SAFE has emerged because the best-performing altcoin of the day, with its value surging 5% within the final 24 hours and its market capitalization now near $300 million. The coin is displaying robust technical indicators regardless of some blended indicators from momentum oscillators that counsel consolidation could also be on the horizon.

Technical evaluation of the EMA strains stays bullish, with short-term averages positioned favorably above long-term ones, pointing to continued energy within the speedy time period. Nonetheless, current RSI and BBTrend readings point out a possible cooling-off interval may very well be approaching because the asset digests its current good points.

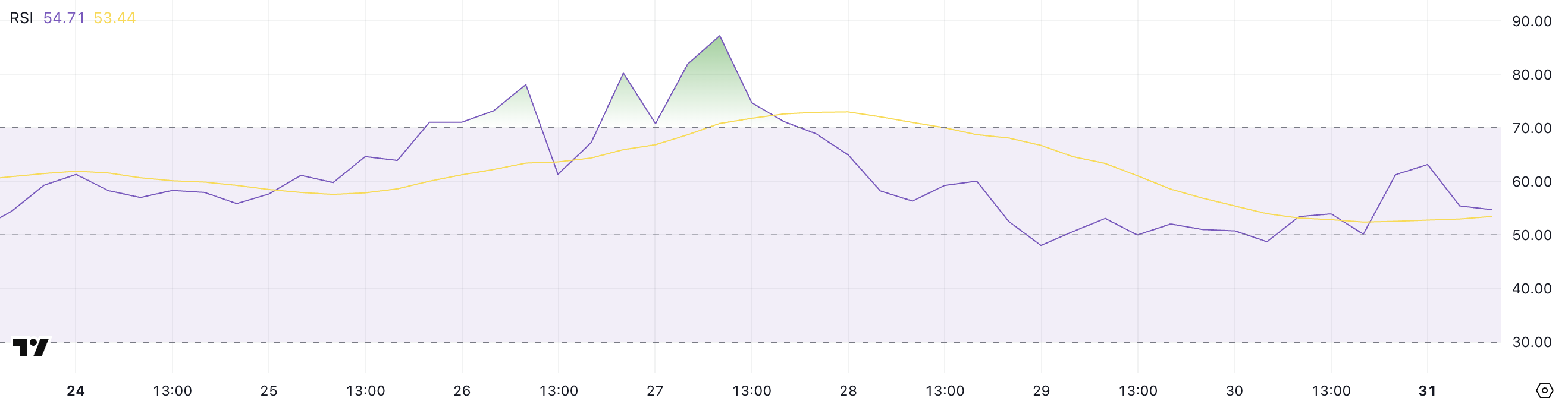

SAFE RSI Is Again To Impartial Ranges After Reaching Overbought Ranges

The SAFE RSI is presently at 54.71, sustaining a impartial place for the previous three days after experiencing important momentum earlier within the week.

This moderation within the indicator means that the earlier shopping for strain has subsided considerably, permitting the asset to consolidate following current value actions.

The present impartial studying signifies a balanced market the place neither patrons nor sellers have a decisive benefit.

The Relative Power Index (RSI) is a momentum oscillator that measures the pace and alter of value actions on a scale from 0 to 100. Usually, an RSI studying above 70 is taken into account overbought, suggesting a possible reversal or pullback, whereas readings under 30 point out oversold situations which may precede a bounce.

With SAFE’s RSI lately peaking at 87 simply 4 days in the past, the asset was in strongly overbought territory, signaling extreme shopping for enthusiasm. The present worth of 54.71 represents a major cooling off from these excessive ranges, suggesting that SAFE’s value may very well be coming into a interval of stabilization.

This moderation might present a more healthy basis for sustainable value motion shifting ahead, because the earlier overbought situations have been labored via with out dropping into oversold territory. This probably signifies underlying energy within the asset regardless of the retreat from current highs.

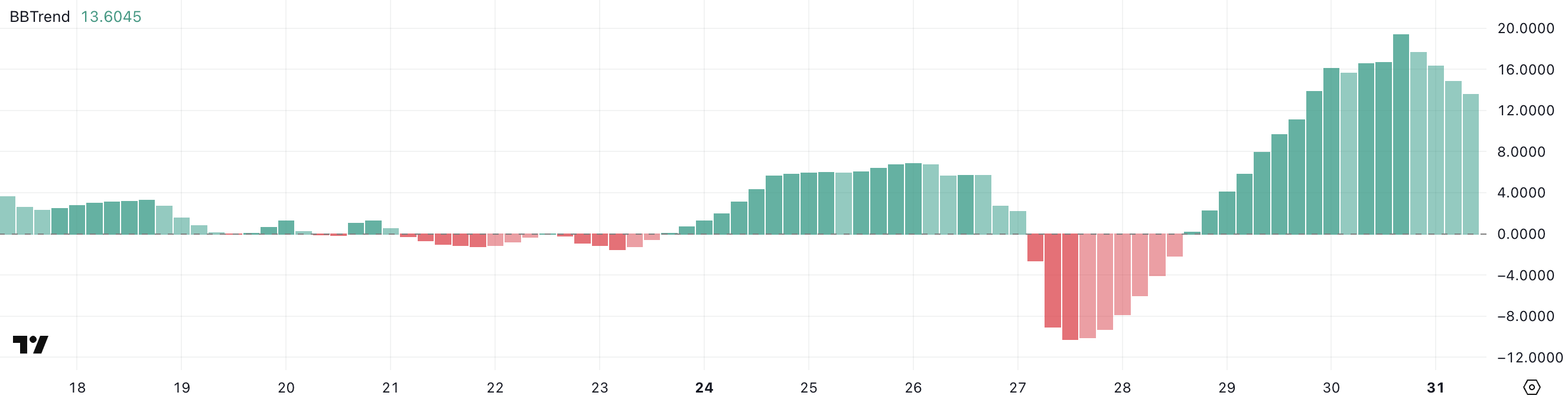

SAFE BBTrend Is Nonetheless Excessive, However Down From Yesterday

The SAFE BBTrend is presently at 13.6, sustaining a optimistic place for the final two days after reaching a peak of 19.39 yesterday.

This current optimistic development means that the value motion has been gaining momentum, although there seems to be some moderation from yesterday’s greater studying.

The continued optimistic BBTrend signifies that the asset continues to be displaying energy, regardless of the slight pullback from yesterday’s peak worth.

BBTrend (Bollinger Bands Development) is a technical indicator that measures the energy and path of a development by analyzing the connection between value and Bollinger Bands.

The indicator usually ranges from unfavorable to optimistic values, with readings above 0 indicating a bullish development and readings under 0 suggesting a bearish development. With SAFE’s BBTrend at 13.6, this means a reasonably robust bullish development that would point out potential for continued upward value motion within the close to time period for the altcoin.

Nonetheless, the lower from yesterday’s 19.39 peak would possibly sign some slowing in momentum, probably resulting in consolidation earlier than the subsequent important transfer greater.

Will SAFE Uptrend Revert Quickly?

SAFE EMA strains are nonetheless bullish, with short-term strains positioned above long-term ones. This optimistic alignment of exponential shifting averages signifies continued upward momentum within the value motion.

If this uptrend momentum maintains its energy, SAFE might probably climb to check the resistance degree at $0.72.

Ought to this resistance be efficiently damaged, the subsequent goal can be $0.879. The altcoin might exceed $0.90 for the primary time since January 19, sustaining its momentum as one of the trending altcoins.

Then again, as indicated by the RSI and BBTrend indicators, the uptrend seems to be dropping some momentum. This might sign a possible reversal within the close to future.

If the development does reverse, SAFE would possibly take a look at the close by assist degree at $0.54, which sits precariously near the present value.

Ought to this assist degree fail to carry, additional draw back might see SAFE decline to check subsequent assist ranges at $0.48 and $0.40. In a worst-case situation, a drop all the way in which to $0.35 might probably happen.

Disclaimer

In step with the Belief Undertaking pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.