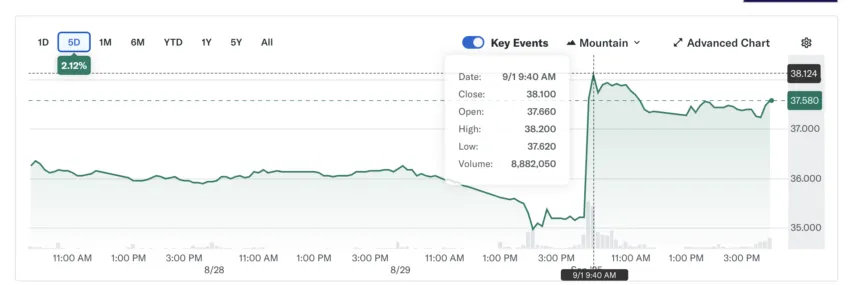

Financial institution of China’s Hong Kong-listed shares jumped 6.7% on Monday to shut at HKD 37.580, after native studies recommended the lender’s metropolis unit is getting ready to use for a stablecoin issuer license. The transfer comes simply weeks after Hong Kong rolled out one of many world’s first devoted licensing frameworks for fiat-referenced stablecoins on August 1.

The event has fueled hypothesis that one among China’s largest state-owned banks may launch its stablecoin, doubtlessly making a industrial rival to Beijing’s centrally managed digital yuan.

Financial institution of China Strikes Towards Stablecoin Software

Based on the Hong Kong Financial Journal, the Financial institution of China (Hong Kong) has arrange a devoted process drive to discover stablecoin issuance and put together utility supplies. The financial institution didn’t reply to requests for remark, however just lately informed traders it’s researching digital asset functions and associated threat administration.

Market analysts say Financial institution of China could be among the many most vital candidates, given the dimensions of its operations and the federal government’s parallel rollout of the digital yuan. Some observers consider a licensed Financial institution of China token may present a regulated, internationally accessible counterpart to the central financial institution’s CBDC.

This information pushed BOC Hong Kong shares up 6.7% to shut at HKD 37.580. The inventory has risen 50.62% year-to-date, underscoring a powerful upward development in investor confidence. The inventory’s historic excessive stays HKD 40.850, recorded in April 2018, leaving simply HKD 3 till a brand new peak.

Hong Kong’s New Stablecoin Framework and World Growth

Hong Kong’s new ordinance requires any entity issuing stablecoins within the metropolis—or these linked to the Hong Kong greenback overseas—to acquire approval from the Hong Kong Financial Authority (HKMA). Licensed issuers should comply with strict reserve administration guidelines, segregate shopper funds, assure redemption at par, and adjust to disclosure, audit, and anti-money laundering necessities.

The HKMA started accepting expressions of curiosity on August 1 and set September 30 as the appliance deadline. Officers stated greater than 40 corporations, together with Commonplace Chartered, Circle, and Animoca Manufacturers, have already inquired. On August 8, Animoca confirmed a three way partnership with Commonplace Chartered Hong Kong and HKT to pursue town’s first license.

Chinese language tech giants JD.com and Ant Group additionally introduced plans to hunt stablecoin licenses overseas. JD.com founder Richard Liu stated in June that the corporate goals to chop cross-border cost prices by means of stablecoins, beginning with business-to-business transfers earlier than increasing to customers. Vincent Chok, CEO of Hong Kong-based First Digital, highlighted effectivity as a driver.

“Blockchain expertise reduces settlement occasions and bypasses the standard middleman charges of banks. The chance is very pronounced in rising markets the place stablecoins hedge towards forex volatility.” He added that regulation is accelerating adoption: “The present trajectory suggests exponential progress within the subsequent two to 5 years.”

Stablecoin Rally Drives Investor Curiosity in Asia

Investor exercise in Hong Kong’s digital asset sector has surged alongside the brand new licensing regime. In July, listed corporations raised about $1.5 billion for stablecoin and blockchain ventures. OSL—one of many metropolis’s largest licensed digital asset platforms—secured $300 million by means of a share placement supported by sovereign wealth and hedge funds.

A sector index monitoring stablecoin-related equities has gained greater than 60% this yr, far forward of the Grasp Seng. Financial institution of China’s rally underscores robust urge for food however highlights the volatility regulators repeatedly warning towards.

Nevertheless, in mid-August, Hong Kong’s SFC and HKMA warned that sharp market swings tied to licensing rumors might mislead traders, urging vigilance.

Analysts be aware that Hong Kong’s strict regime may speed up the rise of non‑USD stablecoins in Asia, offering alternate options to the greenback in regional commerce and settlement.

Japan is getting ready to approve its first yen-pegged token later this yr, whereas China reportedly explores yuan-backed stablecoins to enhance the digital yuan. In South Korea, monetary authorities are additionally learning won-backed stablecoin initiatives.

At this stage, the HKMA has not issued any licenses. Traders are urged to confirm issuer credentials by means of official channels, as regulators preserve that rumors alone is not going to translate into approvals.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.