XMR, the token powering the privacy-focused Monero community, has emerged as as we speak’s prime gainer with a 4% rise, bucking the broader crypto market decline.

The rally comes whilst Kraken, one of many world’s largest exchanges, briefly froze deposits for the token after AI-based protocol Qubic claimed it had gained majority management of the Monero community.

XMR Community Turmoil: Qubic Claims Majority Management, Kraken Responds

On August 14, Qubic, an AI-driven crypto mining protocol, claimed it had gained majority management of Monero’s hashing energy, an occasion generally known as a 51% assault.

Following this, Kraken confirmed that it paused deposits for the altcoin. The change described the transfer as a precautionary measure to guard customers, whereas stressing that XMR’s buying and selling and withdrawals remained totally operational.

The suspension was lifted hours later, although deposits now require 720 confirmations earlier than crediting.

XMR Defies Centralization Fears, Information Positive factors

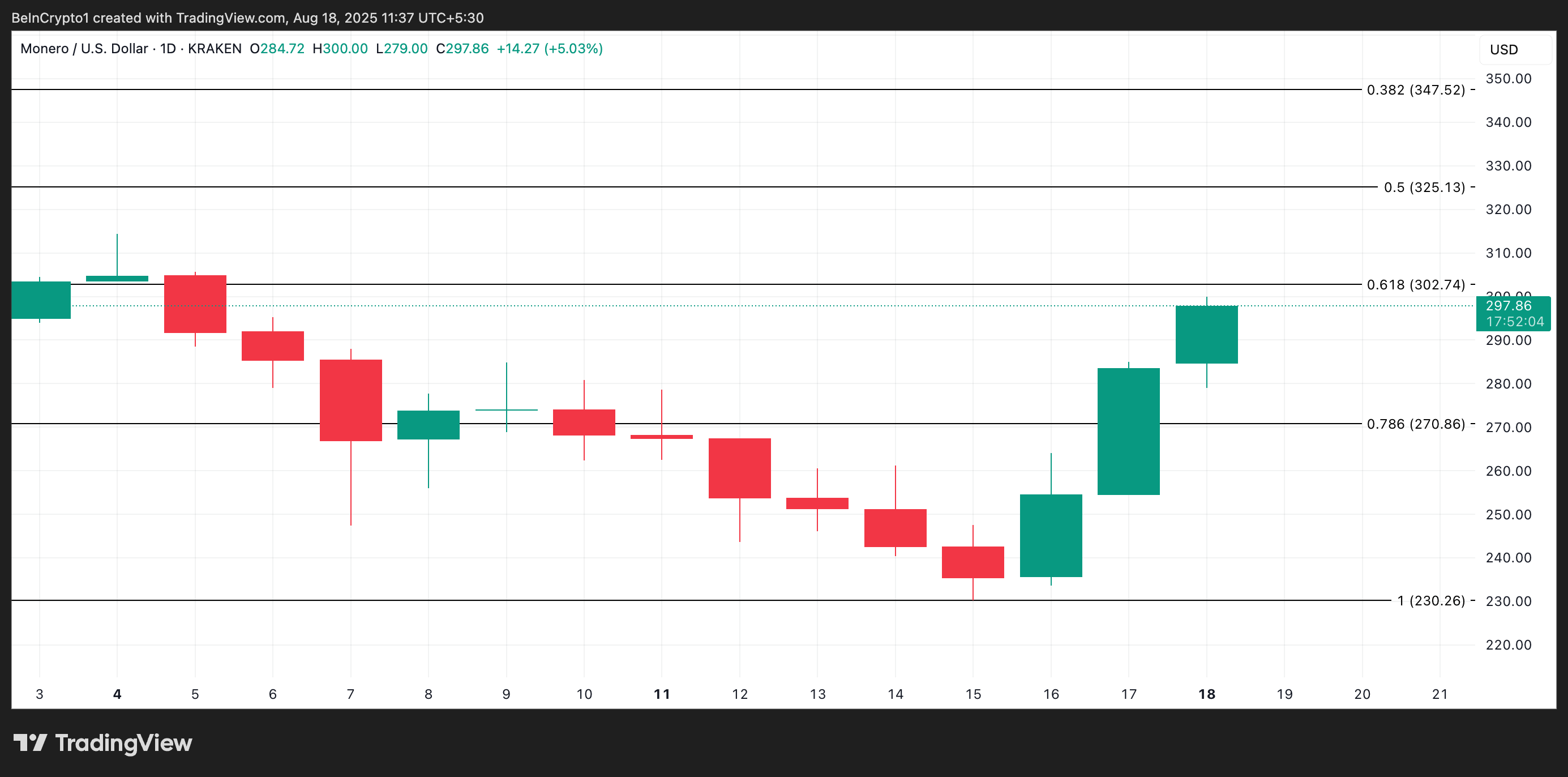

XMR’s efficiency has remained sturdy regardless of issues over mining centralization throughout the Monero community. Readings from the XMR/USD day by day chart present that the altcoin has closed at a brand new excessive since August 16, indicating that the present drama has fueled a resurgence in new demand for XMR.

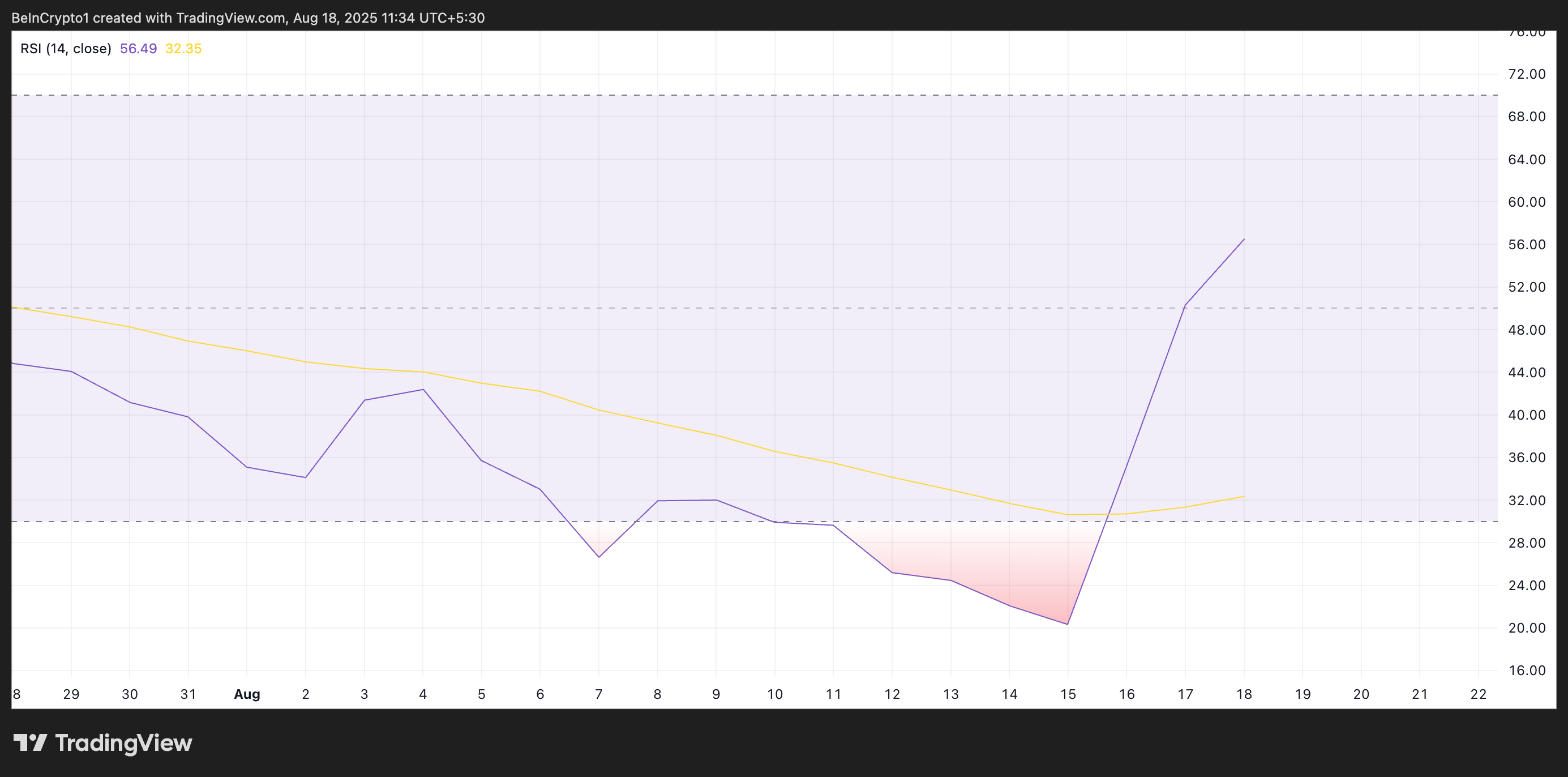

XMR’s climbing Relative Power Index (RSI) displays this uptick in buy-side strain. As of this writing, this key momentum indicator is at 56.49 and in an upward development.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto E-newsletter right here.

The RSI indicator measures an asset’s overbought and oversold market situations. It ranges between 0 and 100. Values above 70 recommend that the asset is overbought and due for a value decline, whereas values underneath 30 point out that the asset is oversold and will witness a rebound.

XMR’s RSI studying indicators that accumulation is strengthening amongst market individuals, which may drive additional value rallies if the development persists.

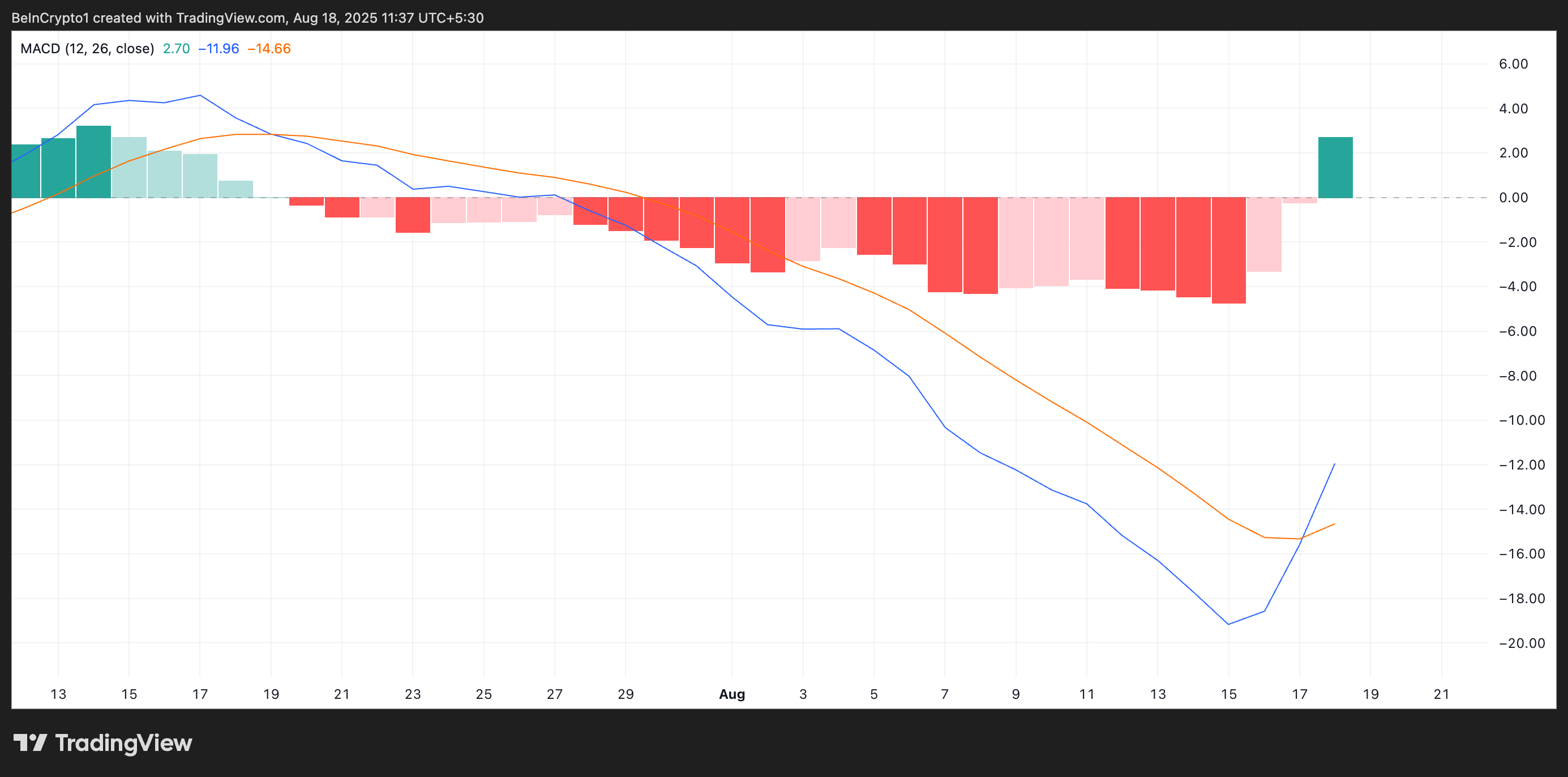

Moreover, the current constructive crossover in Monero’s Shifting Common Convergence Divergence (MACD) helps this bullish outlook. Every day chart readings present the MACD line (blue) crossing above the sign line (orange) for the primary time since July 19, a shift that indicators the start of an uptrend.

This crossover signifies that XMR’s short-term momentum has flipped in favor of patrons, suggesting rising power within the present development. Traditionally, such strikes precede sustained rallies, as merchants interpret them as affirmation that bullish demand is returning after a interval of consolidation or decline.

XMR Climbs in Confidence—Subsequent Cease $325 or Again to $270?

These indicators recommend that XMR is coming into a renewed section of market confidence regardless of Monero’s community centralization issues. If this continues, it may push the token’s value previous the $302.74 resistance mark and towards $325.13.

Nevertheless, XMR dangers shedding current beneficial properties and falling to $270.86 if demand craters.

The put up XMR Climbs After Qubic’s Monero Management Declare and Kraken Freeze appeared first on BeInCrypto.