Welcome to the US Crypto Information Morning Briefing—your important rundown of a very powerful developments in crypto for the day forward.

Seize a espresso as we discover the macro tendencies shifting markets, from Bitcoin’s emergence as a worldwide benchmark asset to Wall Road’s accelerating push into stablecoins. As bond market volatility rattles conventional finance, capital is rotating quick—and crypto is the place it’s touchdown. Right here’s every little thing you could know to remain forward immediately.

Crypto Information of the Day: Bitcoin Goes Mainstream: How World Instability Is Turning BTC Right into a Macro Benchmark

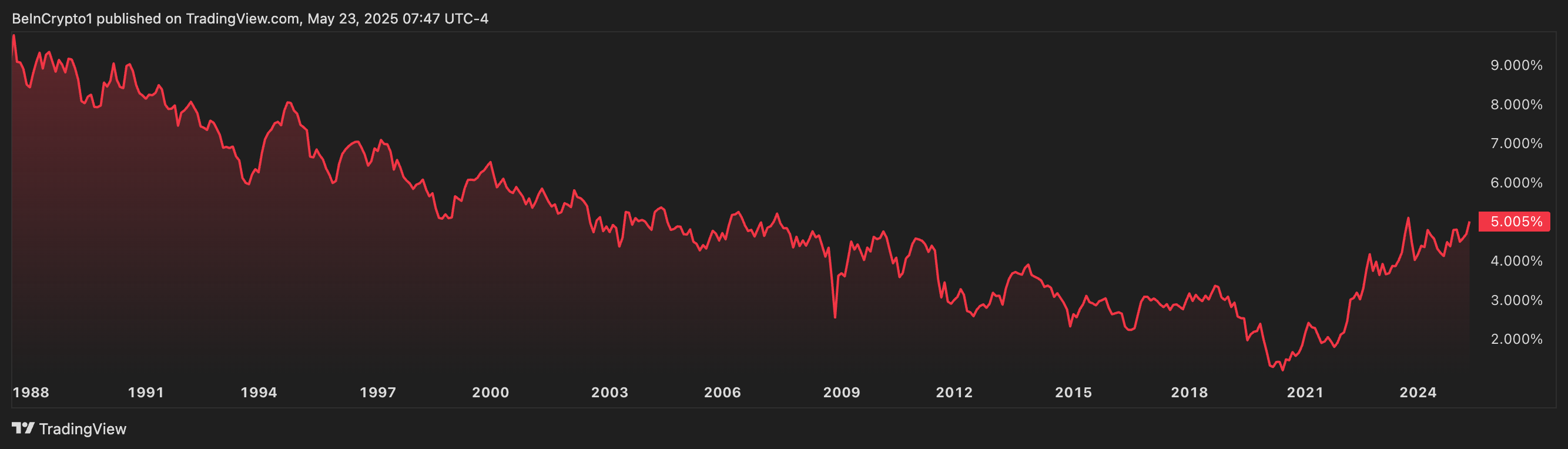

World bond markets are beneath renewed stress, with dismal public sale outcomes stirring worry throughout conventional threat property. In Japan, the Financial institution of Japan’s JGB public sale was the worst since 1987, whereas within the US, the 20-year Treasury public sale closed at 5.104%, sharply greater than the earlier 4.810%. This turmoil is reigniting demand for secure havens—each bodily and digital.

“World bond markets are seeing poor public sale outcomes. Japan BOJ JGBs had the worst public sale since 1987, whereas the US 20yr public sale immediately closed 5.104% (vs) 4.810% beforehand. This has introduced again worry into risk-assets, inflicting Gold to rally again to $3322 (up +$200 from final week’s low). At this time we’re seeing the ‘digital gold’ bid come again for Bitcoin. That is inflicting Bitcoin dominance to return because it continues to outperform altcoins (that are buying and selling as pure risk-assets). There’s nonetheless the potential for Bitcoin to hit astronomical costs if some world central banks (or anybody main central financial institution) begins to purchase Bitcoin as an alternative of normal gold as a diversification. At this time we’re seeing many personal firms do that, which is lifting Bitcoin to new ATHs.” – Greg Magadini, Director of Derivatives, Amberdata

That rotation is already taking part in out in actual time. As international sovereign debt turns into much less enticing, yield-seeking capital is flowing into options—Bitcoin is chief amongst them.

“Seems to be like US debt isn’t too enticing proper now given the worldwide mess. Buyers are looking for yield, and Bitcoin’s the place they’re parking capital.” – Dave Sedacca, Director of Finance at Parity Applied sciences

What’s turning into clear is that Bitcoin is not a fringe asset—it’s getting into the institutional mainstream.

“Bitcoin breaking by way of $110K displays the brand new actuality: it’s not a fringe asset—it’s a macro instrument. ETF inflows, sovereign curiosity, and structurally restricted provide are driving institutional demand at scale. For funds sitting on money in a low-yield world, Bitcoin is beginning to look much less like a threat and extra like a benchmark.” – Mike Cahill, CEO of Douro Labs, a number one contributor to the Pyth Community

And as institutional demand meets Bitcoin’s hard-coded shortage, its value motion is turning into a mirrored image of broader capital cycles.

“We’re seeing what occurs when structurally constrained provide meets reflexive institutional demand. This isn’t simply hypothesis—it’s systemic repricing. Bitcoin is now a part of macro portfolios, and meaning value motion is being pushed by the identical capital rotation and liquidity cycles that transfer conventional markets.” – Doug Colkitt, Preliminary Fogo Contributor

Wall Road’s Stablecoin Push: Huge Banks Put together for a $3.7 Trillion Digital Asset Future

Main US banks—together with JPMorgan, Financial institution of America, Citigroup, and Wells Fargo—are in early discussions to collectively launch a stablecoin, aiming to reclaim floor within the digital finance house.

The trouble is being coordinated by way of shared entities like Early Warning Companies and hinges on upcoming laws, particularly the GENIUS Act, which may quickly cross within the US Senate.

With the stablecoin market projected to succeed in as much as $3.7 trillion by 2030, banks are positioning themselves to compete with crypto-native and tech-driven fee platforms. Lawmakers, together with Senator Cynthia Lummis, emphasize the necessity for regulatory readability to take care of US management in monetary innovation.

“I predict stablecoin progress to $2 trillion, in addition to the US. Treasury’s notice the place this types the idea of their stablecoin forecast, as the purpose of the stablecoin Act is that stablecoins will additional legitimise the entire asset class, all boats rise,” Customary Chartered Head of Digital Property Analysis Geoff Kendrick mentioned in an e-mail.

Chart of the Day

Byte-Sized Alpha

Right here’s a abstract of extra US crypto information to observe immediately:

Crypto Equities Pre-Market Overview

| Firm | On the Shut of Might 22 | Pre-Market Overview |

| Technique (MSTR) | $399.46 | $399.72 (+0.07%) |

| Coinbase World (COIN) | $271.95 | $270.01 (-0.71%) |

| Galaxy Digital (GLXY) | $24.46 | $23.70 (-3.11%) |

| MARA Holdings (MARA) | $15.65 | $15.46 (-1.21%) |

| Riot Platforms (RIOT) | $8.94 | $8.84 (-1.12%) |

| Core Scientific (CORZ) | $10.83 | $10.70 (-1.20%) |

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.