- Chainlink dropped to $13.70, however a pointy decline in exchange-held provide and rising self-custody counsel investor confidence is rising.

- Institutional partnerships and dominance within the oracle area—with over $43B secured—spotlight Chainlink’s robust fundamentals.

- Whale promoting is slowing, community exercise is up, and a bullish harmonic sample hints at a possible breakout towards $30.92.

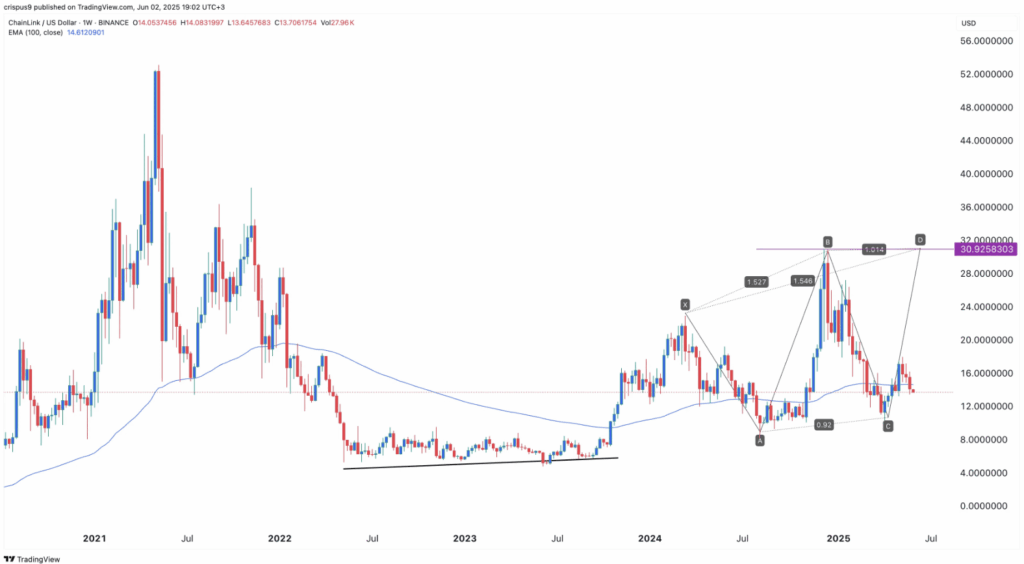

Chainlink hasn’t been having the most effective time recently. It slipped to $13.70 on Monday—its lowest stage since Might 8—marking a 23.75% drop from its Might excessive. The dip’s largely in step with what we’re seeing throughout the board, as Bitcoin and most altcoins pulled again too. Nonetheless, there are just a few key issues hinting that LINK may not keep down for lengthy.

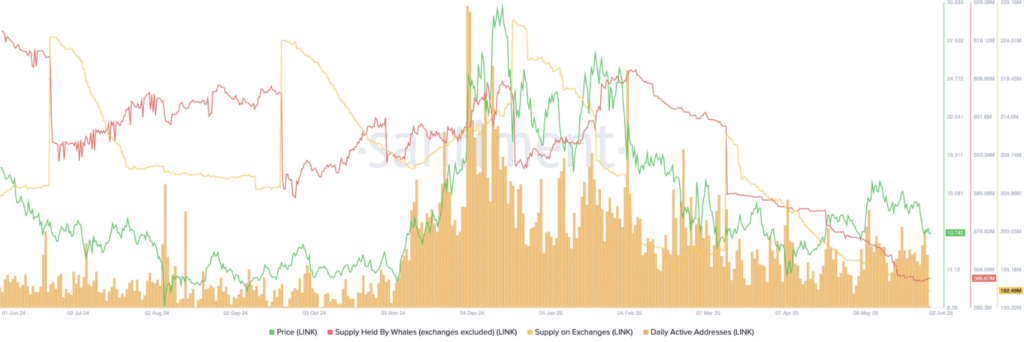

One of many largest inexperienced flags? The provision of LINK on centralized exchanges retains falling. Santiment information reveals it dropped to 192 million tokens from 226 million again in November 2023. That often means holders are shifting cash to chilly wallets—aka, they’re not seeking to promote anytime quickly. That sort of conduct tends to point out long-term conviction.

Robust Fundamentals and Institutional Assist

It’s not simply in regards to the charts—Chainlink’s truly been doing quite a bit behind the scenes. They’ve landed partnerships with huge names like JPMorgan, ANZ Financial institution, UBS, and even Swift. These teams are exploring real-world asset tokenization, and Chainlink’s tech is changing into a go-to for it, particularly their Cross-Chain Interoperability Protocol (CCIP), which lets totally different blockchains discuss to one another.

Then there’s the oracle sport. Chainlink’s nonetheless the king, securing greater than $43 billion throughout DeFi protocols. The following closest? Chronicle, sitting at simply $7.4 billion. That sort of lead doesn’t occur accidentally—it means individuals belief the tech.

Whale Promoting Slows Down

One other factor to observe is whale conduct. For months, massive holders had been offloading LINK, however that appears to be cooling off. Whale wallets now maintain 566.67 million tokens—up barely from final week’s 565.9 million. It’s not a large leap, however it’s a shift. If this retains up, it may imply the heavy promoting is lastly behind us, which might be a giant plus for worth stability.

On the identical time, every day energetic addresses are climbing, suggesting community engagement is choosing up. Extra exercise on-chain often hints at rising curiosity or use, each good indicators for worth momentum.

Technical Setup Might Gas a Breakout

Now onto the technicals—LINK could also be carving out a bullish harmonic sample on the weekly chart. The setup? A traditional XABCD formation, typically adopted by a powerful continuation transfer. Right here’s the tough timeline: XA ran from March to July 2023, AB pulled again into November, and BC stretched to April 2025. If that last CD leg is beginning now, LINK could possibly be headed again to its November excessive round $30.92. That’s a possible 125% transfer from the place it’s proper now.

So yeah, whereas the current drop stings, there’s fairly a bit lining up behind the scenes that would flip issues round for LINK. As at all times although—timing is all the pieces.