Constancy Asset Administration has launched a blockchain-based model of its Treasury cash market fund, extending its digital finance presence.

The brand new product, known as the Constancy Digital Curiosity Token (FDIT), mirrors one share of the Constancy Treasury Digital Fund (FYOXX) and is issued instantly on the Ethereum community.

What’s Constancy Digital Curiosity Token (FDIT)?

In accordance with RWA.xyz, the fund started working in August with a portfolio that consists totally of US Treasury securities and money. Constancy applies a 0.20% administration payment, and Financial institution of New York Mellon is liable for custody.

Sponsored

Sponsored

As of press time, its property have already climbed to greater than $200 million, although participation stays restricted. Present data present the fund has simply two holders—one with roughly $1 million in tokens and one other managing the steadiness.

Constancy has but to touch upon the fund publicly.

Nonetheless, the fund’s launch builds on Constancy’s earlier submitting with the Securities and Alternate Fee (SEC), the place it sought approval so as to add an on-chain share class to its digital Treasury fund.

That step signaled its dedication to real-world asset (RWA) tokenization, a pattern gaining momentum throughout conventional finance.

Over the previous 12 months, world asset managers have been experimenting with blockchain rails to make markets extra environment friendly, minimize settlement occasions, and cut back prices.

This has drawn curiosity from conventional monetary giants like BlackRock, the most important asset administration agency on this planet, already making important progress on this market.

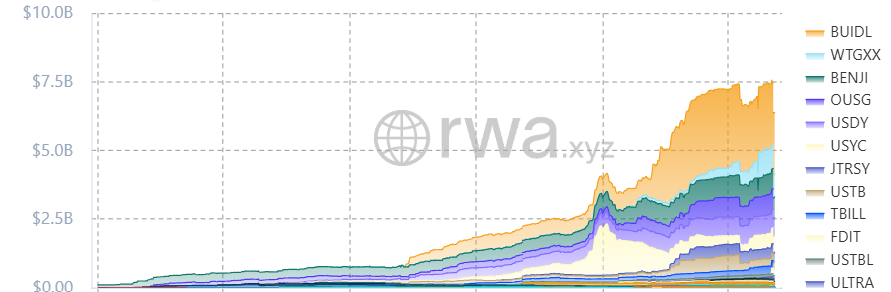

Over the previous 12 months, BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) has change into the most important tokenized Treasury product, with a worth of over $2 billion.

Notably, comparable choices from Franklin Templeton and WisdomTree have helped the broader marketplace for tokenized Treasuries above $7 billion, in response to RWA.xyz.

Contemplating the tempo of this progress, analysts at McKinsey have estimated that tokenized securities may attain a market worth of $2 trillion earlier than the tip of the last decade.