A century-old market cycle mannequin created by farmer and newbie economist Samuel Benner is as soon as once more drawing consideration after resurfacing on social media, with predictions pointing to a bullish market peak in 2026.

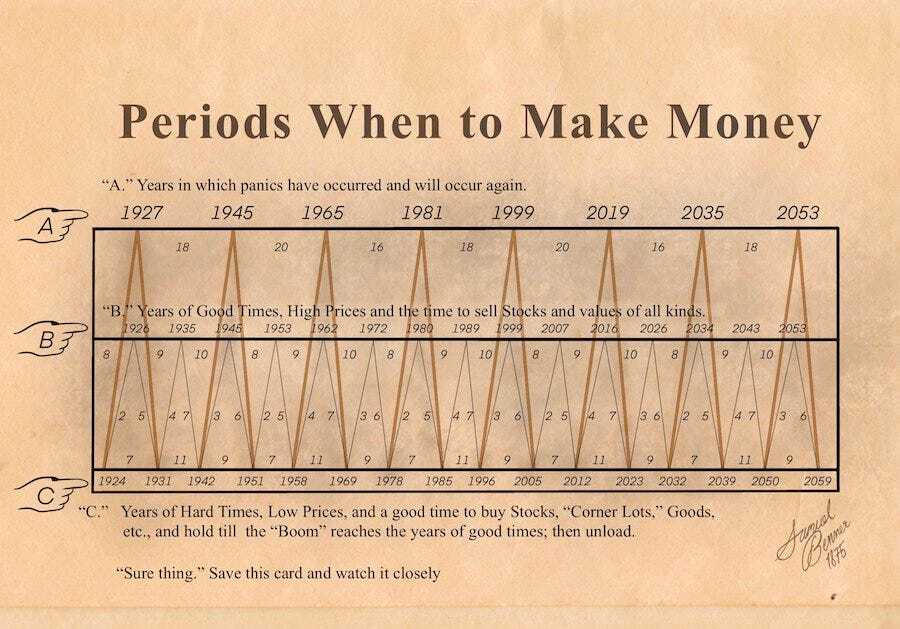

Often called the Benner Cycle, the chart outlines repeating patterns of financial booms, busts, and recoveries spanning over 100 years.

In accordance with the mannequin, “Years of Good Instances” – marked by excessive costs and favorable situations for promoting property — happen in common intervals, sometimes adopted by intervals of market corrections or “panic years.” Benner’s timeline lists 2026 as the subsequent main promoting level, aligning with earlier peaks in 1999, 2007, and 2014, all of which preceded important downturns.

The cycle additionally highlights “Years of Exhausting Instances” when asset costs are depressed, which Benner thought of the most effective moments to build up investments earlier than the subsequent growth. This historic framework has earned credibility amongst some merchants as a consequence of its shocking alignment with previous market occasions, from the Nice Melancholy to the dot-com bubble.

Whereas some analysts view the Benner Cycle as a helpful long-term sentiment gauge, others warning in opposition to treating it as a exact forecasting software, noting that fashionable markets are influenced by elements far past these in Benner’s period.

Nonetheless, with many buyers eyeing 2026 as a possible inflection level, each inventory and cryptocurrency markets may even see heightened speculative exercise within the lead-up to that date – particularly if the sample holds true for an additional century.