The CEO of the Bitcoin (BTC)-focused trade River says he has no real interest in offering entry to something aside from the flagship crypto asset.

In a put up on the social media platform X, River CEO Alexander Leishman says crypto exchanges that record altcoins – which is nearly all of them – have turn out to be extra like casinos caught on a “perpetually hamster wheel of memecoins.”

“There are two paths for a crypto trade/brokerage:

1. Bitcoin-only path – concentrate on serving to individuals construct and protect long-term wealth by way of exhausting cash. This path results in an trade wanting extra like a ‘financial institution’ long run.

2. Multi-asset buying and selling platform – add as many cash as attainable and construct the enterprise mannequin round speculative buying and selling. This results in the trade turning into extra like a on line casino.

Each can become profitable, however these are the one two choices. The minute an trade provides one non-Bitcoin token, they’re signing as much as be on the perpetually hamster wheel of memecoins. It is unnecessary to record ETH if you happen to don’t record the tokens issued on ETH, and the identical goes for Solana.

There are lots of profitable crypto casinos, however I’ve no real interest in constructing such a enterprise. The on line casino enterprise mannequin is constructed round maximal extraction from clients, and the Bitcoin solely mannequin is targeted on serving to individuals construct long-term wealth.”

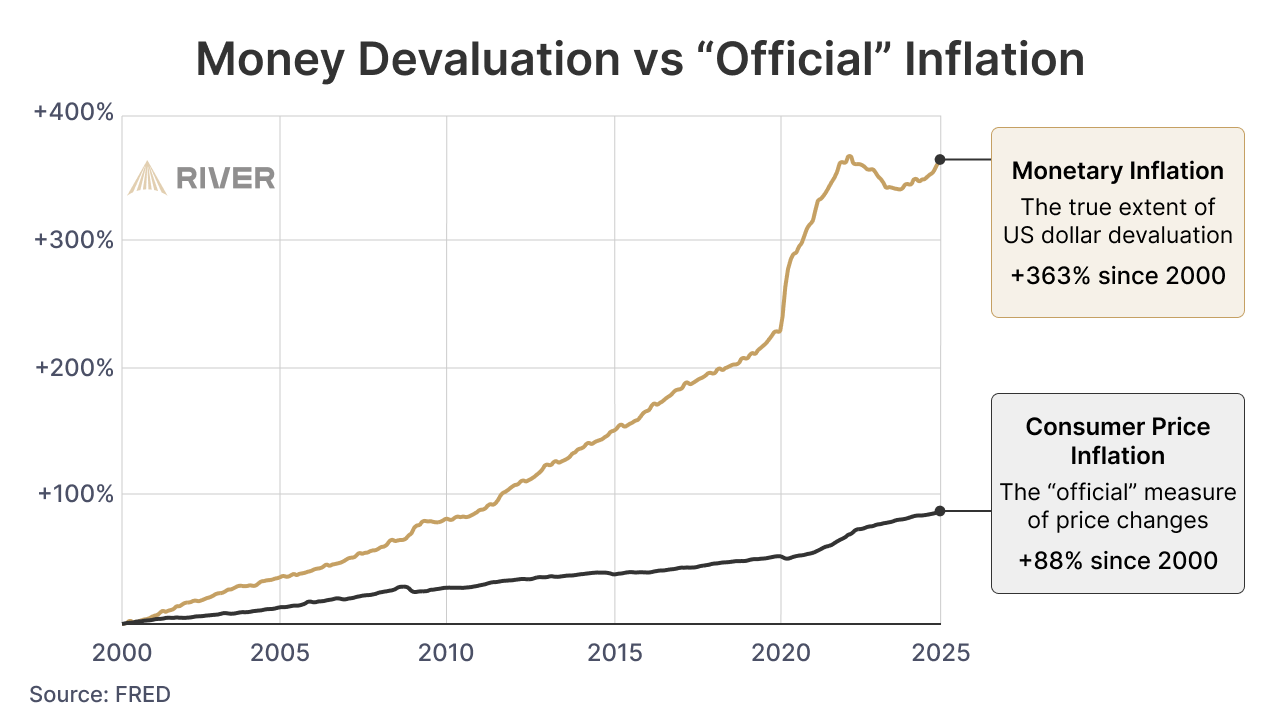

In keeping with River, forex debasement is vastly bigger than formally admitted, which explains the trade is Bitcoin-focused.

“There’s a 275% hole between the inflation you’re informed and actual inflation.

That is why we Bitcoin.”

At time of writing, Bitcoin is buying and selling for $82,100.

Observe us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Value Motion

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any losses you could incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney