A crypto analytics agency believes that Bitcoin (BTC) is gearing up for a recent upside burst because it begins to outperform the inventory market.

In a brand new thread on the social media platform X, Swissblock says that Bitcoin is now “taking part in in its personal league” after BTC held its floor amid a extreme inventory market sell-off this month.

In response to Swissblock, Bitcoin appears to be taking part in the a part of a safe-haven asset within the midst of market uncertainty stemming from President Trump’s commerce battle.

“Bitcoin’s decoupling from equities is confirmed:

Even when sentiment across the commerce battle shifts, Bitcoin gained’t be closely affected.

In truth – like gold – it might strengthen.

Upside strain is brewing.”

Bitcoin is up over 15% this month whereas the S&P 500 is down about 1.42%.

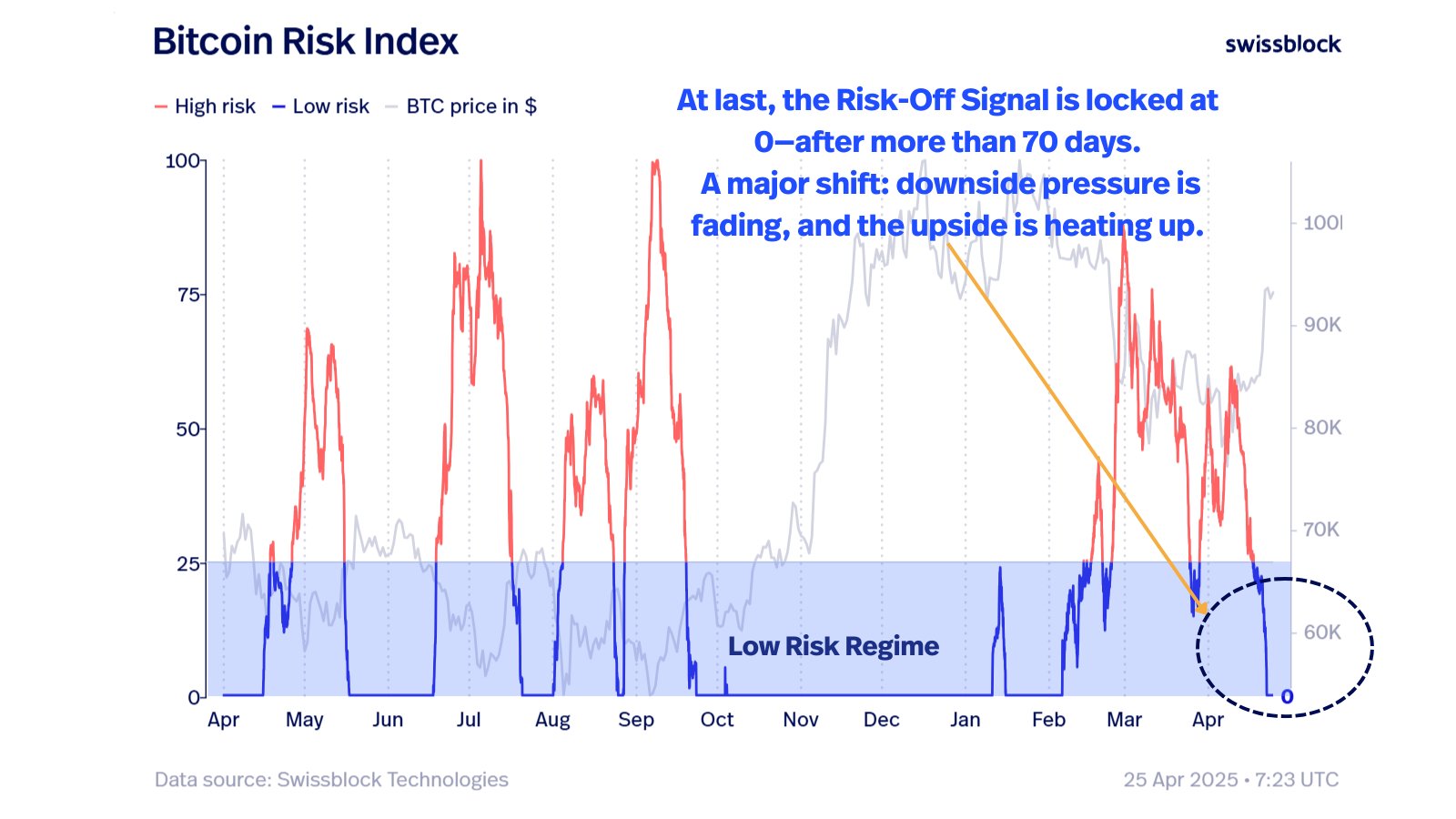

Swissblock additionally says that the Bitcoin Threat Index is flashing bullish for BTC. The metric goals to judge Bitcoin’s present danger atmosphere by aggregating numerous knowledge factors, together with on-chain valuation and cost-basis metrics.

In response to the analytics agency, the metric means that Bitcoin’s promoting strain is fading whereas upside potential is heating up.

“Beware bears!

Threat-Off Sign at 0 for days: clear proof that draw back strain is vanishing.

We’re in bullish stabilization – pullbacks are actually launchpads for extra upside.”

Final week, Swissblock stated that BTC wants to interrupt its fast resistance at round $95,000 to set off new rallies. However the agency additionally stated that BTC could first witness a retracement towards the $89,000 zone to collect bullish momentum earlier than sparking a recent leg up.

At time of writing, Bitcoin is buying and selling for $94,826.

Comply with us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Worth Motion

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any losses you might incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney