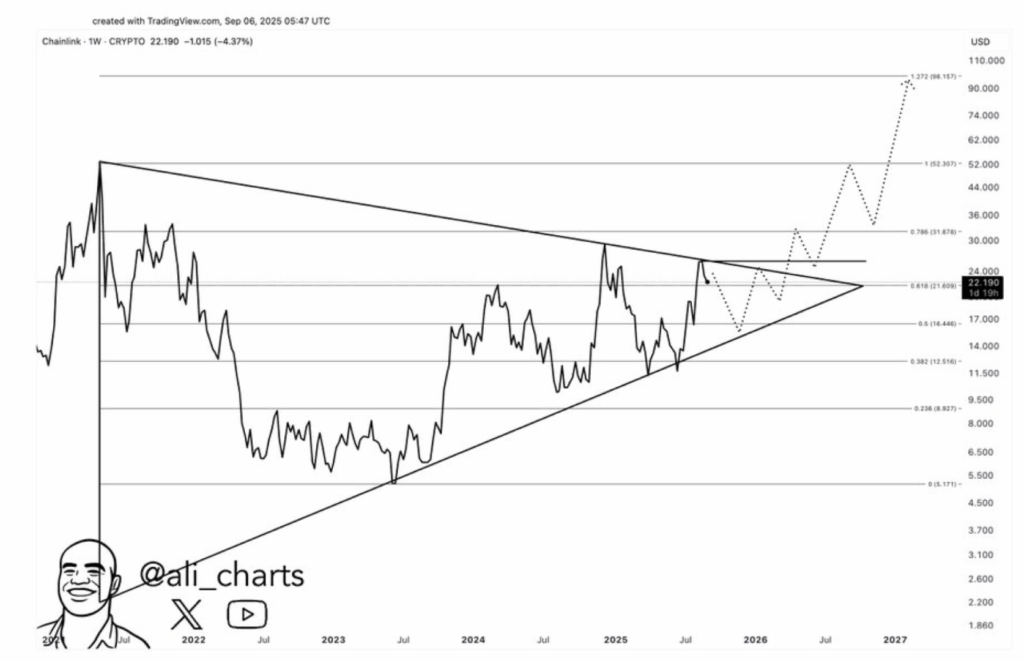

- Chainlink’s worth motion is tightening inside an enormous multi-year triangle, with key help close to $16 and resistance at $24.

- Fibonacci ranges map out a possible path towards $31, $52, and ultimately $98–$100 if bullish momentum holds.

- Analysts say a dip may truly be essentially the most bullish setup, setting the stage for a long-term breakout.

Chainlink may be organising for considered one of its largest strikes in years — a minimum of that’s what some merchants are beginning to whisper about. A crypto analyst, Ali, dropped a weekly chart on X that lays out what he calls the “most bullish setup” for LINK. His roadmap is easy sufficient: a dip again towards $16 earlier than an eventual run that might stretch all the best way to the $100 neighborhood.

At first look, it seems to be like simply one other squiggly chart. However zoom in and also you’ll see an enormous triangle that’s been forming since 2022, with Fibonacci ranges rigorously stacked over it. A retest close to $16 would line every part up neatly — type of like a spring coiling tighter earlier than an enormous snap.

Why Merchants Are Eyeing the Triangle

Ali’s chart exhibits LINK squeezing inside a large symmetrical triangle, getting nearer to its apex. Proper now, worth sits close to $22, brushing up towards the 0.618 Fibonacci retracement at $21.61. If it slides down towards $16, that might hit the 0.5 Fib at $16.49, creating the next low contained in the triangle — usually a main setup earlier than liftoff.

The actual set off sits above $24, the place a descending resistance line has saved LINK capped. A decisive breakout there can be the primary inexperienced gentle.

After all, this isn’t simply chart doodling. Chainlink isn’t a meme coin — it’s a decentralized oracle community, shifting off-chain information into good contracts. Meaning real-world adoption and utilization (like worth feeds and exterior information indicators) straight connect with token demand. When adoption climbs, so does the worth case for LINK.

Fibonacci Map to $100

Ali’s Fibonacci ranges sketch out a transparent path. The important thing numbers:

- Assist round $16.49 (0.5 Fib).

- Resistance close to $21.61 and $31.88.

- Extensions pointing to $52.31 and $98.16 — virtually a bullseye on $100.

His dotted line projection seems to be like a roadmap: dip to $16, bounce above $24, rally towards $31, then $52, and ultimately that magical $98–$100 zone.

However don’t count on fireworks tomorrow. Weekly charts are sluggish movers, and this setup is extra like a rocket countdown than a fast launch. First the triangle squeeze, then the breakout, then stage-by-stage checks at every Fib stage. Solely in any case that might LINK take into consideration touching three digits.

The Massive Image

In easy phrases: a dip to $16 isn’t dangerous information — it might be the precise bullish setup that clears the runway for an extended climb. Breakout above $24 opens the door to $31, $52, and possibly, simply possibly, $100.

It’s the type of situation that reminds merchants of previous altcoin cycles, the place years of sideways compression lastly gave method to explosive upside. Whether or not historical past repeats for LINK… nicely, that’s the wager.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.