In short

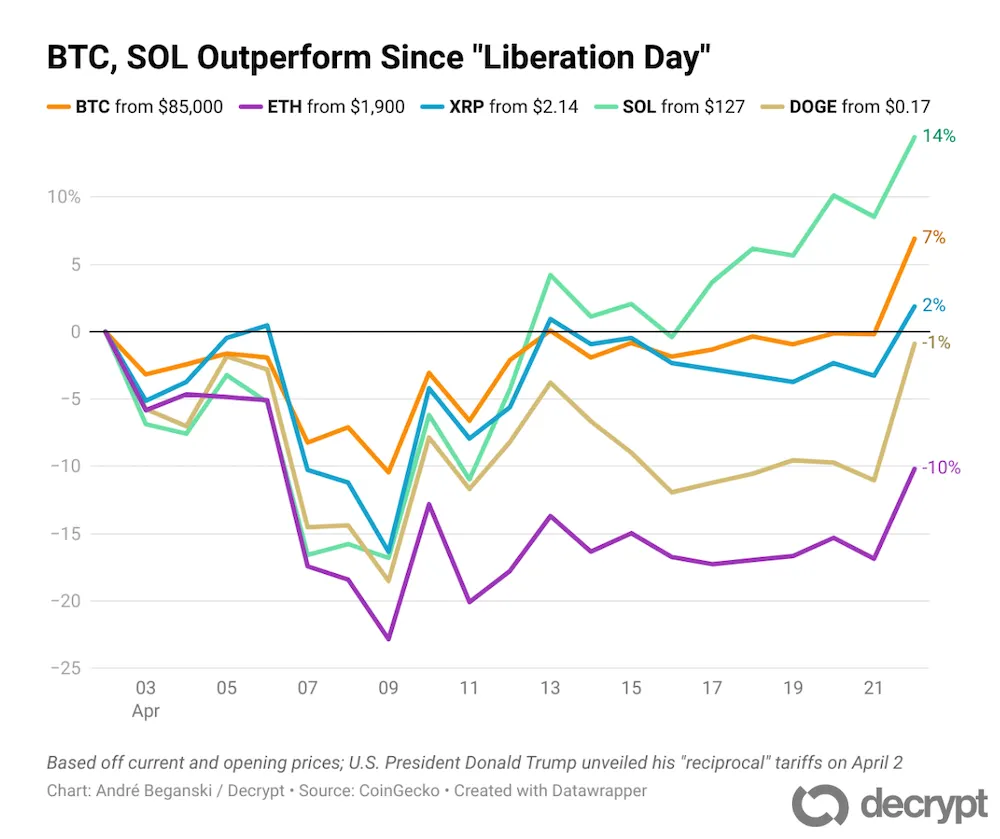

- Since April 2, Solana and Bitcoin have risen 14.5% and seven%, respectively, outperforming different main cryptos.

- Ethereum and XRP have fallen 10% and 12%, respectively, over the identical interval,

- Bitcoin accounts for 60% of the general crypto market capitalization.

Bitcoin isn’t the one cryptocurrency shining brilliant because the U.S. President Donald Trump slapped “reciprocal” tariffs on practically each nation this month.

Since Trump’s Liberation Day on April 2, Solana and Bitcoin have outperformed different main cryptocurrencies, rising 14.5% to $145 and seven% to about $91,100, respectively, based on crypto knowledge supplier CoinGecko. Ethereum (-10%), XRP (-12%), and Dogecoin (-1%) have fallen.

Solana and Bitcoin have buoyed the broader crypto sector, with the worldwide crypto market cap rising 6% to $295 trillion since April 2. Solana accounts for two% of the crypto market’s general worth. Bitcoin’s dominance has remained unchanged at about 60% of the market cap.

Solana’s latest outperformance has little to do with its deserves as a retailer of worth, Messari Analysis Analyst Matthew Nay instructed Decrypt. Moderately, the cryptocurrency was “oversold” as merchants backed off of meme cash and token unlocks dented investor sentiment.

“You’re beginning to see the resurgence of Fartcoin,” Nay mentioned, describing the Solana-based asset as emblematic of enthusiasm towards meme cash and the community’s grip on crypto’s so-called on line casino. “It is by no means going to be as what it was, but it surely hasn’t gone another chain.”

Final month, the chapter property for collapsed crypto trade FTX gained entry to 11 million Solana value $1.6 billion. That represented the most important unlock, instantaneously rising Solana’s circulating provide, since January 2021, per Messari knowledge.

Whereas token unlocks are sometimes bearish, Nay mentioned that the neighborhood is now looking forward to conferences and community upgrades, such because the validator shopper Firedancer.

“Individuals nonetheless just like the asset,” he mentioned. “It was simply oversold, and that is why this resurgence has been as sturdy because it has been.”

Bitcoin as Retailer of Worth

Bitcoin could also be pulling forward due to its “retailer of worth” narrative, David Duong, head of analysis at Coinbase Institutional instructed Decrypt. As traders flock to non-sovereign property like gold, which aren’t backed by a authorities, he believes Bitcoin could also be catching an identical bid.

Inside the cryptosphere, Bitcoin additionally has distinct benefits, Duong added. He highlighted Wall Avenue’s rising embrace and exchange-traded funds permitted within the U.S. final yr.

“The truth that bitcoin has gained institutional adoption and been built-in into extra portfolios through spot ETFs has separated it from different tokens,” he mentioned. “Bitcoin’s worth decline from the height has been fairly light in comparison with what we’ve seen in prior cycles, suggesting there’s higher conviction in holding bitcoin for the long run.”

Edited by James Rubin

Every day Debrief E-newsletter

Begin daily with the highest information tales proper now, plus unique options, a podcast, movies and extra.