SOL Value Prediction: Bearish Indicator Suggests Potential Decline to New Lows

On the worth chart, SOL’s Chaikin Cash Move (CMF) is on the zero line, reflecting the sturdy selloffs amongst merchants. CMF momentum indicator measures cash circulate into and out of an asset.

When an asset’s CMF falls under zero, it experiences destructive cash circulate. This means extra promoting stress than shopping for curiosity over a specified interval. If this development continues, SOL’s worth may fall to $187.71.

Alternatively, a resurgence within the coin’s demand will invalidate this bullish projection. In that situation, SOL’s worth may rise to $229.03.

Disclaimer

Consistent with the Belief Challenge tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.