In an fascinating growth, China has now injected RMB 161.2 billion ($22.4 billion) into its financial system in a transfer that might have international monetary ripple results. This occasion comes amidst an ongoing intensive correction within the crypto market that has sparked speculations on the viability of the present bull market run.

Crypto Market Set For Rebound As China Restarts Cash Provide Development

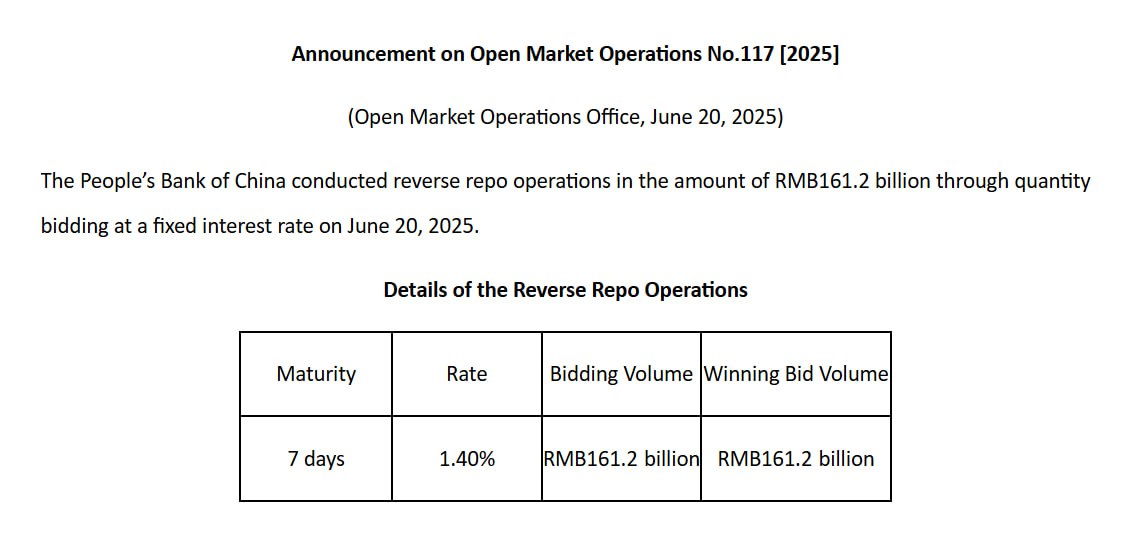

In an Open Market Operations announcement on June 20, the Folks’s Financial institution of China (PBOC) acknowledged intentions to inject RMB 161.2 billion into the financial system by way of a seven-day reverse repo operations at a 1.40% rate of interest. For context, reverse repos are short-term liquidity instruments wherein the central financial institution purchases securities from industrial banks with an settlement to promote them again at a later date, thereby quickly boosting liquidity within the banking system.

Apparently, this newest injection is a part of a broader financial easing pattern noticed in China’s latest coverage stance. Notably, on Might 7, the PBOC carried out a 0.5 proportion level discount within the reserve requirement ratio (RRR), a transfer that freed up roughly RMB 1 trillion ($138 billion) in long-term liquidity, successfully coinciding with a Bitcoin worth surge above $97,000 on that day and new all-time excessive a number of weeks after.

Nevertheless, in contrast to the RRR minimize which had extra enduring liquidity implications, the newest RMB 161.2 billion injection through reverse repo is designed for short-term liquidity administration. Nonetheless, well-liked crypto analyst and key opinion chief Ted Pillows explains it’s a sturdy indicator that China’s M2 cash provide is now trending upward once more after peaking in Q1 2025.

Usually, a rise in M2 indicators increasing liquidity, usually seen as a long-term bullish indicator for each conventional and digital asset markets. Contemplating the continued crypto market correction, China’s newest financial intervention is a optimistic sign reinforcing the potential of bullish resurgence within the coming weeks.

US Fed To Comply with Go well with?

Following the latest announcement by the PBOC, hypothesis is mounting over whether or not the US Federal Reserve would possibly undertake related liquidity-boosting measures. Nevertheless, in accordance with a report by Scotsman Information, analysts at Wells Fargo predict that the Fed is more likely to keep its quantitative tightening stance all through 2025.

At press time, the whole crypto market cap is value $3.14 trillion following a 1.48% lower prior to now day. Every day buying and selling quantity has additionally dropped to $94.96 billion. In the meantime, Bitcoin, the market chief, is at present valued at $102,784 reflecting losses of 0.74% and three.39% on the day by day and weekly chart respectively.

Featured picture from Adobe Inventory, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our group of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.