The creators of the TRUMP meme coin have moved over $52 million value of tokens to centralized exchanges, sparking debate concerning the challenge’s motives and transparency.

The token, themed after US President Donald Trump, has gained large consideration since its launch, however now faces scrutiny over insider exercise and market influence.

TRUMP Staff Describes $52 Million Token Switch as ‘Liquidity Operations’

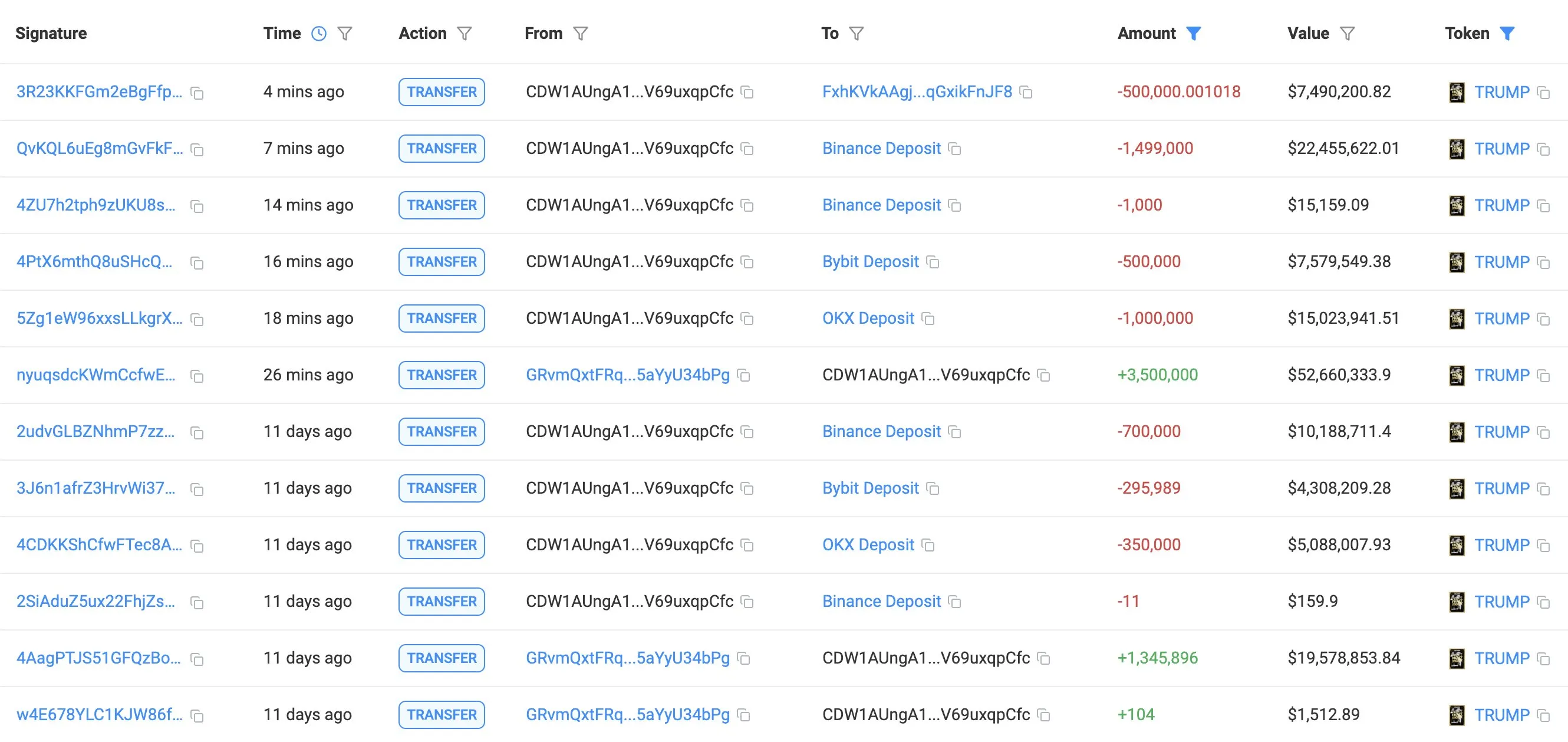

On Might 10, on-chain analytics platform Lookonchain revealed that the staff behind TRUMP deposited 3.5 million tokens, valued at greater than $52 million, throughout three main exchanges—Binance, OKX, and Bybit.

In response to the agency, Binance acquired the biggest share at 1.5 million tokens, estimated at $22 million. OKX adopted with 1 million tokens value $15 million, whereas Bybit acquired simply over 500,000 tokens valued at $7.5 million.

Nevertheless, the TRUMP token staff claimed the switch aimed to strengthen liquidity and keep secure market entry.

They defined that the tokens got here from a pre-designated liquidity pockets created in the course of the challenge’s launch. The staff additionally assured customers that every one lately unlocked tokens had been relocked and would stay so for 90 days.

“Demand for $TRUMP has been great. On Might 10, 2025 at roughly 1:30 am UTC, 3.5 million $TRUMP might be moved onto exchanges to additional assist liquidity operations to assist guarantee continued availability of $TRUMP for each patrons and sellers. All of this liquidity is being supplied from a liquidity pockets from the preliminary launch,” the staff said.

Whereas the staff maintains that the token transfers are a part of routine liquidity administration, current findings recommend a special story.

A CNBC report, citing Chainalysis, revealed that the staff behind TRUMP has earned over $320 million in buying and selling charges.

Moreover, there’s a large hole between investor outcomes. Of greater than two million wallets holding TRUMP, roughly 760,000 are at the moment at a loss.

In sharp distinction, solely 58 wallets have every revamped $10 million, collectively netting about $1.1 billion in earnings.

This stark imbalance suggests {that a} small group of insiders could have captured many of the worth generated by the token.

Primarily, the challenge’s shut affiliation with Trump, mixed with uneven returns and insider earnings, continues to forged doubt on its equity and long-term viability.

In response to BeInCrypto information, the token surged to $77 on its first buying and selling day. Nevertheless, it has since plummeted by 86%, buying and selling close to $14 on the time of writing.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.