- Coinbase reported a large $2.27B in This autumn income, up 138% year-over-year, crushing expectations of $1.84B.

- CEO Brian Armstrong pointed to crypto’s rising political affect, saying the period of regulatory enforcement is fading.

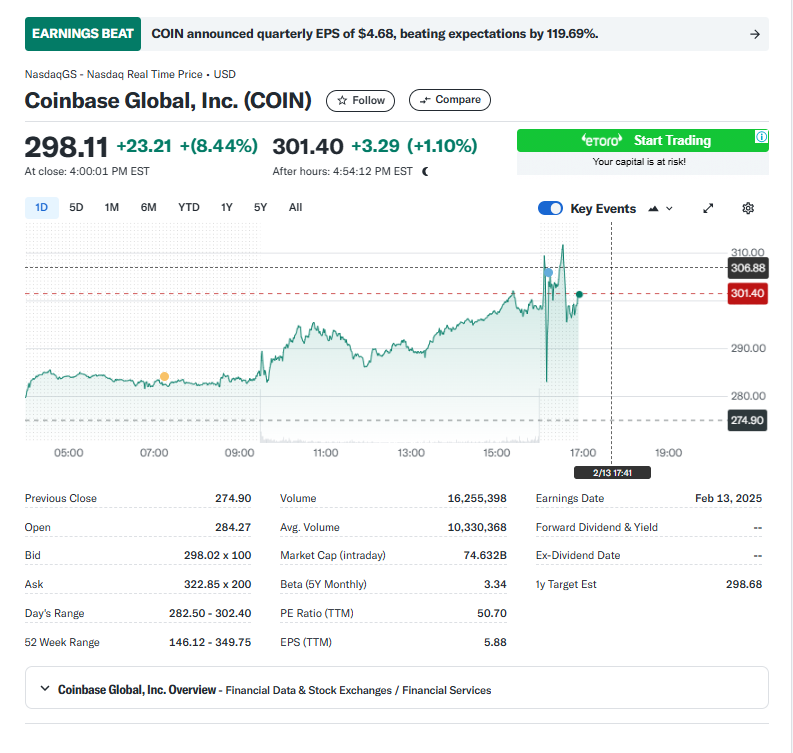

- COIN inventory moved modestly after hours, however had already surged 8.5% earlier, following Robinhood’s robust crypto earnings.

Coinbase (COIN) simply smashed expectations, reporting a large 138% year-over-year income surge in This autumn—fueled by the crypto market’s explosive rally following Donald Trump‘s election win.

The numbers? Enormous.

- Income: $2.27B (vs. $1.84B anticipated, $1.26B final quarter).

- Adjusted earnings: $1.3B, topping $906.9M estimates.

- Buying and selling quantity: $439B, up 185% YoY.

- Transaction income: $1.56B, a 194% improve.

Brian Armstrong: Crypto’s Political Second Has Arrived

In his shareholder letter, Coinbase CEO Brian Armstrong made it clear:

“Crypto’s voice was heard loud and clear within the U.S. elections, and the period of regulation by way of enforcement that crippled our trade is on its approach out.”

For 2025, the corporate’s focus is:

- Driving income

- Increasing utility

- Scaling infrastructure

Regulatory readability, particularly beneath a extra pro-crypto administration, may set the stage for one more huge yr.

Coinbase Inventory Strikes—However Features Have been Already Priced In

Regardless of blowout earnings, COIN shares solely noticed a modest after-hours transfer.

Why? The inventory already ran up 8.5% earlier immediately, using the wave of Robinhood’s robust crypto earnings report on Wednesday.

Backside line? Coinbase simply proved it’s nonetheless the dominant U.S. crypto change—and with 2025 wanting even stronger, this may simply be the start.