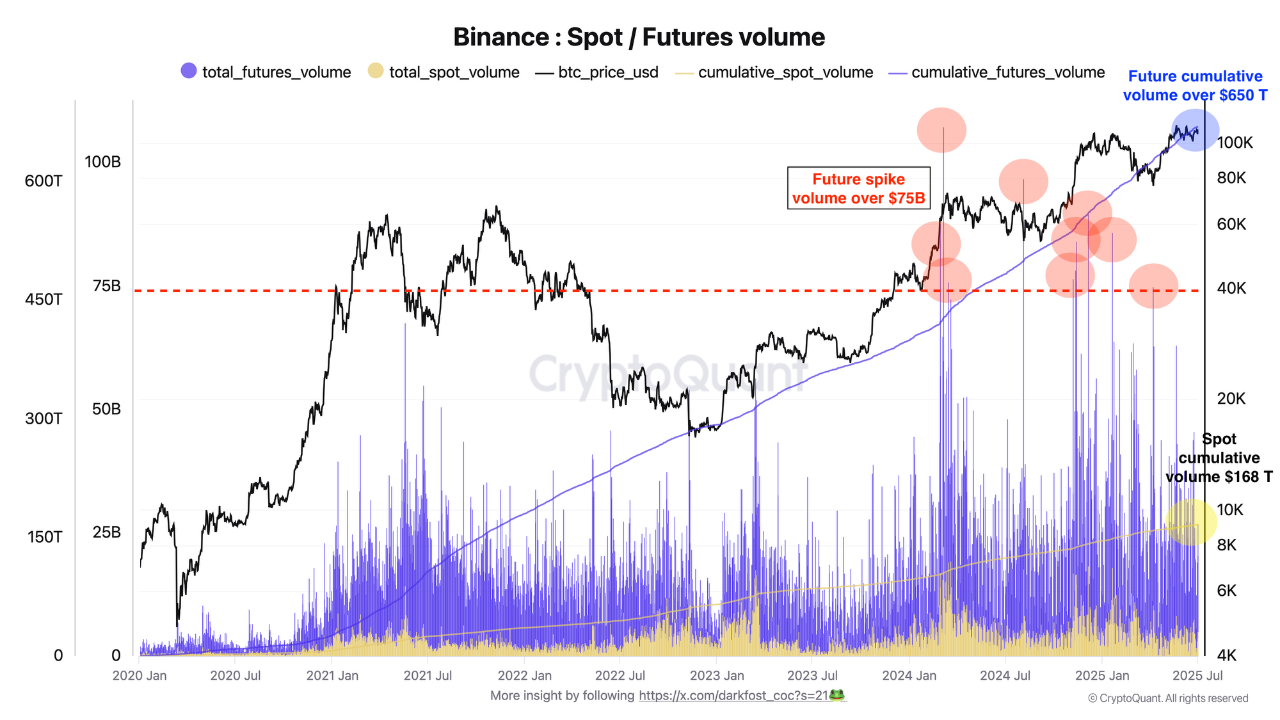

Bitcoin’s market construction has undergone a dramatic transformation, with Binance surpassing $650 trillion in BTC futures quantity since launching the product in September 2019.

As compared, the platform’s BTC spot quantity reached simply $168 trillion over the identical interval—highlighting a decisive shift towards speculative buying and selling within the crypto panorama.

Derivatives Now Drive 75% of Bitcoin Exercise

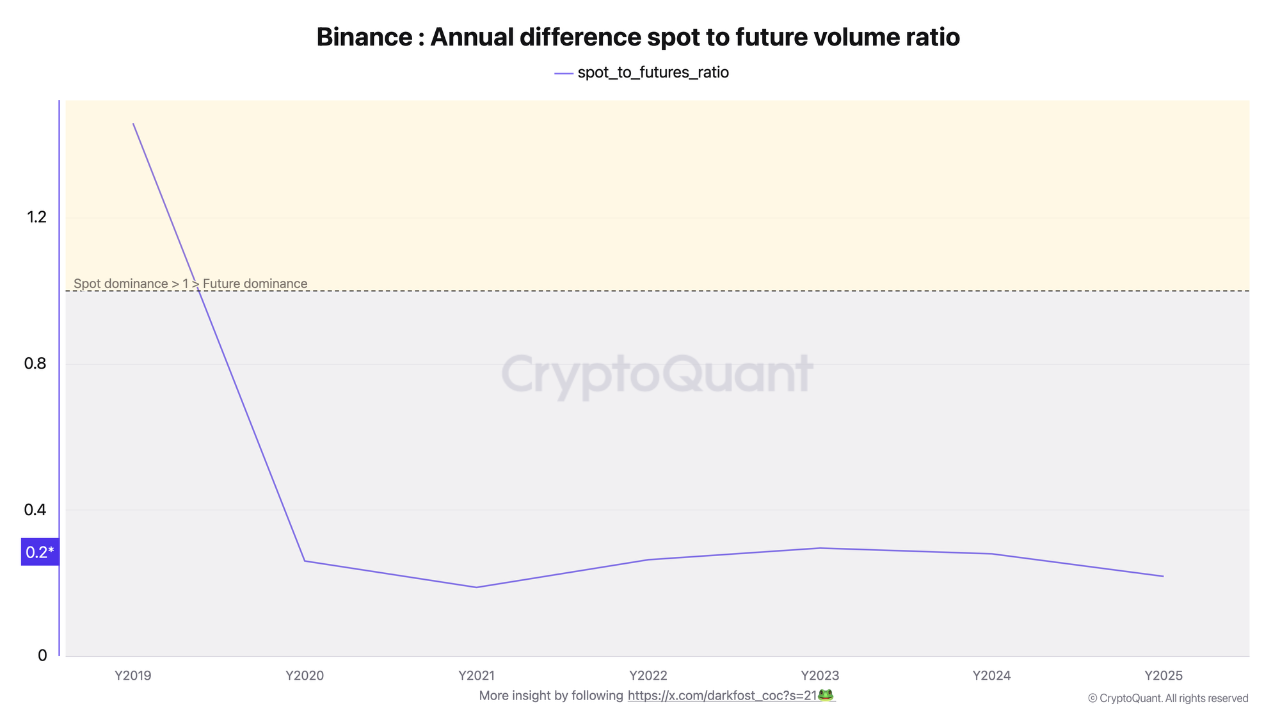

In response to new report by CryptoQuant, the information marks a paradigm shift in how Bitcoin is traded, with futures quantity now accounting for roughly 75% of whole BTC exercise on Binance. The present spot-to-futures quantity ratio stands at 0.21, or 0.26 when adjusted for refined metrics—underscoring the rising dominance of the derivatives market.

Whereas spot quantity is often related to long-term traders and conviction-based shopping for, futures exercise displays short-term hypothesis, leverage, and speedy capital rotation. This transition is not only about quantity—it indicators a broader evolution in market conduct.

Binance Leads as Speculative Hub

Binance has turn into the undisputed chief in Bitcoin derivatives buying and selling. Throughout this cycle, day by day BTC futures quantity has exceeded $75 billion a number of instances, setting new data for the reason that change first launched the product. Such high-frequency buying and selling ranges had been beforehand unthinkable within the pre-derivatives period.

The explosive development of BTC futures highlights not solely elevated hypothesis and market volatility, but additionally Binance’s unmatched function in funneling international liquidity into its derivatives platform.

Why Futures Monitoring Is Now Important

With the overwhelming majority of Bitcoin buying and selling now concentrated within the derivatives house, analysts emphasize that monitoring futures market tendencies is important for understanding worth actions. Liquidations, funding charges, and open curiosity now carry far higher weight in forecasting volatility and directional bias.

Because the derivatives-fueled cycle continues, Binance stays the heartbeat of speculative Bitcoin buying and selling, and futures quantity could more and more function the clearest sign of the place the market is headed subsequent.