Actual Imaginative and prescient’s chief digital belongings analyst Jamie Coutts says {that a} backside could also be forming within the crypto market after declining for weeks.

Coutts tells his 33,800 followers on the social media platform X that based mostly on a metric monitoring the efficiency of crypto belongings over one year the market is gearing up for a bullish reversal.

“This month’s crypto flush resulted within the highest 365-day new low (NL) studying since mid-2024. Whereas not a definitive backside sign, it suggests a backside is forming. Concentrate on belongings that outperformed over the previous 12 months and through this latest pullback. Their power hints at what’s to come back within the subsequent leg of this cyclical bull market.”

He additionally shares the TOTAL2 chart – the market cap of all crypto belongings excluding Bitcoin (BTC) and stablecoins – which exhibits a attainable reversal forming on the each day timeframe after a downtrend.

TOTAL2 is valued at $1.24 trillion at time of writing.

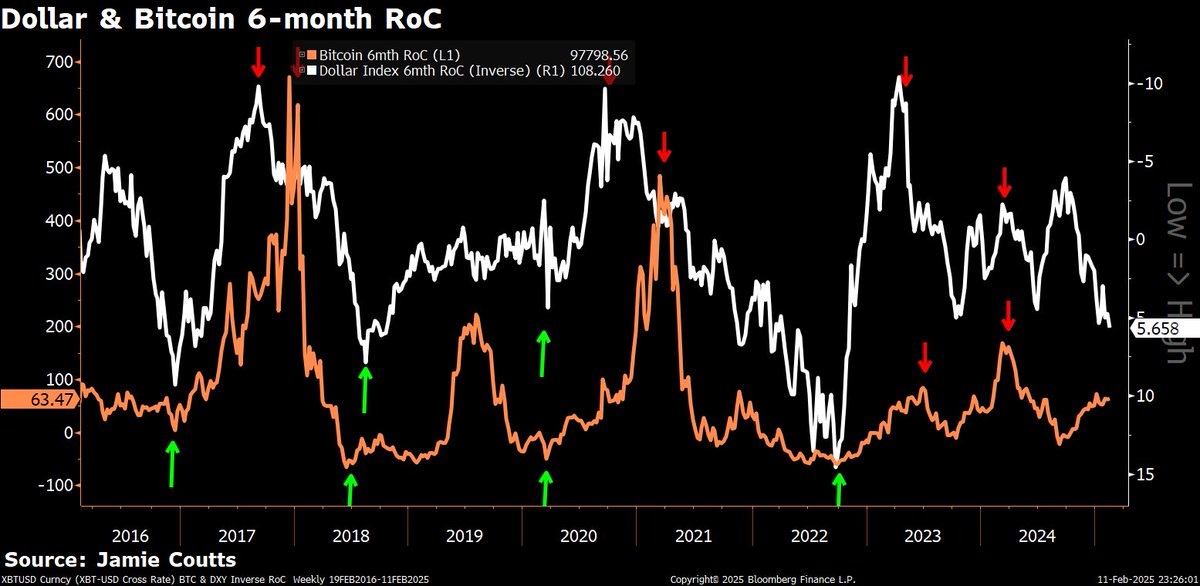

Subsequent up, Coutts says Bitcoin could also be breaking its historic inverse correlation with the US greenback index (DXY), which pits the USD towards a basket of different main foreign exchange, as extra traders could also be treating the flagship crypto asset as a safe-haven asset just like gold.

“Bitcoin’s inverse correlation with the greenback damaged? Because the September low, BTC surged from $70,000 to $110,000 whereas the DXY climbed from 104 to 110. Is it ETFs (exchange-traded funds), MSTR (MicroStrategy), sovereigns? Exhausting to say. Perhaps Bitcoin is lastly being acknowledged because the protected harbor asset it was destined to be.”

He additionally says that the adoption of blockchain expertise is surging based mostly on the metric of each day energetic addresses (DAAs) on sensible contract platforms (SCPs).

“Liquidity drives on-chain exercise – all the time has. However since 2022, that relationship has weakened. Blockchain adoption is proving extra resilient and fewer tethered to liquidity cycles. Over the previous 12 months, energetic addresses have tripled whereas markets stay their ordinary schizophrenic selves, debating the place liquidity is headed subsequent. However right here’s the factor: the tech is hitting escape velocity. Zoom out. Each liquidity and blockchain utilization are in long-term uptrends. The one query that issues – will they be increased in a single, three or 5 years.”

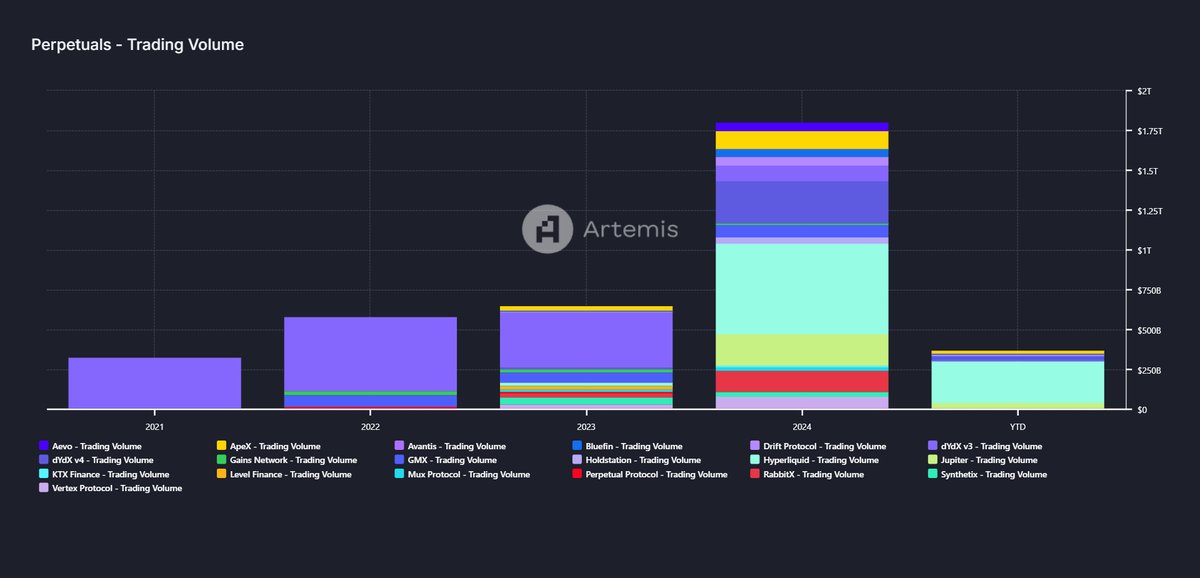

Lastly, he predicts that 2025 will see an explosion of blockchain expertise adoption throughout a number of sectors.

“In 2025, we’ll probably see on-chain perps volumes exceeding $4 trillion. What till RWAs (real-world belongings) land en masse, shares, commodities, bonds, and KYC (Know Your Buyer) options so establishments can take part. Which chains and protocols do you assume will profit most from what’s about to occur?”

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Value Motion

Observe us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal danger, and any losses chances are you’ll incur are your duty. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please word that The Each day Hodl participates in online marketing.

Generated Picture: Midjourney