- Ethereum rebounds: ETH climbed again to $1,847 after dipping beneath $1,750 in late April, exhibiting indicators of renewed power amid broader market uncertainty.

- Alternate outflows surge: Over $380 million price of ETH was withdrawn from exchanges final week, indicating rising investor accumulation and lowered promoting strain.

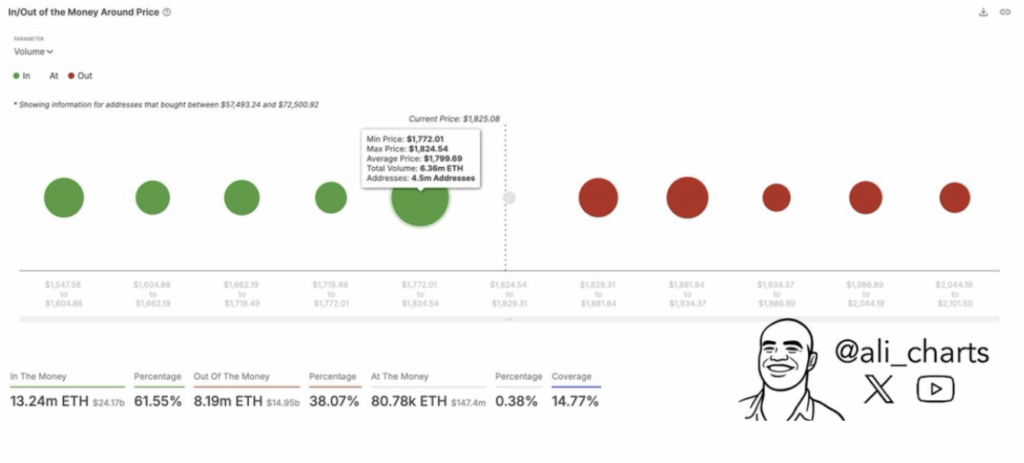

- Key assist and resistance: The $1,770–$1,824 zone is an important assist vary backed by 4.5M pockets holders. If ETH holds above this, the following resistance to look at is $1,881.

Ethereum appears to be discovering its footing once more. After wobbling beneath $1,750 on the tail finish of April, the second-largest crypto by market cap bounced again, now hovering round $1,847. That’s a pleasant little climb—however what’s behind it?

Properly, a couple of issues.

Buyers Pull $380M in ETH Off Exchanges—Right here’s Why That Issues

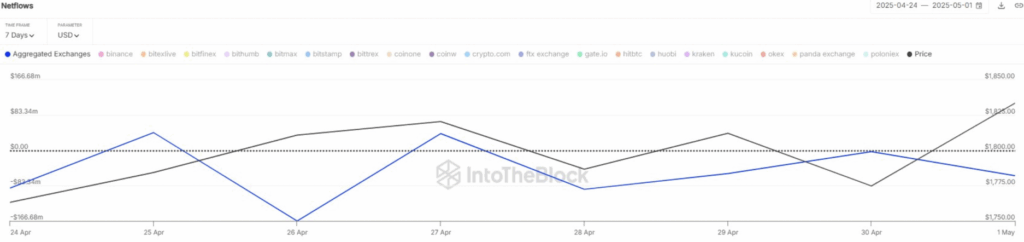

In accordance with knowledge from IntoTheBlock, a whopping $380 million price of ETH was yanked off centralized exchanges in simply the previous week. That’s not small change—it’s a powerful signal that buyers are shifting towards long-term holds, shifting ETH into chilly storage or self-custody wallets. Traditionally, when folks cease leaving their cash on exchanges, it typically hints at one thing larger brewing… bullish, possibly?

We’re additionally seeing 5 straight days of damaging netflows throughout 19 high exchanges. The final time we noticed a optimisticinflux was April 27—with about $50 million rolling in. However only a day earlier than that? Over $166 million left the exchanges. This back-and-forth motion would possibly look chaotic, however the huge image says: persons are accumulating.

And when provide on exchanges drops? You guessed it—much less ETH out there to promote normally means much less strain downward.

$1,770 – Ethereum’s Line within the Sand?

Crypto analyst Ali Martinez chimed in with some well timed perception too. Utilizing IntoTheBlock’s “In/Out of the Cash Round Worth” mannequin, he flagged a key assist zone for ETH—between $1,772 and $1,824.

Roughly 4.5 million wallets purchased ETH in that vary. So now that ETH has clawed again as much as $1,845, all these holders are in revenue territory. That value space? It’s changing into a psychological stronghold. If Ethereum holds the road above $1,770, the bullish case stays alive. Dip beneath it although, and we is likely to be gazing one other spherical of draw back volatility.

What Comes Subsequent?

Proper now, Ethereum trades at round $1,839, slowly inching towards the following hurdle at $1,881. If it manages to shut above that, it may begin choosing up actual momentum. However it’s a wait-and-see second—ETH’s been unpredictable these days.

For now, the takeaway is obvious: much less ETH on exchanges = much less promoting strain. And which means Ethereum could possibly be setting the stage for a extra sustained transfer… assuming the bulls don’t get spooked once more.