Hedera (HBAR) is beneath stress, down roughly 13.5% over the previous seven days, with its market cap holding at round $7 billion. Current technical indicators level to rising bearish momentum, with each pattern and momentum indicators leaning closely adverse.

The value has been hovering close to a crucial assist zone, elevating the danger of a breakdown under $0.15 for the primary time in months. Except bulls regain management quickly, HBAR might face additional losses earlier than any significant restoration try.

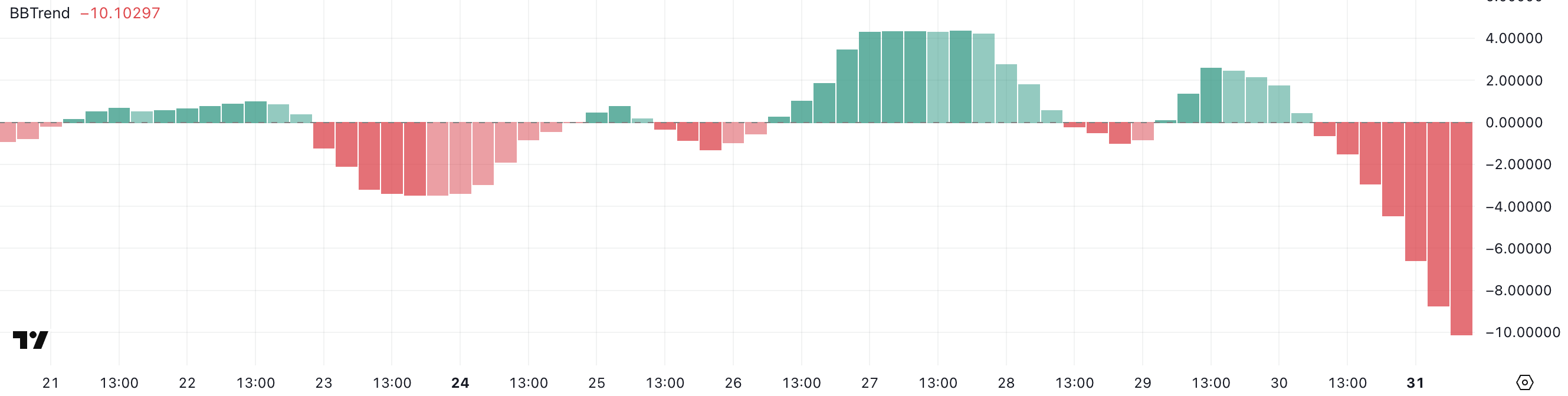

HBAR BBTrend Has Been Turning Closely Down Since Yesterday

Hedera’s BBTrend indicator has dropped sharply to -10.1, falling from 2.59 only a day in the past. This speedy decline indicators a robust shift in momentum and means that HBAR is experiencing an aggressive draw back transfer.

Such a steep drop typically displays a sudden enhance in promoting stress, which might rapidly change the asset’s short-term outlook.

The BBTrend, or Bollinger Band Pattern, measures the power and course of a pattern utilizing the place of worth relative to the Bollinger Bands. Optimistic values usually point out bullish momentum, whereas adverse values level to bearish momentum.

The additional the worth is from zero, the stronger the pattern. HBAR’s BBTrend is now at -10.1, signaling sturdy bearish momentum.

This means that the worth is trending decrease and doing so with rising power, which might result in additional draw back except patrons step in to sluggish the momentum.

Hedera Ichimoku Cloud Paints a Bearish Image

Hedera’s Ichimoku Cloud chart displays a robust bearish construction, with the worth motion positioned nicely under each the blue conversion line (Tenkan-sen) and the crimson baseline (Kijun-sen).

This setup signifies that short-term momentum is clearly aligned with the longer-term downtrend.

The value has constantly failed to interrupt above these dynamic resistance ranges, signaling continued vendor dominance.

The long run cloud can also be crimson and trending downward, suggesting that bearish stress is predicted to persist within the close to time period.

The span between the Senkou Span A and B traces stays extensive, reinforcing the power of the downtrend. For any potential reversal to achieve credibility, HBAR would first have to problem and break above the Tenkan-sen and Kijun-sen, and finally push into or above the cloud.

Till then, the present Ichimoku configuration helps a continuation of the bearish outlook.

Can Hedera Fall Beneath $0.15 Quickly?

Hedera worth has been hovering across the $0.16 stage and is approaching a key assist at $0.156.

If this assist fails to carry, it might open the door for additional draw back, doubtlessly pushing HBAR under the $0.15 mark for the primary time since November 2024.

Nonetheless, if HBAR manages to reverse its present trajectory and regain bullish momentum, the primary goal to look at is the resistance at $0.179.

A breakout above that stage might result in a stronger rally towards $0.20 and, if momentum continues, even attain $0.215. In a extra prolonged bullish situation, HBAR might climb to $0.25, signaling a full restoration and pattern reversal.

Disclaimer

According to the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.