- Robinhood now helps HBAR spot buying and selling, marking a strategic enlargement past main cash.

- HBAR value spiked over 10% post-listing, with whales and altcoin sentiment driving curiosity.

- Regardless of SEC crackdowns elsewhere, Robinhood is doubling down on tokens with robust ecosystems.

Robinhood simply rolled out spot buying and selling for Hedera’s HBAR token on its U.S. platform, increasing its crypto lineup and aiming to catch the wave of retail buyers in search of the following altcoin breakout. The itemizing is a part of an even bigger technique, as Robinhood retains transferring past the standard heavyweights like Bitcoin and Ethereum, leaning into rising Layer-1 initiatives and even meme cash to draw contemporary demand.

In keeping with a put up on X, customers can now purchase, promote, and maintain HBAR immediately on Robinhood with out counting on exterior wallets or exchanges. Hedera runs on a hashgraph consensus mannequin, which differs from typical proof-of-work or proof-of-stake setups, giving HBAR a singular angle within the crowded altcoin house. Robinhood’s push right here may additionally increase HBAR liquidity and drive extra speculative curiosity amongst retail merchants.

Why Robinhood Is Increasing Into HBAR

This itemizing follows Robinhood’s broader pivot towards changing into a one-stop store for digital and conventional monetary merchandise. Not too long ago, the corporate launched tokenized inventory buying and selling on the Arbitrum community and even began creating its personal Layer-2 blockchain aimed toward scaling transaction throughput. Including HBAR exhibits its intention to supply a various vary of crypto property, particularly these with rising ecosystems.

The technique additionally aligns with earlier listings of area of interest tokens and Solana-based meme cash like MEW and MOODENG. By stacking its crypto portfolio with each severe infrastructure initiatives and trend-driven cash, Robinhood is making a play to maintain its platform related in a fiercely aggressive panorama.

HBAR Worth Response and Market Outlook

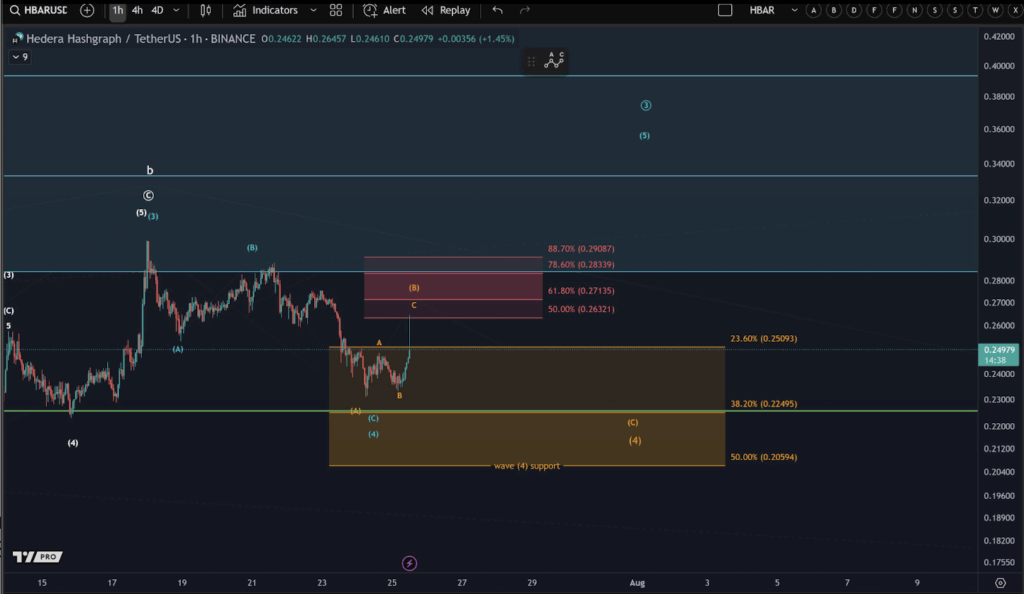

HBAR value popped 3% after the itemizing information after which jumped over 10%, at the moment buying and selling close to $0.2661. Analysts level to renewed whale exercise and a rising urge for food for altcoins as causes behind the push. Earlier this yr, HBAR examined the $0.32 degree earlier than pulling again, and merchants at the moment are anticipating a retest of that key zone. A breakout above it would set off renewed shopping for momentum.

Nevertheless, analysts at “Extra Crypto On-line” warning that HBAR may nonetheless be in a corrective section, with the newest rally presumably forming a B-wave quite than a clear breakout. This means that whereas short-term beneficial properties are potential, the correction sample won’t be over but.

Robinhood’s Place Amid Regulatory Shifts

The timing of this itemizing is notable, contemplating many U.S. exchanges are trimming their altcoin choices as a consequence of SEC scrutiny. Whereas some platforms are scaling again, Robinhood continues so as to add new tokens, specializing in these with robust communities and lively networks. Earlier this yr, the corporate eliminated a couple of riskier tokens however has since doubled down on property with actual traction.

If momentum in altcoins continues and the altseason narrative beneficial properties steam, HBAR’s addition to Robinhood may give it further visibility—and doubtlessly a value increase—throughout this cycle.