- TRON Inc.’s treasury hit $220M after its high shareholder injected one other 312.5M TRX.

- TRON leads all blockchains in transactions and USDT minting, with over 9.4M transactions logged this yr.

- Worth hovers close to $0.337, with bulls eyeing $0.50 long-term if assist holds.

The Nasdaq may’ve discovered a brand new obsession—crypto treasuries. Extra listed corporations are stacking digital belongings, and TRON Inc. has joined the pattern in an enormous means. As of September 5, the corporate’s treasury swelled to $220 million after its largest backer doubled down on TRX.

Bitcoin was the primary darling of Wall Road’s treasury playbook, however the tide has clearly shifted. Ethereum, Solana, and now TRON are carving out their place, with large cash beginning to take them severely.

TRON Inc. Expands Its TRX Stash

Bravemorning Restricted, TRON Inc.’s largest shareholder, simply pumped one other 312.5 million TRX into the treasury—value round $110 million. That increase took the corporate’s whole holdings as much as $220 million and elevated Bravemorning’s share to over 86%.

The transfer alerts that establishments aren’t ignoring TRON anymore, regardless of the coin’s rocky path because the 2021 altcoin mania. Nonetheless, the inventory didn’t react kindly—TRON Inc. shares slipped 9% in a day to commerce close to $3.91, effectively off their highs above $10 shortly after its July Nasdaq debut.

TRON Leads in Transactions and Stablecoin Motion

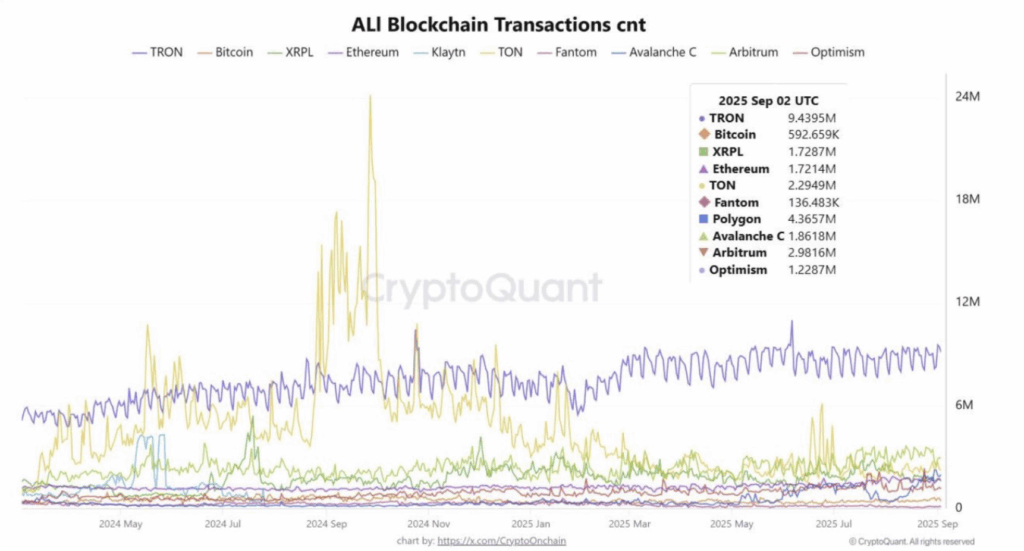

Even when the inventory’s lagging, the blockchain’s uncooked numbers look robust. TRON led your entire market in transaction depend this yr, clocking in 9.43 million—over double Polygon’s 4.36 million. Ethereum, Arbitrum, Toncoin, XRP Ledger, and even Bitcoin had been left trailing.

A lot of that dominance comes from USDT exercise. Tether Treasury retains minting billions of {dollars}’ value of stablecoins on TRON, whereas Binance has been busy swapping billions in USDT between TRON and Ethereum. Liquidity is clearly flowing into the community.

Interoperability performs a job too. TRON partnered with Close to Protocol to allow USDT swaps with out the trouble of bridges or wallets, utilizing SwapKit and THORSwap because the engines. Add over 25 new cross-chain connections through deBridge, and it’s clear the chain is widening its attain.

TRX Worth Exams Key Ranges

On the charts, TRX is wobbling after a break of construction round $0.34. The token’s buying and selling simply above $0.337, with bulls needing to carry the road at assist. A bounce above $0.342 may re-open the trail greater, whereas shedding the present degree dangers sliding again to $0.336 or worse.

Bears are exhibiting enamel within the quick time period, however the lengthy recreation nonetheless favors bulls. If TRX manages to reclaim momentum, the $0.50 goal turns into life like. That might push its market cap north of $50 billion—roughly $19 billion greater than in the present day.

For now, TRON appears to be like caught in a tug-of-war between profit-taking whales and a blockchain that’s firing on all cylinders. Merchants with persistence might even see it as a setup value watching.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.