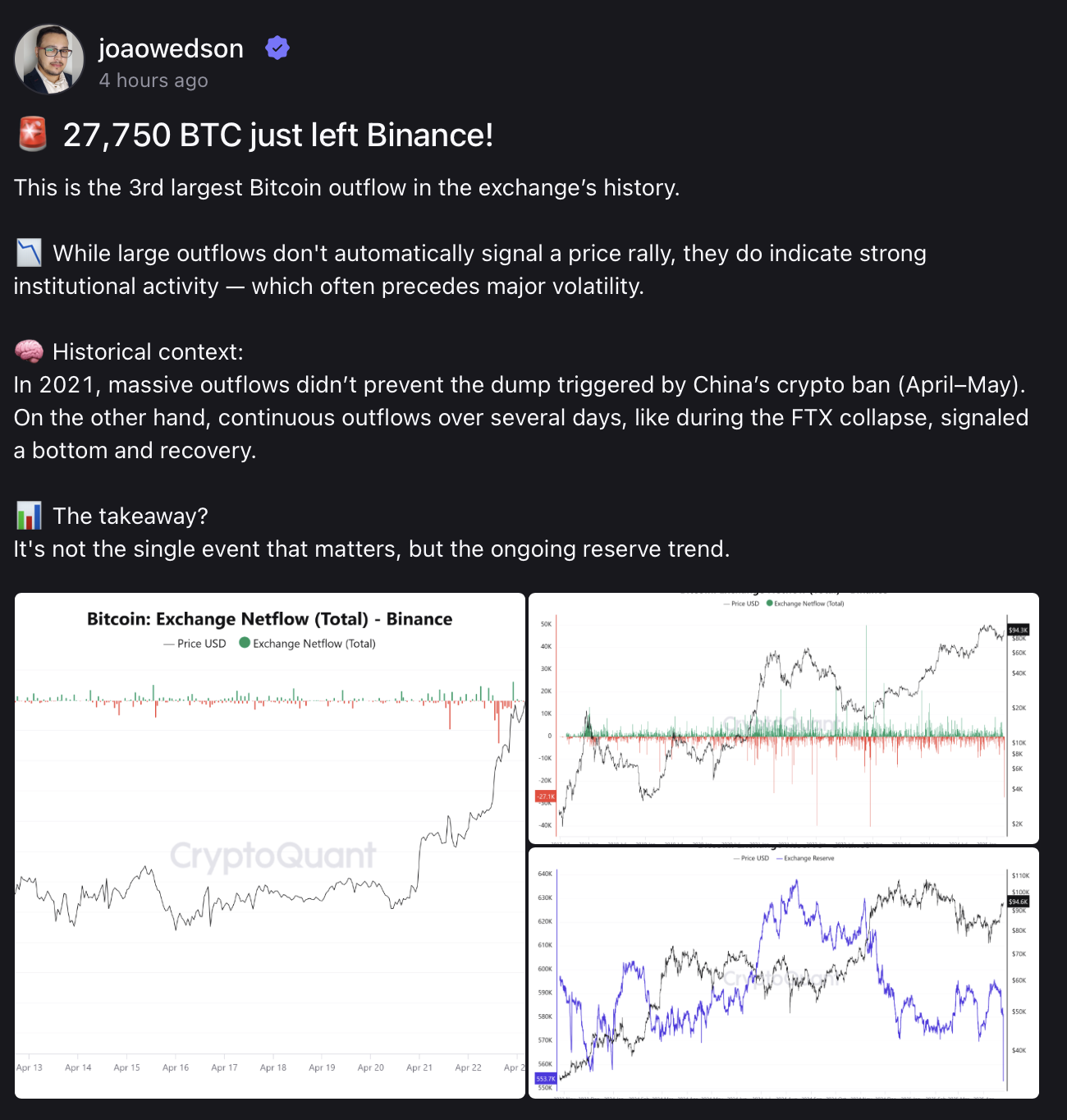

Binance simply witnessed one among its most vital Bitcoin outflows ever, with greater than 27,750 BTC leaving the alternate in a single day.

This marks the third-largest Bitcoin withdrawal within the platform’s historical past.

The transfer has raised eyebrows amongst analysts and merchants, igniting hypothesis about whether or not establishments are as soon as once more shifting their holdings to chilly storage — a sample usually seen forward of key market pivots.

Institutional Exercise or Early Sign?

Giant-scale outflows don’t assure a worth surge, however they usually point out strategic positioning. In lots of previous instances, establishments have moved BTC off exchanges to carry long-term, which might tighten market provide and add upward stress — particularly if retail demand follows.

Nonetheless, not each outflow results in a rally. In 2021, large withdrawals preceded a market crash as China imposed a sweeping ban on crypto. Conversely, throughout the FTX collapse in late 2022, constant BTC outflows had been an early signal that the market had bottomed, resulting in months of restoration.

Pattern Over Time Issues Most

Analysts emphasize that it’s not simply the scale of a single withdrawal that counts. What issues extra is the longer-term pattern of reserves throughout exchanges. Sustained outflows over a number of days or even weeks have traditionally carried extra bullish weight than one-off occasions.

If this newest motion proves to be the beginning of a brand new pattern — particularly amid rising regulatory uncertainty and macro volatility — it may lay the groundwork for the subsequent leg of Bitcoin’s rally.

Whether or not this marks the start of sustained accumulation or stays a blip, it indicators rising confidence from giant holders. And that, in itself, could possibly be a strong shift.