- 93.92% of XRP provide is in revenue, echoing previous cycle tops.

- NUPL readings mirror 2017 and 2021 peaks, elevating prime dangers.

- A breakdown beneath $3.05 may ship XRP towards $2.39, whereas a breakout would possibly open the door to $6.

XRP has blasted previous the $3 mark, placing nearly 94% of its total circulating provide into revenue, based on Glassnode. In simply 9 months, the token has climbed over 500%, rising from underneath $0.40 to a current excessive of $3.11. For a lot of traders, it’s been one of many strongest runs in years, with practically everybody holding XRP now sitting on positive aspects.

However historical past exhibits that such excessive profitability usually comes with danger. Again in early 2018, when greater than 90% of XRP holders had been in revenue, the coin topped close to $3.30 earlier than collapsing 95%. An identical setup unfolded in April 2021, when profitability ranges above 90% got here simply earlier than an 85% crash from the $1.95 peak. With 93.92% of provide in revenue at the moment, merchants are beginning to marvel if this cycle is establishing the identical means.

NUPL Flashes Warning Indicators

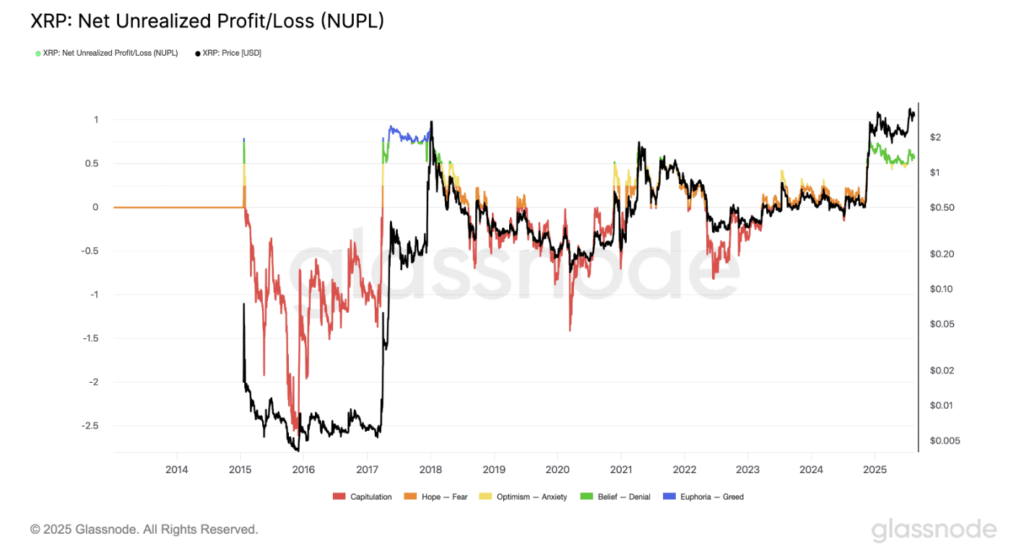

One other purple flag comes from XRP’s Internet Unrealized Revenue/Loss (NUPL), which measures the distinction between paper positive aspects and losses throughout the community. The indicator has entered the “perception–denial” zone—a degree traditionally linked to market tops. In late 2017, XRP’s NUPL spiked on this vary proper because the token peaked above $3.30. The identical factor occurred in April 2021, simply earlier than XRP crashed from $1.95.

Presently, the NUPL studying suggests traders are sitting on heavy income, although not fairly at “euphoria” ranges. Nonetheless, if it creeps increased into greed territory—the primary time since 2018—the chance of large-scale profit-taking may develop shortly. To keep away from that, XRP will want sturdy inflows, presumably from establishments and altcoin market momentum, to soak up the promoting strain.

Bearish Setup Alerts Doable 20% Drop

On the charts, XRP is consolidating inside a descending triangle sample after its break above $3. This formation, normally bearish, is outlined by decrease highs urgent in opposition to a flat assist close to $3.05. Earlier this month, XRP slipped beneath that line in a fakeout earlier than bouncing again. However repeated retests elevate the chances of an actual breakdown.

If XRP closes decisively underneath $3.05, technicals level to a drop towards $2.39—a 23.5% slide from present ranges—by September. On the flip aspect, bulls nonetheless have an opportunity. A breakout above the descending resistance line would invalidate the bearish sample and will set off a push increased, with some analysts calling for a rally as much as $6.

The Crossroads for XRP

Proper now, XRP sits at a vital crossroads. Almost everyone seems to be in revenue, which traditionally has marked cycle tops, whereas NUPL indicators flash warnings. On the identical time, institutional curiosity and broader market energy may hold the rally alive. Whether or not this ends with a pointy correction or a breakout to new highs could rely upon how a lot recent demand enters the market within the coming weeks.