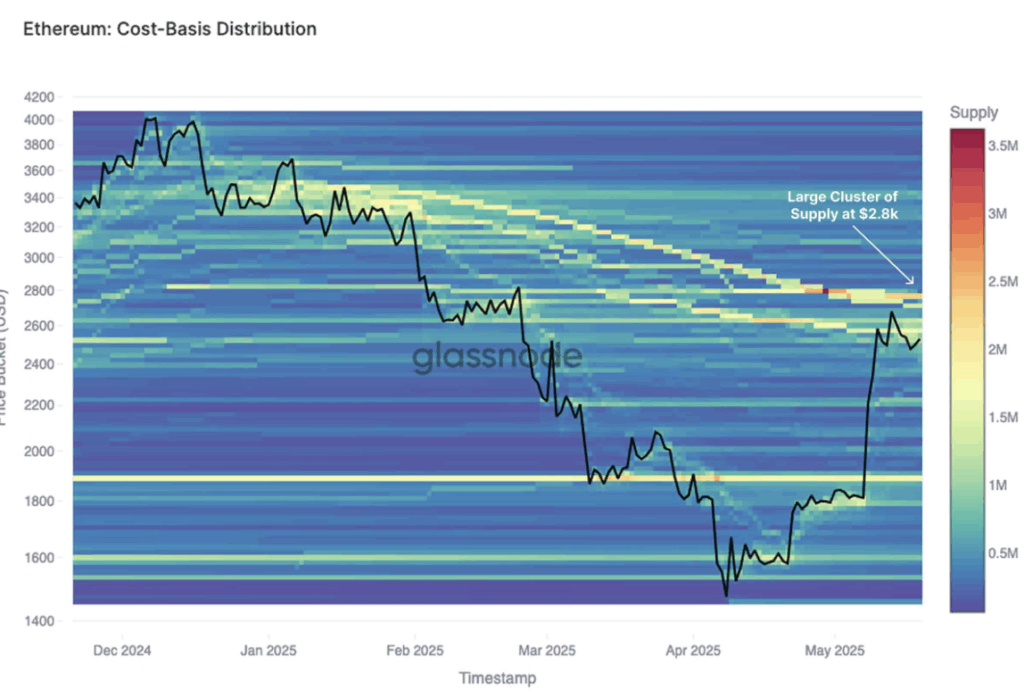

- Ethereum is dealing with robust resistance at $2,800, a degree the place many holders are prone to promote at breakeven, creating severe strain on the present rally.

- Whales are shifting ETH again to exchanges, and open curiosity is falling, suggesting cautious sentiment at the same time as retail merchants stay overly bullish and closely lengthy.

- Momentum is fading, with RSI dipping and ETH consolidating under resistance—if bulls can’t push by way of quickly, a worth correction might be on the desk.

Ethereum’s been on a little bit of a tear these days—however now it’s bumping up towards an enormous, chunky resistance zone proper round $2,800. That degree, in accordance with Glassnode, is the place a complete bunch of traders purchased in… that means quite a lot of of us may be seeking to dump and break even when we get shut.

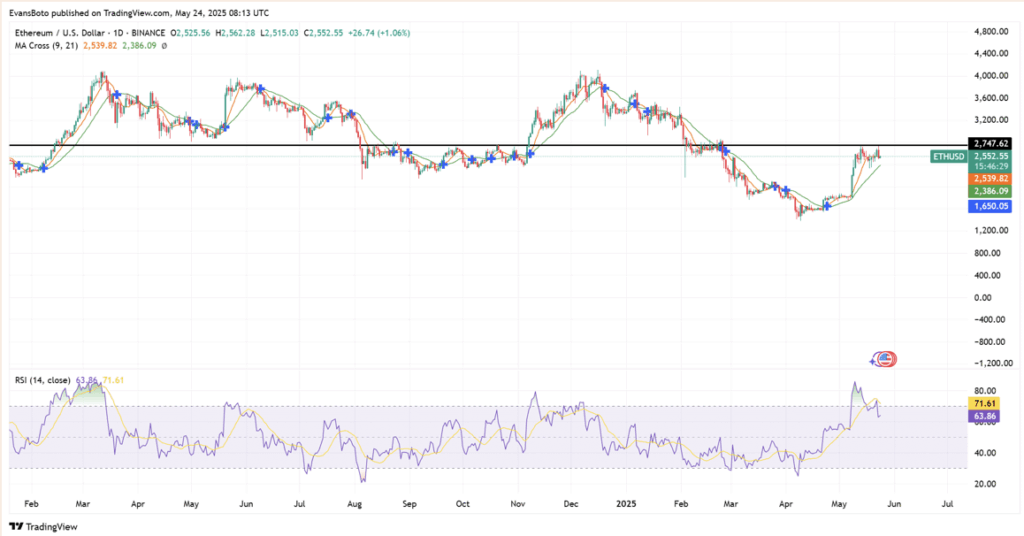

Proper now, ETH’s floating round $2,549.98—down about 4.5% prior to now 24 hours. The climb over the previous couple of weeks was robust, little doubt. However now? It’s displaying indicators of fatigue.

Indicators of a Drained Rally

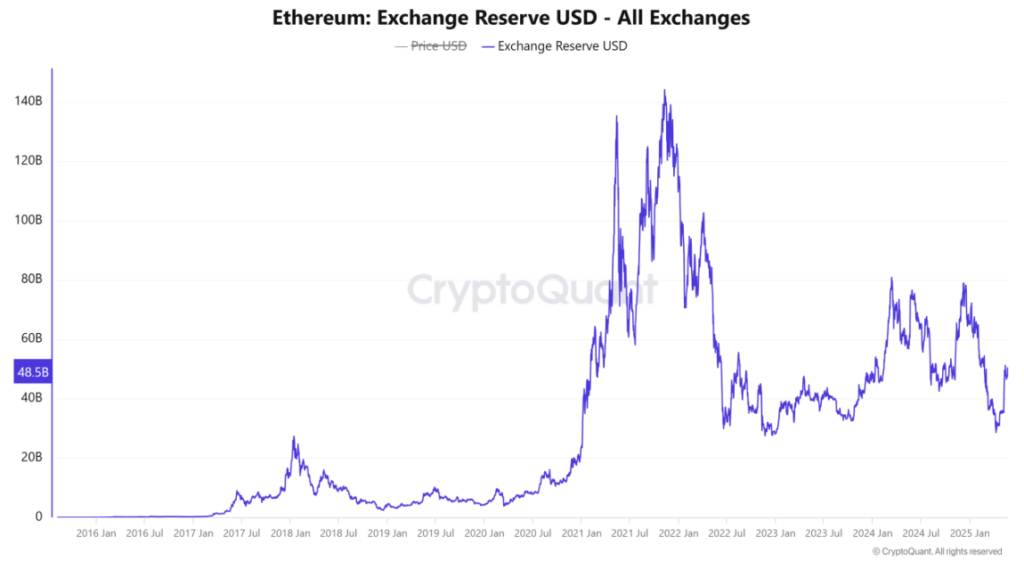

The Trade Reserve’s dropped 3.66% to $48.18B. Often that’s bullish—it suggests individuals are pulling cash off exchanges, not able to promote. However on the flip facet, Open Curiosity is down too—falling 4.32% to $16.61B. That’s a little bit of a combined bag.

Might imply merchants are taking part in it secure, perhaps taking income or hedging as we method that scary $2.8k mark. And with OI dipping whereas worth bounces round? Yeah, that’s an indication of us are getting a bit cautious.

Whales Are Quietly Making Strikes

IntoTheBlock dropped a stat that’s arduous to disregard: the Giant Holder-to-Trade Netflow Ratio fell a wild 193.84% prior to now week. Translation? Huge wallets are shifting ETH again to exchanges—in all probability excited about promoting quickly.

Now, zooming out, the 30-day netflow remains to be manner up (450%+), so whales did load up lately. However this shift in habits hints they may be seeking to unload a few of that stash quickly.

Retail Merchants Go All-In… Perhaps Too Exhausting?

On Binance, ETH longs make up a large 84.28% of open positions. That’s tremendous lopsided—virtually nobody is shorting proper now. The Lengthy/Brief Ratio’s sitting up at 5.36, which normally screams “overconfident.”

If ETH can’t bust by way of resistance quickly, this over-leveraged crowd may get worn out fast. And when that unwind begins, it tends to get messy quick.

Momentum Fading, Assist Nonetheless Sturdy

ETH bought smacked again after touching $2,747 and has been chilling close to $2,550 since. Nonetheless above its 9-day and 21-day EMAs, however the RSI slipping from 71 to round 63 exhibits momentum’s positively cooling.

Until bulls get their act collectively and ship ETH flying above $2,800 with some severe quantity, we might be taking a look at a little bit of a pullback. Key assist ranges at $2,540 and $2,386 may maintain the road if it does dip.

What’s Subsequent?

This $2,800 space’s shaping as much as be a make-or-break second. If ETH smashes by way of, count on fireworks. But when the resistance holds, whales may dump, retail may panic, and the worth may roll over.

Eyes on quantity, whale flows, and that key resistance zone. It’s about to get fascinating.