- Avalanche Sees Exercise Surge Amid Worth Dip: AVAX dropped 1.13% to $23.66, however on-chain exercise spiked with a 221% soar in Lively Addresses and a 109% rise in Transaction Rely, largely pushed by NFT transactions on OpenSea.

- Price Income Rises, However Liquidity Outflows Persist: Avalanche’s payment income elevated from $19,500 to $24,300, indicating greater community utilization, however the complete worth locked (TVL) slid 3.26% as $50 million value of AVAX was offered off.

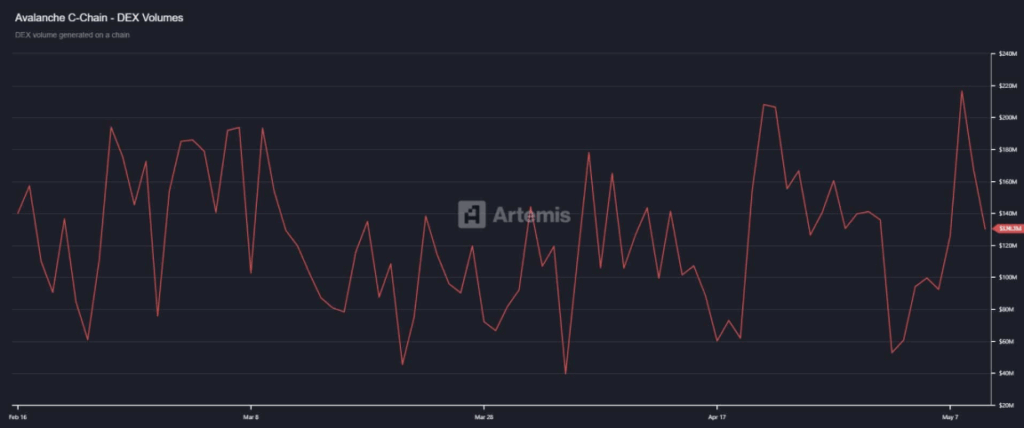

- Buying and selling Quantity Declines as Demand Weakens: DEX buying and selling quantity dropped from $216.5 million to $130.3 million, suggesting that regardless of robust on-chain metrics, AVAX nonetheless wants broader demand restoration to maintain a breakout.

Avalanche (AVAX) took a slight hit, dropping 1.13% within the final 24 hours to commerce at $23.66. However regardless of the pullback, some analysts nonetheless see room for features – so long as the community can shake off the promoting stress that’s been build up.

Surge in On-Chain Exercise – Is AVAX Gearing Up?

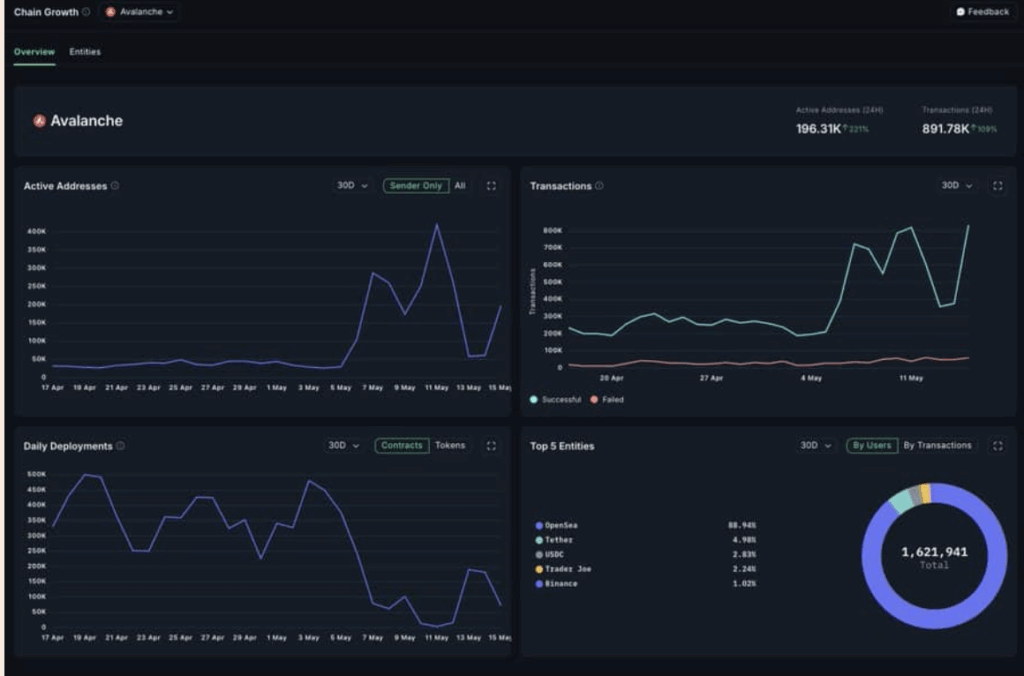

Exercise on Avalanche has been something however quiet. In accordance with Nansen, Lively Addresses spiked by 221% whereas Transaction Rely jumped 109% in simply in the future. That’s a variety of motion – and most of it’s tied to OpenSea, the NFT market. AMBCrypto’s analysis discovered that 89.94% of these transactions have been OpenSea-related, hinting that NFTs are driving a variety of the present motion on the community.

This aligns with a broader development. NFT apps have been the second-best performing sector previously 30 days, posting a stable 78.1% progress. If this momentum retains up, it may push AVAX greater within the close to time period.

Charges Climb as Community Utilization Rises

The elevated exercise can be displaying up in payment technology. Avalanche’s payment income climbed from $19,500 on Might 11 to $24,300 at press time – an indication that individuals are really utilizing the chain extra. And whereas that’s an excellent look, it’s solely a part of the image.

Liquidity Outflows and Weak Alternate Exercise

Right here’s the flip facet – liquidity remains to be bleeding out. Knowledge from DeFiLlama exhibits that the full worth locked (TVL) in Avalanche protocols dipped 3.26% over the previous few days, sliding from $1.519 billion to $1.469 billion. That’s $50 million value of AVAX offered off.

And it’s not simply liquidity. Buying and selling quantity on decentralized exchanges (DEXs) dropped from $216.5 million to $130.3 million, suggesting that demand isn’t fairly there but. For AVAX to interrupt out of its present vary, that demand wants to select up – each on-chain and throughout buying and selling platforms.

Backside Line – Blended Alerts

Avalanche is flashing some conflicting alerts proper now. On-chain exercise is heating up, pushed by NFT-related transactions and rising payment income. However on the identical time, liquidity outflows and weak alternate volumes are dragging on worth motion. If AVAX can appeal to contemporary demand throughout all channels, it’d regain its bullish footing. However for now, the market stays in wait-and-see mode.