The important thing promoting level of Bitcoin as a retailer of worth has the whole lot to do with the credibility of its financial coverage. As Bitcoin inventor Satoshi Nakamoto as soon as wrote, the foundations of the system had been “set in stone” when the community first launched, and people guidelines included the 21-million-Bitcoin provide cap and the associated issuance coverage maintained by the roughly four-year halving cycle.

However are these guidelines actually set in stone? Is there actually no likelihood Bitcoin’s financial coverage will change in some unspecified time in the future sooner or later?

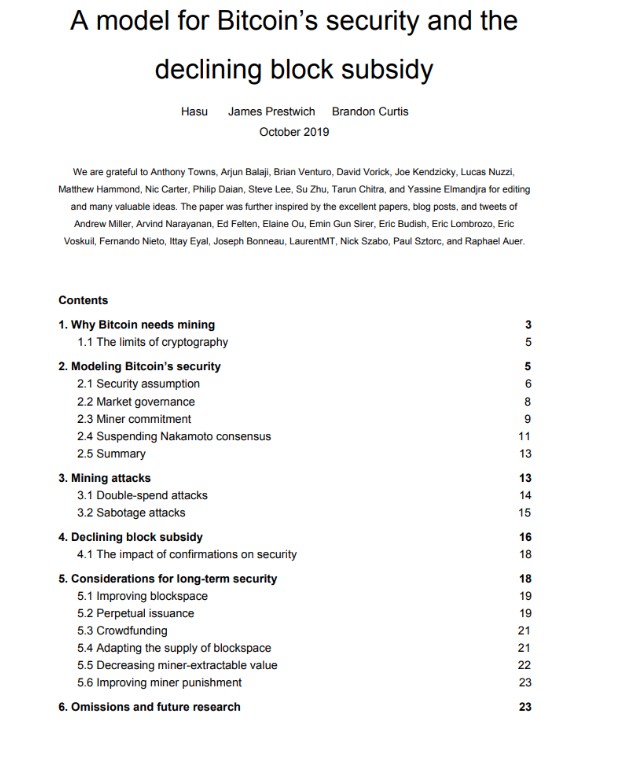

Some critics consider that after the block reward drops too low because of the halvings — and if transaction payment income has not risen considerably — there’ll now not be sufficient incentive for miners to safe the community. They argue the Bitcoin community could also be compelled to extend the availability in consequence.

“If charges don’t magically develop orders of magnitude there are two candidate options: 1) add tail issuance, take away the 21M restrict [or] 2) swap to proof-of-stake,” Ethereum Basis Researcher Justin Drake wrote on X earlier this yr. “Each ‘options’ appear to be cultural non-starters. Additionally tail issuance solely works proactively, not after a 51% takeover.”

To Drake’s level, there may be certainly sturdy resistance to potential alterations to Bitcoin’s financial coverage. As Plan B Community director Giacomo Zucco hyperbolically said in a latest debate, “It ought to be punished by demise when you suggest it.”

And lots of Bitcoin holders additionally see the supposed safety finances challenge as nothing greater than concern, uncertainty and doubt (FUD) from altcoin promoters. “The crypto orthodoxy is that Bitcoin has an unsolved safety finances drawback,” The Bitcoin Bond Firm CEO Pierre Rochard posted on X. “Any arguments in opposition to this dogma are seen as heretical by the pious cryptobros.”

So, who’s proper? Can Bitcoin stay safe over the long run, or is an impending disaster looming?

Bitcoin’s declining block subsidy

All through Bitcoin’s historical past, miners have been rewarded with each the block subsidy and transaction charges. The block subsidy is the newly created Bitcoin included in every block, whereas charges are the mechanism used to incentivize miners to incorporate particular transactions. If you put these two collectively, you get the full block reward, which is what gives a motive for miners to spend assets on the mining course of within the first place.

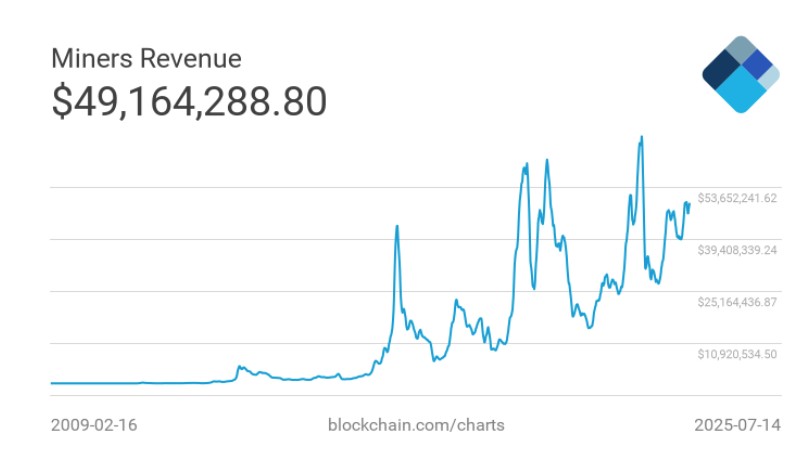

The block subsidy is lower in half roughly each 4 years by way of halving occasions. The subsidy began at 50 BTC per block when the system first launched, and it’s now down to three.125 BTC per block in 2025. Regardless of the decline within the Bitcoin-denominated block subsidy over time, the worth of it in US-dollar phrases has elevated as a result of Bitcoin’s value appreciation. However the block subsidy decreases and asymptotically approaches zero, that means that the side of miner incentivization will ultimately run out.

“As soon as a predetermined variety of cash have entered circulation, the motivation can transition solely to transaction charges and be utterly inflation free,” wrote Satoshi within the authentic white paper.

Rising Bitcoin charges might repair the issue… of spam

Attributable to Bitcoin’s block measurement restrict, elevated payment income for miners would additionally imply an elevated payment price on a per-L1 transaction foundation. In different phrases, an onchain transaction that prices $1 or much less in the present day could ultimately price $20. After all, this elevated price on the base layer can probably be offset by permitting many cheaper funds to happen on secondary layers earlier than selecting the bottom chain.

Whereas this raises prices for individuals who wish to make transactions on Bitcoin’s base layer, some Bitcoin customers see this as a possible profit as a result of it will possibly crowd out non-Bitcoin use instances, akin to Ordinals or Runes, as utilizing the Bitcoin base layer as a generalized database would grow to be extra pricey.

Up to now, payment will increase have had the facet impact of pricing out inefficient use of the bottom Bitcoin blockchain. Examples of this phenomenon embrace exchanges dragging their ft on upgrading to Segregated Witness and integrating transaction batching (and later the Lightning Community), Veriblock going from 30% of all Bitcoin transactions to close zero, and Tether’s USDT shifting to cheaper, different crypto networks akin to Ethereum and Tron.

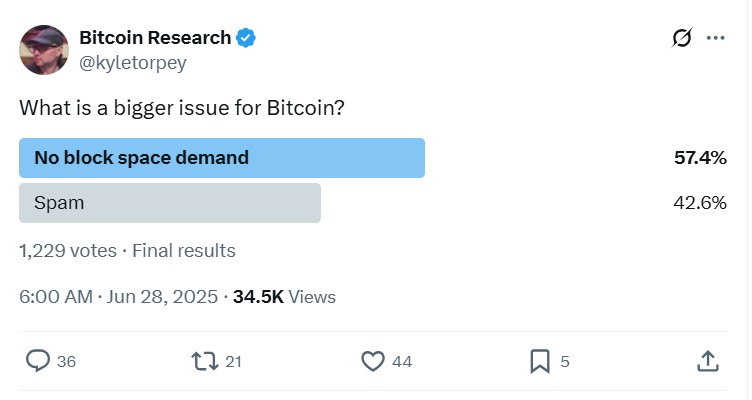

After all, not everybody agrees with this evaluation, and that disagreement ties into the latest dialog in Bitcoin concerning particular person nodes’ potential use of filters on the peer-to-peer relay community, particularly for bigger OP_RETURN outputs. Whereas there are issues from a lot of the Bitcoin userbase round “spam” from Ordinals and different meta token protocols, others see the shortage of block house demand on the community extra usually as a extra urgent concern.

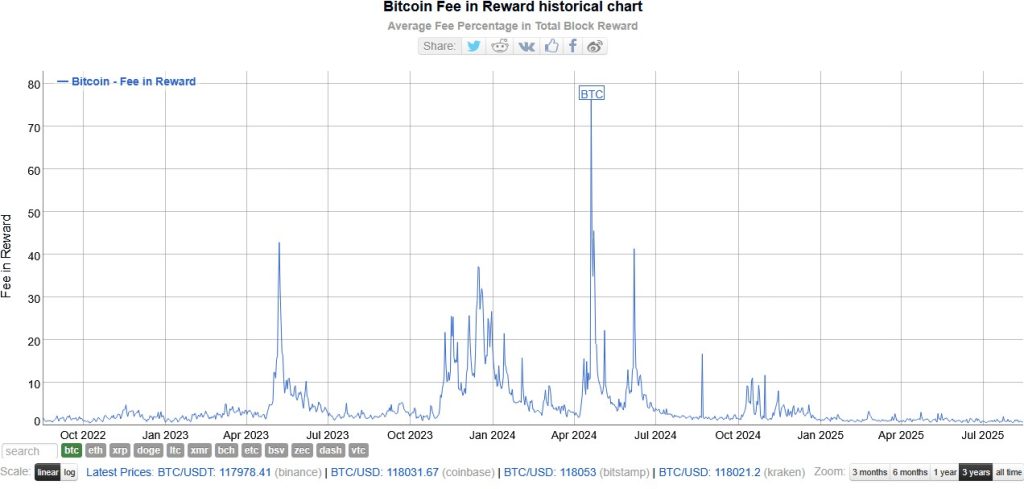

Up thus far, we haven’t seen Bitcoin function in a persistently high-fee setting the place charges account for extra miner earnings than the subsidy. Some Bitcoin customers see meta token protocols as probably useful for growing charges reasonably than viewing them as nothing greater than spam, however as famous above, these types of different use instances have traditionally tended to vanish after charges have risen.

Whereas there was quite a lot of hysteria in the course of the block measurement warfare concerning the necessity to instantly improve the community’s block measurement restrict by way of a tough fork, the fact is numerous types of offchain Bitcoin use, such because the Lightning Community and ETFs, have led to a scenario the place persons are capable of achieve entry to Bitcoin as a retailer of worth and whilst a medium of trade with no need to the touch the bottom community frequently. Nevertheless, this doesn’t imply these offchain techniques don’t contribute to payment income in any respect, as they nonetheless ultimately settle to the bottom chain.

Elevating Bitcoin’s 21 million provide cap is a non-starter

So, what are probably the most viable choices for changing Bitcoin’s block subsidy because it continues to say no over the subsequent 115 years or so? There are many potential concepts to select from, however a few of them are a lot worse than others.

As a result of difficulties related to making consensus adjustments to Bitcoin, potential will increase to miner income that contain elementary adjustments to how the system works in the present day are full non-starters. This would come with choices akin to altering Bitcoin’s financial coverage to proceed the block subsidy in perpetuity or successfully firing the miners and turning Bitcoin right into a proof-of-stake community like Ethereum or Solana.

Will increase to the block weight restrict (the efficient successor to the block measurement restrict because of the Segregated Witness smooth fork) might additionally probably improve income in mixture; nevertheless, elevating the price of working a full node can also be controversial (as illustrated by the block measurement warfare), because it will increase the price of verifying Bitcoin’s financial coverage and the validity of transactions with out putting further belief in a 3rd get together. So, enlargement of payment income in that means is proscribed.

The most important #bitcoin mine in America calculates 10,500,000,000,000,000,000x algorthithms per second powered by 700 megawatts of electrical energy. pic.twitter.com/Nsjti8rOKt

— Documenting ₿itcoin ? (@DocumentingBTC) February 2, 2024

Essentially the most sensible concepts contain excessive onchain charges

After the community began to achieve its capability limits for the primary time in 2017, the bottom layer pivoted from a peer-to-peer digital money system to largely a settlement layer for a brand new financial system. Over the long run, this deliberate, multilayer strategy continues to be the consensus path ahead by way of the safety, viability, and credibility of the Bitcoin community.

The thought is to extend the financial density of onchain Bitcoin transactions by way of upper-layer transaction protocols the place a single onchain motion can account for successfully a vast variety of funds (no less than within the case of the Lightning Community).

Learn additionally

Options

Billions are spent advertising crypto to sports activities followers — Is it value it?

Options

Ethereum L2s will likely be interoperable ‘inside months’: Full information

There are a lot of upper-layer transaction protocols for Bitcoin in numerous phases of growth, with probably the most notable and standard instance being the Lightning Community. Statechains, Ark, Drivechain, Shielded CSV, federated sidechains and rollups are among the different notable techniques.

These upper-layer protocols enable Bitcoin funds to happen in keeping with a particular set of tradeoffs, whereas last settlement and large-value transactions can nonetheless happen on the base blockchain layer. Centralized techniques akin to custodial e-cash or the aforementioned ETFs nonetheless use the Bitcoin base layer for settlement as effectively.

The latest assist from numerous Bitcoin builders for the CTV+CSFS OP code adjustments may have some relevance right here.

“I don’t assume that CTV+CSFS helps remedy the long-term mining subsidy drawback per se,” former Bitcoin Core contributor and supporter of CTV and CSFS James O’Beirne tells Journal. “I feel probably the most you would say is that CTV+CSFS merely makes the chain extra helpful (e.g., by offering primitive vaults), and that is perhaps an oblique motive for chainspace demand to rise.”

Notably, some upper-layer Bitcoin transaction layers, akin to Drivechain, Anduro and Rootstock, enable miners to gather charges on these merged-mined secondary layers in addition to the bottom chain. LayerTwo Labs CEO Paul Sztorc has argued that a majority of these secondary layers have a key benefit in that miners are those who finally determine which transactions go into blocks on the bottom blockchain.

Demand for Bitcoin block house is the important thing

If there may be not ample demand for Bitcoin block house to incentivize miners to behave truthfully, then it possible signifies that Bitcoin has failed to achieve ample adoption as cash. In different phrases, it isn’t the case that inadequate block house demand will result in Bitcoin’s eventual failure; reasonably, it will be an illustration of a failure that has already occurred.

A 2021 analysis paper (PDF) on the matter beforehand said, “It’s laborious to think about that Bitcoin might utterly die from something aside from a complete lack of demand.”

Learn additionally

Options

Insiders’ information to real-life crypto OGs: Half 1

Options

Adam Again says Bitcoin value cycle ’10x greater’ however will nonetheless decisively break above $100K

Nevertheless, it ought to be famous that perpetual issuance was included as a reputable, albeit controversial, choice within the paper.

“If we’ve got no [or] few fee-paying customers, it signifies that most individuals don’t care about what we’re promoting,” Sztorc, whose writings had been cited as one of many inspirations of the analysis paper, tells Journal.

Potential smooth fork tweaks to Bitcoin

There’s additionally the potential for tweaks to the community to be made in an effort to preserve the venture going even within the face of person adoption points. Mushy forks may very well be applied so as to add a minimal payment price for transactions on the community, or a system of demurrage may very well be added the place those that are merely holding Bitcoin additionally pay charges to miners frequently.

There’s additionally the choice of reducing the block weight restrict, which might be ironic, given how many individuals beforehand thought the community’s destiny relied on a rise to that restrict. Very similar to the choice of accelerating the block weight restrict, miners can probably profit from altering block house provide below sure demand situations.

Nevertheless, it ought to be reiterated that Bitcoin would possible already be in a nasty spot if its survival relied on these types of choices. As smooth forks, these are the types of issues miners can successfully implement on their very own (so long as full nodes don’t revolt by way of laborious forks), they usually’re those who would theoretically want the income bump. There will be excessive difficulties related to making adjustments to Bitcoin, however that goes out the window when the system is successfully damaged with out the improve.

If Bitcoin continues to develop as a strategic reserve asset, it’s additionally potential that incentives to mine will exist with out the necessity for charges. It is a situation the place giant Bitcoin holders, maybe some mixture of economic establishments and nation states, are incentivized to mine merely to guard the worth of their holdings on the planet’s most trusted reserve asset. Mining would additionally guarantee their transactions would ultimately be included in blocks (ignoring potential 51% assaults).

“May there then be a world coordination to pay a vital safety finances by way of taxes to enshrine and safe Bitcoin as a public good?” Jal Toorey, who developed The Nashian Orientation of Bitcoin, beforehand questioned aloud in his writings.

Notably, Tether has already invested in mining whereas additionally utilizing Bitcoin as partial backing for its privately-issued USDT forex. And there are prone to be synergies between giant Bitcoin holders and forex issuers for the foreseeable future.

Then once more, these entities might additionally merely make common donations to miners reasonably than mining themselves, which finally ends up trying extra just like the demurrage situation. In different phrases, the worst-case situation seems to be some variation of the identical idea: holders needing to pay a tax, which they successfully already pay in the present day by way of the block subsidy-imposed inflation tax. The block subsidy, demurrage, fee-based donations, a minimal payment price and savers selecting to mine to guard their financial savings are all completely different flavors of an analogous idea.

“Ideally, the Bitcoin neighborhood will get collectively and fixes this drawback with some form of tax,” longtime Bitcoin researcher and Bitcoin Core contributor Peter Todd tells Journal. “There’s quite a lot of methods to implement it. However clearly, cash doesn’t come out of skinny air, so regardless of what’s finished, it’ll be a tax. Possibly there may be another intelligent scheme that fixes this challenge. However after years of debate, nobody has give you one.”

That is the place the important thing level of credible competition by way of Bitcoin’s long-term safety finances resides: Some assume the payment market alone will be capable to safe the community, whereas others see issues with a safety mannequin primarily based solely on charges.

On high of issues concerning ample payment income for miners, those that are fearful in regards to the lack of a long-term tax on holders to exchange the block subsidy are involved with potential points round block affirmation reliability and mining centralization. Nevertheless, it is a separate challenge out of the scope of this text, and it may be much less of an issue in a situation the place Bitcoin is broadly used and there are many transactions pending within the mempool.

“As for what’s prone to occur… too early to inform,” Todd tells Journal. “However there’s a good likelihood the problem isn’t mounted, and it results in everlasting mining centralization.”

Whereas the particular technique by which Bitcoin will likely be secured over the long run isn’t utterly clear, there are a number of prospects to make sure miners have some incentive to course of transactions so long as sufficient folks discover Bitcoin helpful as cash and even simply as a retailer of worth. And this incentive doesn’t want to return within the type of altering Bitcoin’s financial coverage.

Subscribe

Essentially the most participating reads in blockchain. Delivered as soon as a

week.

Kyle Torpey

Kyle Torpey has been masking Bitcoin and crypto since 2014. Notably, he lined Bitcoin’s blocksize warfare at Bitcoin Journal and Forbes. Over time, his work has additionally been printed in Fortune, Vice, Investopedia, and lots of different media shops