- Chainlink reserves are increasing quickly, pulling 40K+ LINK off the market weekly whereas whales added almost $43M in tokens final month.

- Alternate balances maintain falling, a bullish signal that buyers are shifting LINK into self-custody as partnerships just like the U.S. Commerce Division deal enhance utility.

- Technicals present a cup-and-handle sample with targets round $27 and $31, backed by a golden cross and rising momentum.

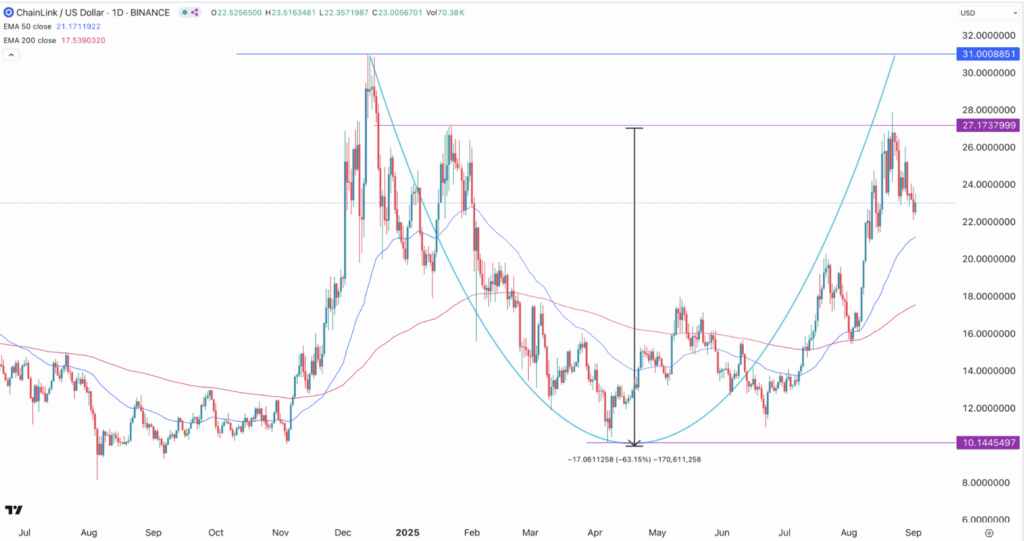

Chainlink has taken a breather after dropping about 17% from its yearly excessive, sliding right into a technical correction. Nonetheless, the setup doesn’t look all that dangerous. On the charts, LINK is shaping up a cup-and-handle sample, which merchants typically see as a bullish signal. Backing it up, among the venture’s fundamentals are quietly strengthening within the background.

Strategic Reserves and Whale Shopping for

One of many massive tailwinds for LINK is the brand new strategic reserves. These have already scooped up over 193,000 tokens value round $4.5 million, they usually’re rising at a tempo of greater than 40,000 LINK every week. The thought is easy: funnel charges into reserves, purchase up tokens, and reduce down circulating provide. That creates a cushion below the value and helps long-term progress.

Whales appear to agree with the play. Nansen knowledge exhibits they’ve grabbed about 1.9 million LINK (value $43 million) prior to now month, boosting their stash from 3.8 million to five.1 million. Often, when the “good cash” piles in, it alerts confidence in a restoration. On the identical time, alternate balances have been shrinking—falling from 280 million in August to 268 million. When tokens go away exchanges, it typically hints buyers are shifting them to safer storage, a bullish clue for worth stability.

Partnerships Enhance Actual-World Utility

Chainlink hasn’t simply been counting on merchants—it’s additionally increasing partnerships. The U.S. Commerce Division revealed GDP knowledge by Chainlink, a primary for a authorities utilizing an oracle supplier this fashion. Extra not too long ago, Chainlink teamed up with Solv Protocol to launch a Safe Alternate Fee feed for SolvBTC, powered by its Proof of Reserve. Hundreds of latest knowledge factors have additionally been pushed to the community, broadening its use circumstances throughout industries from finance to real-world asset tokenization.

Technical Outlook: Cup-and-Deal with Factors Larger

On the every day chart, LINK climbed from $10 in April to $28 in August earlier than easing again to $23. The pullback suits neatly into the “deal with” section of its cup-and-handle formation, with the higher boundary sitting at $27. A golden cross again in July (when the 50-day MA crossed above the 200-day) provides extra gas to the bullish view. If the sample performs out, targets round $27 and $31 could possibly be subsequent in line.

Even with the current correction, the basics—rising reserves, whale accumulation, shrinking alternate balances, and main partnerships—paint an image of a venture constructing actual traction. LINK should still wobble within the quick run, however the broader setup leans towards one other leg increased.

The submit Chainlink Value Pulls Again however Fundamentals Keep Sturdy first appeared on BlockNews.